0001417398DEF 14AFALSE00014173982022-10-012023-09-300001417398hi:KimberlyRyanMember2022-10-012023-09-30iso4217:USD0001417398hi:JoeRaverMember2021-10-012022-09-300001417398hi:KimberlyRyanMember2021-10-012022-09-3000014173982021-10-012022-09-300001417398hi:JoeRaverMember2020-10-012021-09-3000014173982020-10-012021-09-3000014173982021-12-302022-09-3000014173982021-10-012021-12-29000141739812022-10-012023-09-300001417398hi:EquityAwardsReportedValueMemberecd:PeoMemberhi:JoeRaverMember2020-10-012021-09-300001417398hi:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2020-10-012021-09-300001417398hi:EquityAwardsReportedValueMemberecd:PeoMemberhi:JoeRaverMember2021-10-012022-09-300001417398hi:EquityAwardsReportedValueMemberecd:PeoMemberhi:KimberlyRyanMember2021-10-012022-09-300001417398hi:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2021-10-012022-09-300001417398hi:EquityAwardsReportedValueMemberecd:PeoMemberhi:KimberlyRyanMember2022-10-012023-09-300001417398hi:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2022-10-012023-09-300001417398hi:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMemberhi:JoeRaverMember2020-10-012021-09-300001417398hi:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2020-10-012021-09-300001417398hi:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMemberhi:JoeRaverMember2021-10-012022-09-300001417398hi:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMemberhi:KimberlyRyanMember2021-10-012022-09-300001417398hi:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2021-10-012022-09-300001417398hi:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMemberhi:KimberlyRyanMember2022-10-012023-09-300001417398hi:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2022-10-012023-09-300001417398ecd:PeoMemberhi:JoeRaverMemberhi:EquityAwardsGrantedInPriorYearsUnvestedMember2020-10-012021-09-300001417398ecd:NonPeoNeoMemberhi:EquityAwardsGrantedInPriorYearsUnvestedMember2020-10-012021-09-300001417398ecd:PeoMemberhi:JoeRaverMemberhi:EquityAwardsGrantedInPriorYearsUnvestedMember2021-10-012022-09-300001417398ecd:PeoMemberhi:KimberlyRyanMemberhi:EquityAwardsGrantedInPriorYearsUnvestedMember2021-10-012022-09-300001417398ecd:NonPeoNeoMemberhi:EquityAwardsGrantedInPriorYearsUnvestedMember2021-10-012022-09-300001417398ecd:PeoMemberhi:KimberlyRyanMemberhi:EquityAwardsGrantedInPriorYearsUnvestedMember2022-10-012023-09-300001417398ecd:NonPeoNeoMemberhi:EquityAwardsGrantedInPriorYearsUnvestedMember2022-10-012023-09-300001417398ecd:PeoMemberhi:EquityAwardsGrantedDuringTheYearVestedMemberhi:JoeRaverMember2020-10-012021-09-300001417398hi:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2020-10-012021-09-300001417398ecd:PeoMemberhi:EquityAwardsGrantedDuringTheYearVestedMemberhi:JoeRaverMember2021-10-012022-09-300001417398ecd:PeoMemberhi:EquityAwardsGrantedDuringTheYearVestedMemberhi:KimberlyRyanMember2021-10-012022-09-300001417398hi:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2021-10-012022-09-300001417398ecd:PeoMemberhi:EquityAwardsGrantedDuringTheYearVestedMemberhi:KimberlyRyanMember2022-10-012023-09-300001417398hi:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2022-10-012023-09-300001417398hi:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMemberhi:JoeRaverMember2020-10-012021-09-300001417398hi:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2020-10-012021-09-300001417398hi:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMemberhi:JoeRaverMember2021-10-012022-09-300001417398hi:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMemberhi:KimberlyRyanMember2021-10-012022-09-300001417398hi:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2021-10-012022-09-300001417398hi:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMemberhi:KimberlyRyanMember2022-10-012023-09-300001417398hi:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2022-10-012023-09-300001417398hi:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMemberhi:JoeRaverMember2020-10-012021-09-300001417398hi:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2020-10-012021-09-300001417398hi:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMemberhi:JoeRaverMember2021-10-012022-09-300001417398hi:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMemberhi:KimberlyRyanMember2021-10-012022-09-300001417398hi:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2021-10-012022-09-300001417398hi:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMemberhi:KimberlyRyanMember2022-10-012023-09-300001417398hi:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2022-10-012023-09-300001417398ecd:PeoMemberhi:JoeRaverMemberhi:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2020-10-012021-09-300001417398ecd:NonPeoNeoMemberhi:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2020-10-012021-09-300001417398ecd:PeoMemberhi:JoeRaverMemberhi:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2021-10-012022-09-300001417398ecd:PeoMemberhi:KimberlyRyanMemberhi:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2021-10-012022-09-300001417398ecd:NonPeoNeoMemberhi:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2021-10-012022-09-300001417398ecd:PeoMemberhi:KimberlyRyanMemberhi:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2022-10-012023-09-300001417398ecd:NonPeoNeoMemberhi:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2022-10-012023-09-30000141739822022-10-012023-09-30000141739832022-10-012023-09-30000141739842022-10-012023-09-30000141739852022-10-012023-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | | | | |

Filed by the Registrant ☒ |

| |

Filed by a Party other than the Registrant ☐ |

| |

| Check the appropriate box: |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| | |

| Hillenbrand, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

| |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

HILLENBRAND, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held February 20, 2024

The Annual Meeting of shareholders of Hillenbrand, Inc., an Indiana corporation (the “Company”), will be held at the Company’s headquarters at One Batesville Boulevard, Batesville, Indiana 47006, on Tuesday, February 20, 2024, at 10:00 a.m. Eastern Standard Time, for the following purposes:

(1)to elect three members to the Board of Directors;

(2)to approve, by a non-binding advisory vote, the compensation paid by the Company to its Named Executive Officers (“Say on Pay Vote”);

(3)to ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal year 2024; and

(4)to transact such other business as may properly come before the meeting and any postponement or adjournment of the meeting.

We intend to hold the Annual Meeting in person, but we urge you to consider voting in advance of the meeting via one of the remote methods described in the proxy statement. If for any reason we determine that it is not possible or advisable to hold the Annual Meeting in person, we will announce alternative arrangements for the meeting, which may include a change in venue or holding the meeting solely by means of remote communication. We will announce any such change and the details on how to participate by press release, on our web site at https://ir.hillenbrand.com, and in a filing with the Securities and Exchange Commission. If you are planning to attend the Annual Meeting in person, please check our web site in advance for any updates to planned arrangements.

In preparing for the Annual Meeting, we regularly review and consider the requirements, recommendations, and protocols that are issued and that may be issued by public health authorities and governments. We require you to register your planned in-person attendance with us at least ten (10) business days prior to the meeting, by writing to the Investor Relations Department, Hillenbrand, Inc., One Batesville Boulevard, Batesville, Indiana 47006 or by email at investors@hillenbrand.com. Preregistration and an admission ticket, as well as matching photo identification, are necessary to gain entrance to the secure area of our headquarters building where the meeting will be held. We value the opportunity to have more personal engagement with our shareholders and require you to follow these procedures and any protocols we may have in place on the meeting date.

| | | | | | | | |

| By Order of the Board of Directors, | |

| | |

| | |

| Nicholas R. Farrell | |

| Secretary | |

Your vote is very important. Whether or not you plan to attend the Annual Meeting, we encourage you to read the proxy statement and submit your proxy and voting instructions as soon as possible. Important notice regarding the availability of proxy materials for the Annual Meeting of shareholders to be held on February 20, 2024: This proxy statement, the accompanying proxy card, and our 2023 Annual Report to Shareholders are available on the Internet at www.hillenbrand.com.

January 9, 2024

TABLE OF CONTENTS

[This page intentionally left blank.]

HILLENBRAND, INC.

PROXY STATEMENT SUMMARY

To assist you in reviewing the proposals to be acted upon at the 2024 Annual Meeting of shareholders (the “Annual Meeting”) of Hillenbrand, Inc., an Indiana corporation (“Hillenbrand” or the “Company”), we call your attention to the following information about the proposals and the Board’s voting recommendations, along with highlights of the Company’s corporate governance and executive compensation practices. The following description is only a summary. For more complete information about these topics, please review the proxy statement in its entirety.

Annual Meeting Information

| | | | | |

| Time and Date: | February 20, 2024 @ 10:00 a.m. EST |

Location: | Hillenbrand headquarters |

Record Date: | December 15, 2023 |

Admission: | Pre-registration by writing to the Investor Relations Department (email to investors@hillenbrand.com acceptable), together with ticket attached to the proxy card (available to beneficial owners upon request as described in the proxy statement) and photo identification |

See “Questions and Answers about the Annual Meeting and Voting” in the proxy statement for additional information.

Proposals and Voting Recommendations

| | | | | | | | | | | |

| Proposal | Board’s Voting

Recommendation | Page

References |

| No. 1 | Election of Directors | FOR | |

| No. 2 | Non-Binding Advisory Vote to Approve Compensation of Named Executive Officers, or “Say on Pay” | FOR | |

| No. 3 | Ratification of Appointment of the Independent Registered Public Accounting Firm | FOR | |

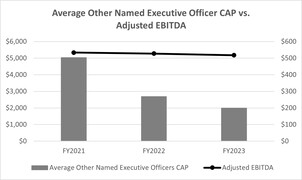

Incentive Compensation Plans and Results

Our compensation program is characterized by certain distinct features highlighted in the proxy statement that we believe strengthen its performance orientation and reflect our ongoing commitment to align executive pay with long term shareholder value.1

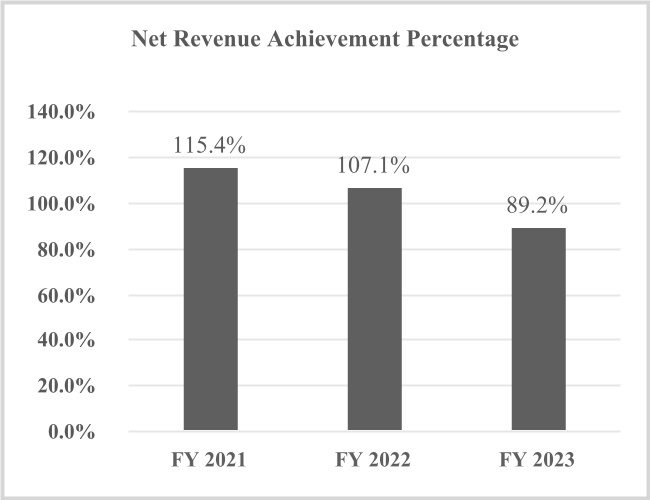

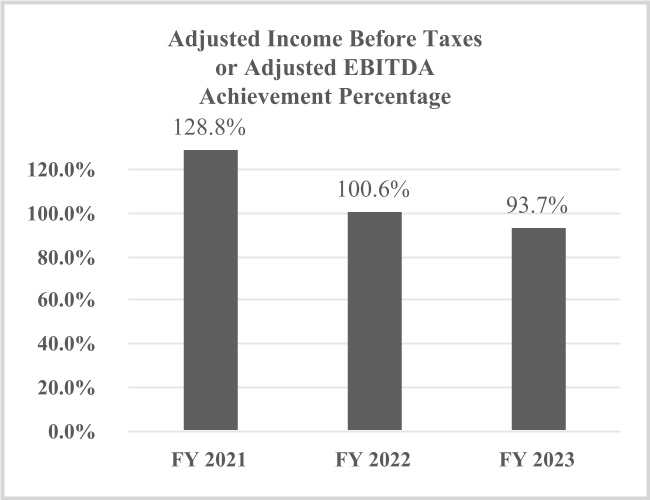

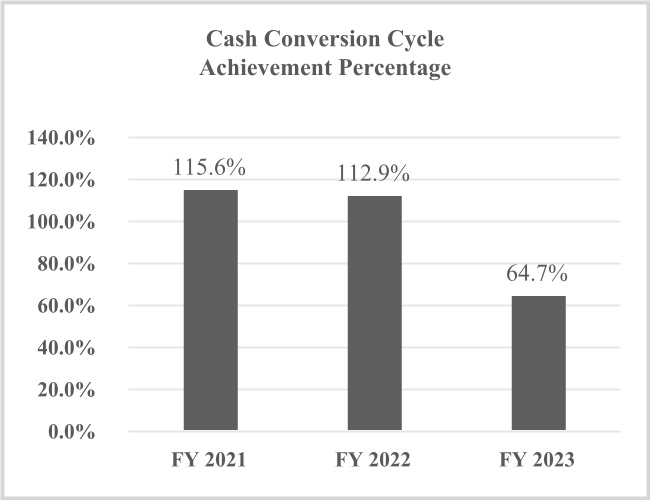

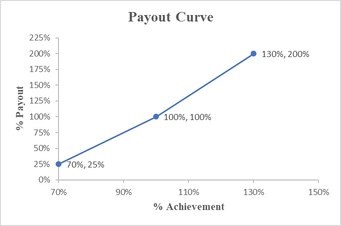

Short-term: The Compensation and Management Development Committee of our Board of Directors (the “Compensation Committee”) determined for fiscal 2023 to use net revenue, order intake (used by our Coperion subsidiary in lieu of net revenue as further detailed in the proxy statement), adjusted earnings before interest, taxes, depreciation, and amortization (“EBITDA”), and cash

______________________________

1 See the “Executive Compensation” section of our proxy statement for additional detail on our compensation program and for additional background on our Say on Pay Vote.

conversion cycle as the metrics for the Company’s short-term incentive compensation (“STIC”) plan in evaluating the Company’s operational performance, efficiency, and sustainable improvements, as shown in the charts below. We believe that these metrics align the interests of our management with those of our shareholders. For fiscal 2023, the Compensation Committee conducted a comprehensive review of the performance and payout curves associated with the metrics within the STIC plan and determined that the wider and flatter curves used in the past two performance cycles were no longer needed to address the economic and supply chain challenges brought about by COVID. Therefore, the Compensation Committee set performance and payout curves to levels more consistent with pre-pandemic levels, and which aligned with the going-forward needs of the Company.

The following charts show actual performance for these metrics for the past three years, reflected as the achievement percentage of target:2

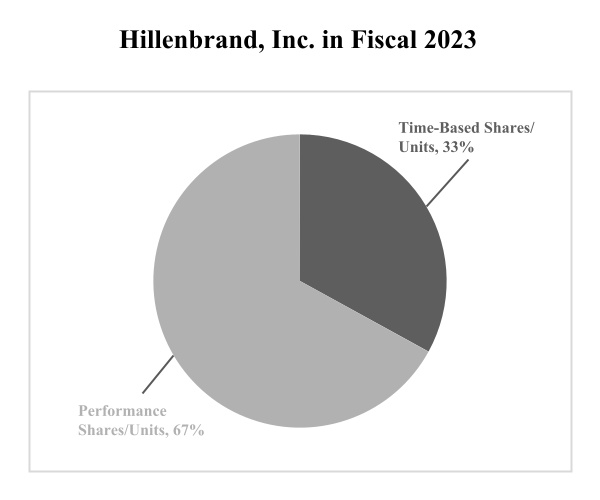

Long-term: For the Company’s long-term incentive compensation (“LTIC”) plan for our Named Executive Officers, the Compensation Committee determined for fiscal 2023 that one-third of

______________________________

2 The charts present the achievement percentages for these metrics at the consolidated Company level for the Named Executive Officers. As part of the annual compensation setting process, the Compensation Committee establishes payout curves for these achievement percentages to determine payout levels. These charts do not reflect achievement of these metrics at an underlying business unit level, nor achievement of the order intake metric used by our Coperion subsidiary which applies to one of our Named Executive Officers as further explained in the proxy statement. In addition, for awards made in fiscal 2021 and fiscal 2022, the Company used a different externally reported financial metric as the starting point for calculation. This measure, called “Adjusted Income Before Taxes (IBT),” is further explained in the fiscal 2021 and 2022 proxy statements. The measure used in fiscal 2023, Adjusted EBITDA, is also further explained in this proxy statement. The chart shows Adjusted EBITDA achievement for fiscal year 2023, and Adjusted IBT achievement for fiscal 2021 and 2022.

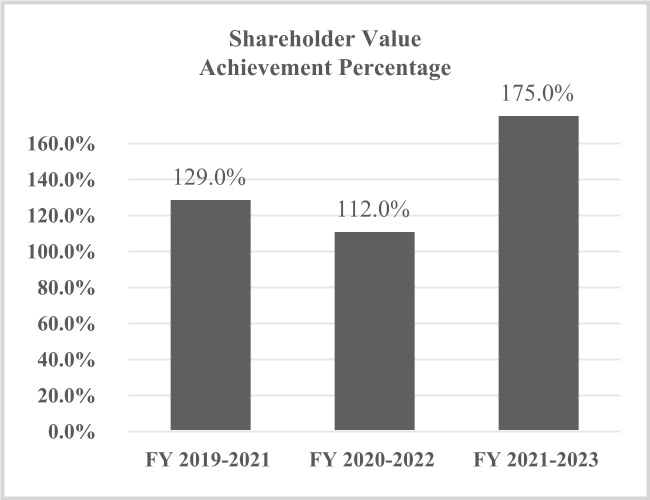

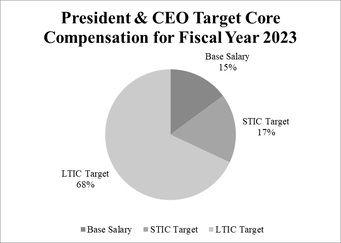

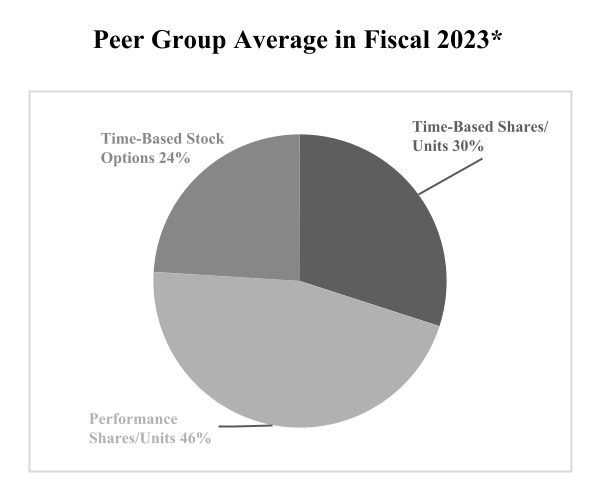

the grant value would be awarded in time-based restricted stock units and the remaining two-thirds would be awarded in performance-based restricted stock units. The performance-based awards are based on shareholder value creation and relative total shareholder return metrics over a three-year measurement period, which we believe closely aligns the interests of our management with those of our shareholders.

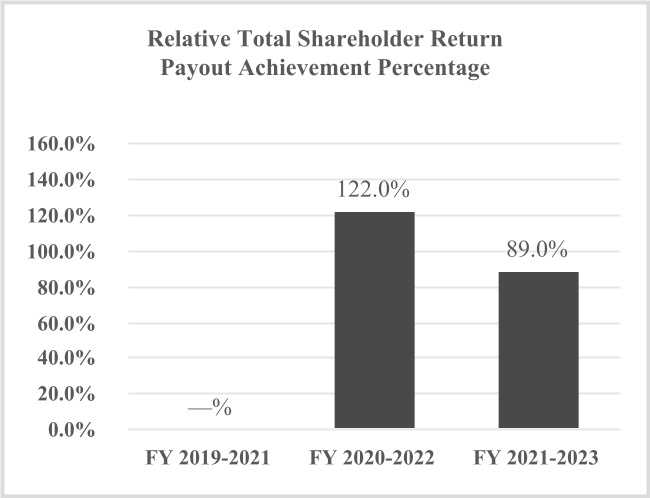

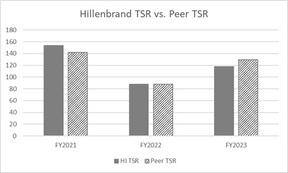

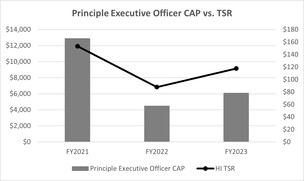

The following charts show achievement relative to target for these metrics for the past three measurement periods:

Governance and Executive Compensation Highlights

The following graphics highlight key components of our governance and executive compensation practices.

| | | | | | | | |

| Here’s What We Do . . . |

| | |

| þ | | Pay for performance |

| | |

| þ | | Benchmark Named Executive Officer target core compensation to the 50th percentile of peer group compensation3 |

| | |

| þ | | Maintain stock ownership guidelines based on shares of Company common stock and time-based restricted stock units beneficially owned: for directors, five times annual cash compensation; for the CEO, five times base salary; for Senior Vice Presidents, two times base salary; for certain other senior officers designated by the CEO, one times base salary |

| | |

| þ | | Seek to ensure that at least 75 percent of the CEO’s target core compensation is at risk4 |

| | |

| þ | | Require an independent Chairperson of the Board and that at least 80 percent of directors be independent |

| | |

| þ | | Require executives and directors to preclear all stock trades, including gifts, with the Company’s Legal Department |

| | |

| þ | | Require that directors receive at least a majority of the votes cast in an uncontested election to be elected |

| | |

| þ | | Require that the Compensation Committee, the Audit Committee, and the Nominating/Corporate Governance Committee of our Board each be composed entirely of outside, independent directors |

| | |

| þ | | Engage an independent compensation consultant, hired by and reporting directly to the Compensation Committee |

| | |

| þ | | Operate with multiple performance metrics that drive our incentive compensation plans, including a relative metric that measures our performance against the Standard & Poor’s 400 Mid Cap Industrials index (a peer group reflecting companies of similar size and complexity) |

| | |

| þ | | Maintain a clawback policy covering cash and equity incentive compensation plans that applies in the event of a restatement of our financial statements |

| | |

| þ | | Impose a limit of $600,000 on total annual base compensation5 for non-employee directors |

______________________________

3 We define our Named Executive Officers’ annual “core compensation” as annual base salary and the target values for STIC and LTIC.

4 A portion of the CEO’s target core compensation consists of time-based restricted stock units, which the Compensation Committee considers to be “at risk” since the value fluctuates based on stock price performance and vesting of all tranches is contingent upon continued service. This portion does not exceed one-third of target annual LTIC awards made to the CEO and, together with the portion represented by performance-based LTIC awards and STIC, comprises the “at risk” compensation.

5 Director “annual base compensation” includes both the annual cash retainer and grant date fair value of annual stock award as detailed further in this proxy statement.

| | | | | | | | |

| | |

| þ | | Encourage Board refreshment in a variety of ways, including by requiring, without exemptions or conditions, our directors to retire no later than the first Annual Meeting of shareholders following the date on which that director turns 73 years of age |

| | |

| þ | | Maintain a Board diversity policy that provides that Board members will be diverse in terms of gender and of race and ethnicity, and in terms of other characteristics, including background, perspective, knowledge, skills, and experience |

| | | | | | | | |

Here’s What We Don’t Do . . . |

| | |

| x | | Permit re-pricing, exchanging, or cashing out of “underwater” stock options without shareholder approval |

| | |

| x | | Permit spring-loading, back-dating, or similar practices that “time” the grant of our equity awards |

| | |

| x | | Permit granting of stock options below fair market value |

| | |

| x | | Permit “recycling” (into the equity plan pool) of Company shares that are (i) used to pay an award exercise price or withholding taxes, or (ii) repurchased on the open market with the proceeds of a stock option exercise price |

| | |

| x | | Permit transferability of stock options for consideration |

| | |

| x | | Permit single-trigger change in control agreements for Named Executive Officers and other executives |

| | |

| x | | Permit change in control tax gross-ups for executives |

| | |

| x | | Permit a liberal change in control definition in our equity plan |

| | |

| x | | Permit pledging, short sales or hedging of Company securities by directors, officers, or other employees |

| | |

| x | | Permit directors, officers, or other employees to hold Company securities in margin accounts or otherwise to pledge Company securities as collateral for loans |

Recent Developments

This past year, we have augmented our governance and executive compensation practices in the following ways:

| | | | | | | | | | | |

| þ | | Appointed Helen W. Cornell as our third Board Chairperson, effective upon the retirement of our prior Board Chairperson on January 10, 2023 |

| | | |

| þ | | Published our fourth annual sustainability report, under the United Nations Global Compact, enhancing our energy and emissions data for major manufacturing sites, including initial Scope 3 disclosures, and expanding health and safety and diversity disclosures |

| | | |

| þ | | Updated our STIC program to replace the prior Adjusted IBT measure with one based on Adjusted EBITDA, which further aligns internal compensation with externally reported metrics while preserving the overall focuses of top- and bottom-line growth, healthy cash generation, and the appropriate balance of STIC components |

| | | |

| þ | | Tightened our STIC performance and payout curves to encourage achievement and emphasize high performance |

| | | |

| þ | | Revised and updated our clawback policy (“Clawback Policy”) to align with final Securities & Exchange Commission rules and New York Stock Exchange listing standards, and to strengthen the Company’s ability to recover any erroneously awarded performance-based compensation |

| | | |

| þ | | Adopted an amendment to our Amended and Restated Code of By-Laws to prohibit indemnification to a Company director, officer, or employee that would be against public policy, in further support of the revised Clawback Policy |

| | | |

| þ | | Amended our Insider Trading and Disclosure Policy to reflect new Exchange Act Rule 10b5-1 requirements, including mandatory “cooling-off” periods and limitations on the number and types of plans permitted to be adopted |

| | | |

| þ | | Implemented a new compensation peer group following the divestiture of our historical Batesville business segment, which represented a strategic shift in the Company’s business and accelerated our transformation into a pure-play industrial company |

| | | |

| þ | | Revised our Code of Ethical Business Conduct (available on our web site) in connection with our transformation into a pure-play industrial company, with a focus on, among other improvements, reflecting the Company’s recently adopted Purpose, Shape What Matters For TomorrowTM, and its updated mission, vision, and values |

HILLENBRAND, INC.

PROXY STATEMENT

This proxy statement relates to the solicitation by the Board of Directors of Hillenbrand, Inc. (the “Company” or “Hillenbrand”) of proxies for use at the Annual Meeting of the Company’s shareholders to be held at the Company’s headquarters at One Batesville Boulevard, Batesville, Indiana 47006, telephone (812) 931-5000, on Tuesday, February 20, 2024, at 10:00 a.m. Eastern Standard Time, and at any postponements or adjournments of the meeting. This proxy statement was first mailed to shareholders on or about January 9, 2024.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

The following questions and answers will explain the purpose of this proxy statement and what you need to know to vote your shares. Throughout these questions and answers and the proxy statement, we sometimes refer to Hillenbrand and the Company in terms of “we,” “us,” or “our.”

| | | | | |

| Q: | What is the purpose of this proxy statement? |

| |

| A: | The Board of Directors of Hillenbrand (the “Board”) is soliciting your proxy to vote at the 2024 Annual Meeting of shareholders of Hillenbrand because you were a shareholder at the close of business on December 15, 2023, the record date for the 2024 Annual Meeting, and are entitled to vote at the Annual Meeting. The record date for the 2024 Annual Meeting was established by the Board in accordance with our Amended and Restated Code of By-laws (the “By-laws”) and Indiana law. This proxy statement contains the matters that must be set out in a proxy statement according to the rules of the U.S. Securities and Exchange Commission (“SEC”) and the New York Stock Exchange (“NYSE”) and provides the information you need to know to vote at the Annual Meeting. You do not need to attend the Annual Meeting to vote your shares. |

| |

| |

| Q: | What is the difference between holding shares as a “shareholder of record” and as a “beneficial owner”? |

| |

| A: | If your shares are registered directly in your name with Hillenbrand’s transfer agent, Computershare Investor Services, LLC, you are the “shareholder of record” with respect to those shares, and you tell us directly how your shares are to be voted. If your shares are held in a stock brokerage account or by a bank or other nominee, then your nominee is the shareholder of record for your shares and you are considered the “beneficial owner” of shares held in street name. As the beneficial owner, you direct your broker, bank, or nominee how to vote your shares. |

| |

| |

| | | | | |

| Q: | What am I being asked to vote on? |

| |

| A: | •Election of three directors for the three-year term set forth under Proposal No. 1 – Election of Directors: Helen W. Cornell, Jennifer W. Rumsey, and Stuart A. Taylor, II; •Approval, by a non-binding advisory vote, of the compensation paid to the Company’s Named Executive Officers, as disclosed pursuant to SEC compensation disclosure rules in the “Compensation Discussion and Analysis” and “Executive Compensation Tables” sections of this proxy statement and in any related material herein (the “Say on Pay Vote”); •Ratification of the appointment of Ernst & Young LLP (“EY’) as the Company’s independent registered public accounting firm for fiscal year 2024. |

| |

| The Board recommends a vote FOR each of the director nominees; FOR approval of the compensation paid to the Named Executive Officers of the Company pursuant to the Say on Pay Vote; and FOR the ratification of the appointment of EY as the Company’s independent registered public accounting firm for fiscal year 2024. Our Named Executive Officers are those officers specified by Item 402(a)(3) of Regulation S-K. See the introductory discussion in Part I under “Executive Compensation” for more information regarding Named Executive Officers. |

| |

| |

| Q: | What are the voting requirements to elect the directors and to approve the other proposals being voted on? |

| |

| A: | The Restated and Amended Articles of Incorporation of Hillenbrand (as amended to date, the “Articles of Incorporation”) provide that in an uncontested election, the directors are elected by a majority of the votes cast at the Annual Meeting. This means that to be elected, the number of votes cast “for” a director nominee must exceed the number of votes “withheld” from that nominee. The adoption of each of the proposals (a) to approve, by a non-binding advisory vote, the compensation paid to the Named Executive Officers, and (b) to ratify the appointment of EY as the Company’s independent registered public accounting firm for fiscal year 2024 requires the affirmative vote of a majority of the votes cast for or against approval. If you are present or represented by proxy at the Annual Meeting and you affirmatively elect to abstain, your abstention, as well as any broker non-votes, will not be counted as votes cast on any matter to which they relate. See “How will my shares be voted?” below for more information about broker non-votes. |

| |

| |

| Q: | How many votes do I have? |

| |

| A: | You are entitled to one vote for each share of Hillenbrand common stock that you held as of the record date. |

| |

| |

| | | | | |

| Q: | How do I vote? |

| |

| A: | The different ways that you (if you are a shareholder of record) or your nominee (if you are a beneficial owner) can vote your shares depend on how you received your proxy statement this year. |

| |

| For shareholders of record, many of you were not mailed a paper copy of proxy materials, including this proxy statement, a proxy card, and our 2023 Annual Report to Shareholders. Instead, commencing on or about January 9, 2024, we sent you a Notice of Internet Availability of Proxy Materials (“Notice”) telling you that proxy materials are available at the web site indicated in that Notice, www.proxyvote.com, and giving you instructions for voting your shares at that web site. We also told you in that Notice (and on the web site) how you can request us to mail proxy materials to you. If you subsequently do receive proxy materials by mail, you can vote in any of the ways described below. If not, you must vote via the Internet (and we encourage you to do so) at www.proxyvote.com, by telephone, or in person at the Annual Meeting as explained below. With respect to shareholders of record who received proxy materials by mail, we commenced mailing on or about January 9, 2024. You can vote using any of the following methods: |

| | | | | | | | |

| | |

| | Proxy card or voting instruction card. Be sure to complete, sign, and date the card and return it in the prepaid envelope. |

| | |

| | By telephone or the Internet. The telephone and Internet voting procedures established by Hillenbrand for shareholders of record are explained in detail on your proxy card and in the Notice many shareholders receive. These procedures are designed to authenticate your identity, to allow you to give your voting instructions, and to confirm that these instructions have been properly recorded. |

| | |

| | In person at the Annual Meeting. You may vote in person at the Annual Meeting. You may also be represented by another person at the meeting by executing a proper proxy designating that person. If you are not the record holder of your shares and want to attend the meeting and vote in person, you must obtain a legal proxy from your broker, bank, or nominee and present it to the inspectors of election with your ballot when you vote at the meeting. |

| | | | | |

| With respect to the beneficial owners of shares held by nominees, the methods by which you can access proxy materials and give voting instructions to your nominee may vary, depending on the nominee. Accordingly, if you are such a beneficial owner, you should follow the instructions provided by your nominee. |

| |

| |

| | | | | |

| Q: | I share an address with another shareholder and we received only one Notice of Internet Availability of Proxy Materials or one paper copy of the proxy materials, as applicable. How may I obtain an additional copy? |

| |

| A: | The Company has adopted a procedure approved by the SEC called “householding.” Under this procedure, the Company is delivering a single copy of either the Notice of Internet Availability of Proxy Materials or a paper copy of the proxy materials, as applicable, to multiple shareholders who share the same address, unless the Company has received contrary instructions from one or more of the shareholders. This procedure reduces the Company’s printing costs, mailing costs, and fees. Shareholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, a separate copy of the Notice of Internet Availability of Proxy Materials or a paper copy of the proxy materials or the annual report, as applicable, will be promptly delivered to any shareholder at a shared address to which the Company delivered a single copy. To receive a separate copy, or a separate copy of future materials, shareholders may write or call the Company’s Investor Relations Department at One Batesville Boulevard, Batesville, Indiana 47006, telephone (812) 931‑6000, and facsimile (812) 931-5209. Shareholders who hold shares in street name may contact their broker, bank, or other nominee to request information about householding. |

| |

| |

| Q: | How will my shares be voted? |

| |

| A: | For shareholders of record, all shares represented by the proxies mailed to shareholders will be voted at the Annual Meeting in accordance with instructions given by the shareholder. Where proxies are returned without instructions, the shares will be voted: (1) FOR election of each of the three nominees named above as directors of the Company; (2) FOR approval, by a non-binding advisory vote, of the compensation paid to the Named Executive Officers pursuant to the Say on Pay Vote; (3) FOR ratification of the appointment of EY as the independent registered public accounting firm of the Company for fiscal year 2024; and (4) in the discretion of the proxy holders, upon such other business as may properly come before the Annual Meeting (we are not currently aware of any other matter that may come before the meeting). Where a proxy is not returned, your shares will not be voted unless you attend the Annual Meeting and vote in person (including by means of remote communication, if applicable). For beneficial owners, the brokers, banks, or nominees holding shares for the beneficial owner must vote those shares as instructed. If the broker, bank, or nominee has not received instructions from the beneficial owner, the broker, bank, or nominee generally has discretionary voting power only with respect to matters that are considered routine matters. Under applicable New York Stock Exchange rules, Proposal No. 1 relating to election of directors, and Proposal No. 2 relating to a non-binding advisory vote to approve Named Executive Officer compensation are deemed to be non-routine matters with respect to which brokers and nominees may not exercise their voting discretion without receiving instructions from the beneficial owners of the shares (this is referred to as a “broker non-vote”). Proposal No. 3 relating to ratification of the appointment of EY as the independent registered public accounting firm of the Company for fiscal year 2024 is a matter on which brokers holding stock for the accounts of their clients who have not been given specific voting instructions are allowed to vote client shares. |

| | | | | |

| To avoid a broker non-vote of your shares on Proposals No. 1 and 2, you must send voting instructions to your bank, broker, or nominee or obtain a legal proxy and vote your shares in person at the Annual Meeting. |

| |

| |

| Q: | What can I do if I change my mind after I vote my shares prior to the Annual Meeting? |

| |

| A: | If you are a shareholder of record, you may revoke your proxy at any time before it is voted at the Annual Meeting by: •sending written notice of revocation to the Secretary of Hillenbrand at One Batesville Boulevard, Batesville, Indiana 47006; •submitting a revised proxy by telephone, Internet, or paper ballot after the date of the revoked proxy; or •attending the Annual Meeting and voting in person. If you are a beneficial owner of shares, you may submit new voting instructions by contacting your broker, bank, or nominee. You may also vote in person at the Annual Meeting if you obtain a legal proxy as described under “How do I vote?” above. |

| |

| |

| Q: | Who will count the votes? |

| |

| A: | Representatives of Broadridge Investor Communication Solutions, Inc. (“Broadridge”) will tabulate the votes and act as inspectors of election. |

| |

| |

| Q: | What constitutes a quorum at the Annual Meeting? |

| |

| A: | As of the record date, 70,123,120 shares of Hillenbrand common stock were outstanding. A majority of the outstanding shares must be present or represented by proxy at the Annual Meeting to constitute a quorum for the purpose of conducting business at the Annual Meeting. Your shares will be considered part of the quorum if you submit a properly executed proxy or attend the Annual Meeting. |

| |

| |

| Q: | Who can attend the Annual Meeting in person? |

| |

A: | We intend to hold the Annual Meeting in person, but, we urge you to consider voting in advance of the meeting via one of the remote methods described above in lieu of attending the meeting in person. Even so, all shareholders as of the record date may attend the Annual Meeting in person but must have an admission ticket, bring matching photo identification, and register their planned in-person attendance with the Company at least ten (10) business days prior to the Annual Meeting, by writing to the Investor Relations Department, Hillenbrand, Inc., One Batesville Boulevard, Batesville, Indiana 47006 or by email at investors@hillenbrand.com. In addition, we require you to follow these procedures and any protocols we may have in place on the meeting date. If you are a shareholder of record, the ticket attached to the proxy card or a copy of your Notice (whichever you receive), together with matching photo identification and pre-registration, will admit you. |

| | | | | |

| If you are a beneficial owner, you may request a ticket by writing to the Secretary of Hillenbrand at One Batesville Boulevard, Batesville, Indiana 47006, or by faxing your request to (812) 931-5185 or emailing it to investors@hillenbrand.com. You must provide evidence of your ownership of shares with your ticket request, which you can obtain from your broker, bank, or nominee. We encourage you or your broker to fax or email your ticket request and proof of ownership as soon as possible to avoid any mail delays. If for any reason we determine that it is not possible or advisable to hold the meeting in person, we will announce any such change and the details on how to participate by press release, on our website at https://ir.hillenbrand.com, and in a filing with the Securities and Exchange Commission. If you are planning to attend the Annual Meeting in person, please check our website in advance for any updates to planned arrangements. |

| |

| |

| Q: | When are shareholder proposals due for the 2025 Annual Meeting? |

| |

| A: | For a shareholder proposal to be presented at the Company’s 2025 Annual Meeting of shareholders and to be considered for possible inclusion in the Company’s proxy statement and form of proxy relating to that meeting, it must be submitted to and received by the Secretary of Hillenbrand at its principal offices at One Batesville Boulevard, Batesville, Indiana 47006, not later than September 11, 2024. Our By-laws describe certain information required to be submitted with such a proposal. In addition, without regard to whether a proposal is or is not submitted in time for possible inclusion in our proxy statement for the 2025 Annual Meeting, our By-laws provide that for business to be brought before the Annual Meeting by a shareholder, or for director nominations to be made by a shareholder for consideration at the Annual Meeting, written notice thereof must be received by the Secretary of Hillenbrand at its principal offices not later than 100 days prior to the anniversary of the immediately preceding Annual Meeting, or not later than November 12, 2024, for the 2025 Annual Meeting of shareholders. This notice must also provide certain information as set forth in our By-laws. See the discussion below under “Committees of the Board of Directors” under “The Board of Directors and Committees” for additional details regarding shareholder nominees for director. In addition to the foregoing, any shareholder who intends to solicit proxies in support of director nominees other than the Company's nominees must comply with the additional requirements of Rule 14a-19 under the Securities Exchange Act of 1934, as amended. |

| |

| |

| Q: | What happens if a nominee for director is unable to serve as a director? |

| |

| A: | If any of the nominees becomes unavailable for election, which we do not expect to happen, votes will be cast for such substitute nominee or nominees as may be designated by the Board, unless the Board reduces the number of directors. |

| |

| |

| Q: | Can I view the shareholder list? If so, how? |

| |

| A: | A complete list of the shareholders entitled to vote at the Annual Meeting will be available to view during the Annual Meeting. The list will also be available to view at the Company’s principal offices during regular business hours during the five business days preceding the Annual Meeting. |

| |

| |

| | | | | |

| Q: | Who pays for the proxy solicitation related to the Annual Meeting? |

| |

| A: | The Company pays for the proxy solicitation related to the Annual Meeting. In addition to sending you these materials, some of our directors and officers, as well as management and non-management employees, may contact you by telephone, mail, email, or in person. You may also be solicited by means of press releases issued by Hillenbrand and postings on our web site, www.hillenbrand.com. None of our officers or employees will receive any additional compensation for soliciting your proxy. We will also reimburse banks, nominees, fiduciaries, brokers, and other custodians for their costs of sending proxy materials to the beneficial owners of Hillenbrand common stock. |

| |

| |

| Q: | How can I obtain a copy of the Annual Report on Form 10-K? |

| |

| A: | A copy of Hillenbrand’s 2023 Annual Report on Form 10-K, as well as Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, are available on the Internet at the Company’s web site, www.hillenbrand.com. The 2023 Annual Report on Form 10-K may also be obtained free of charge by writing or calling the Investor Relations Department of Hillenbrand at its principal offices at One Batesville Boulevard, Batesville, Indiana 47006, telephone (812) 931-6000, and facsimile (812) 931-5209. |

| |

| Q: | How can I obtain the Company’s corporate governance information? |

| |

A: | The documents listed below are available on the Internet at the Company’s web site, www.hillenbrand.com. You may also go directly to https://ir.hillenbrand.com/corporate-governance/governance-documents for those documents. Printed copies are also available to any shareholder who requests them through our Investor Relations Department at One Batesville Boulevard, Batesville, Indiana 47006, telephone (812) 931‑6000, and facsimile (812) 931-5209. The available documents are: •Hillenbrand, Inc. Corporate Governance Standards •Hillenbrand, Inc. Committee Charters – Audit Committee, Nominating/Corporate Governance Committee, Compensation and Management Development Committee, and Mergers and Acquisitions Committee •Position Descriptions for Chairperson of the Board, Vice Chairperson of the Board, Members of the Board, and Committee Chairpersons •Restated and Amended Articles of Incorporation of Hillenbrand, Inc. •Amended and Restated Code of By-laws of Hillenbrand, Inc. •Hillenbrand, Inc. Code of Ethical Business Conduct •Hillenbrand, Inc. Global Anti-Corruption Policy •Supply Chain Transparency Policy – Hillenbrand, Inc. and its subsidiaries •Human Rights Policy – Hillenbrand, Inc. and its subsidiaries •Global Environmental Policy – Hillenbrand, Inc. and its subsidiaries •Conflict Minerals Policy – Hillenbrand, Inc. and its subsidiaries •Supplier Diversity Policy – Hillenbrand, Inc. and its subsidiaries •Hillenbrand, Inc. Insider Trading and Disclosure Policy •Hillenbrand, Inc. Clawback Policy |

|

|

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

This section of the proxy statement introduces the current directors, including the three directors in Class I who have been nominated to serve additional three-year terms.

The Articles of Incorporation and the By-laws of Hillenbrand provide that directors of the Board are classified with respect to the terms that they serve by dividing them into three equal (or near-equal) Classes. Each director is elected to serve a three-year term (or the term applicable to his or her Class) and until his or her successor is duly elected and qualified, or until his or her earlier death, resignation, lawful removal, or failure to be re-elected in accordance with the Company’s By-laws.

The Board of Directors currently consists of ten directors, with three directors in each of Class I and Class II and four directors in Class III.6 The terms of the directors expire as follows:

| | | | | |

| Class | Term Expires at |

| Class I | 2024 Annual Meeting |

| Class II | 2025 Annual Meeting |

| Class III | 2026 Annual Meeting |

The three directors in Class I who are nominated for election to the Board at the 2024 Annual Meeting, each of whom has agreed to serve as a director if elected, are Helen W. Cornell, Jennifer W. Rumsey, and Stuart A. Taylor, II . Each of these directors has been nominated to serve a three-year term as required by our By-laws.

The Board of Directors recommends that the shareholders vote FOR Proposal No. 1 to elect each of the three nominees to the Board of Directors.

The Articles of Incorporation of Hillenbrand provide that in an uncontested election, directors are elected by a majority of the votes cast at the Annual Meeting. This means that to be elected, the number of votes cast “for” a director nominee must exceed the number of votes “withheld” from that nominee. If you own shares through a bank, broker, or other holder of record, you must instruct your bank, broker, or other holder of record how to vote your shares in order for your vote to be counted on this Proposal. At the Annual Meeting, the proxies being solicited will be voted for the three nominees as Class I directors.

Set forth below is information about all of our current directors, including the three nominees for election at the 2024 Annual Meeting of shareholders. The biographical information provided for each person includes all directorships held by and other relevant business experience of such person at any time during at least the past five years and, in some cases, directorships held prior to such five-year lookback.

______________________________

6 As previously disclosed, in conformity with the Company’s director retirement policy, F. Joseph Loughrey, a former Class II director, retired from service as a member of the Board during fiscal year 2023. In connection with Mr. Loughrey’s retirement, the Board reduced the size of the Board to ten directors.

| | | | | | | | | | | | |

| Class I Nominees for Election as Directors with Terms Expiring in 2027 | |

Helen W. Cornell Independent | Age 65 Chairperson of the Board Chairperson of the NCG Committee | |

| CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

Owensboro Grain Company, grain and soybean products (privately-owned). | Industrial Experience. More than twenty-two years as a leader in global industrial manufacturing; her strong manufacturing background and global industrial expertise continues to benefit the Board, the Company, and the shareholders as Hillenbrand works to execute its profitable growth strategy.

Corporate Finance. A certified public accountant (CPA) and certified management accountant (CMA) with a long tenure in operations and finance, and experience interfacing with investors, including as CFO of a major public company and most recently as President and CEO of Owensboro Grain Company, as well as board experience with both a public and private company.

Risk Management and Oversight. Long record of managing risk as former CEO and President of Owensboro Grain Company and former CFO and Executive Vice President of Gardner Denver, Inc.

Strategic Thinking. Extensive experience in strategic transactions and operations as an executive and as Chairperson of the Board.

Mergers and Acquisitions. Leader of many mergers, acquisitions, financings, and investments, including during her tenure as a member of Hillenbrand’s M&A Committee. | |

| 2015 to 2023 | President and CEO | |

Gardner Denver, Inc. (n/k/a Ingersoll Rand), a leading global manufacturer of compressors, blowers, pumps, loading arms, and fuel systems for various industrial, medical, environmental, transportation, and process applications. | |

| 1998 to 2010 | CFO and Executive Vice President | |

| HILLENBRAND BOARD SERVICE | |

Since 2023 | Chairperson of the Board | |

| Since 2022 | Chairperson of the NCG Committee | |

2022 to 2023 | Vice Chairperson of the Board | |

2018 to 2022 | Chairperson of Compensation Committee | |

Since 2013 | Compensation Committee Member | |

2011 to 2023 | M&A Committee Member | |

2011 to 2013 | Audit Committee Member | |

Since 2011 | Director and NCG Committee Member | |

| OTHER BOARD SERVICE | |

Dot Family Holdings, LLC, a privately-owned food redistributor. | |

Since 2012 | Director, Chair of Compensation Commitee, Audit Committee Member; past Chair of the Audit Committee | |

Brescia University, a private Catholic liberal arts college in Owensboro, Kentucky. | |

| 2018 to 2023 | Board of Trustees and Finance Committee Member | EDUCATION | |

Owensboro Grain Company. | MBA (Finance), Vanderbilt University

BS (Accounting), University of Kentucky | |

| 1998 to 2023 | Director, Chair of the Board, and Chair of the Executive Committee | |

The Alamo Group, a global leader in design and manufacture of agricultural equipment for farms and ranches and infrastructure maintenance equipment for governmental and industrial markets. | |

| 2011 to 2016 | Director, Chair of the Audit Committee and Compensation Committee Member | |

| | | | | | | | | | | | |

| | |

Jennifer W. Rumsey Independent | Age 50 | |

| CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

Cummins, Inc., designer, manufacturer, and seller of innovative products, including components, engines, power generation, and digital solutions. | Innovation/Technology. Deep technological background and experience, particularly given her tenure as a senior technical executive of a Fortune 500 public industrial manufacturing company, including in product life cycle responsibility, from advanced research to current product support, in engineering and product quality, and in multiple business areas.

Sustainability/ESG. Current CEO and President of a global leader providing power solutions that both meet business needs and have large-scale environmental impact; previously as Cummins CTO, led strategic investments in key technologies and applications to transition to lower carbon emissions products.

Continuous Improvement (Lean, Six Sigma). Six Sigma certified, including extensive knowledge, professional skills, and experience in improving performance, increasing profits, and decreasing errors.

Operations (Manufacturing, Service). Experience overseeing strategic direction, growth initiatives, and global operations including as President and CEO of a Fortune 500 public industrial manufacturing company.

Industrial Experience. Decades of experience in highly technical fields at a Fortune 500 public industrial manufacturing company in a variety of technical and operational functions.

| |

| Since 2022 | President and CEO

| |

| 2021 to 2022 | President and Chief Operating Officer

| |

| 2019 to 2021 | Vice President and President, Components Business Segment

| |

| 2015 to 2019 | Vice President, Chief Technical Officer

| |

| HILLENBRAND BOARD SERVICE | |

| Since 2020 |

Director, NCG Committee Member, and Compensation Committee Member

| |

| OTHER BOARD SERVICE | |

College of Engineering at Purdue University, a public land-grant research university in West Lafayette, Indiana. | |

2016 to 2022 | Advisory Council Member | |

Cummins, Inc. | |

Since 2023 | Chair | |

| Since 2022 | Director

| |

US Department of Energy (“DOE”) Hydrogen and Fuel Cell Technical Advisory Committee, established under the Energy Policy Act of 2005 to advise the Secretary of Energy on hydrogen research, development, and demonstration efforts. | |

| 2019 to 2021 | Advisory Council Member | EDUCATION | |

| | MS (Mechanical Engineering), Massachusetts Institute of Technology

BS (Mechanical Engineering), Purdue University | |

| | | | | | | | | | | | |

| | |

Stuart A. Taylor, II. Independent | Age 63 Chairperson of the M&A Committee | |

| CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

The Taylor Group, LLC, a private equity firm focused on creating and acquiring businesses. | Mergers and Acquisitions. Thirty years of investment banking experience as a leader in financings, mergers, acquisitions, investments, and strategic transactions, including a career at several large investment banking firms and running a private investment management company.

Strategic Thinking. More than two decades as CEO and owner of private equity firm, evaluating strategic investments and transactions and managing risk.

Corporate Finance. Extensive experience supervising business operations, including providing strategic and financial advisory and investment banking services to public and private companies, as well as supervisory authority over the Taylor Group’s principal financial and accounting officers on all financial matters.

Risk Management and Oversight. Decades of experience as CEO with ultimate responsibility for risk-adjusted decision making and oversight of risk management.

Human Resources. Extensive experience managing employees as CEO, and serving on Human Resources and Compensation Committees of multiple boards of directors for both public and private companies.

| |

| Since 2001 | CEO | |

Bear, Stearns, & Co. Inc., a global brokerage and investment banking firm (acquired by JPMorgan Chase & Co. in 2008). | |

| 1999 to 2001 | Senior Managing Director | |

CIBC World Markets, an investment banking firm based out of Canada. | |

| 1996 to 1999 | Managing Director of Global Automotive Group and Capital Goods Group | |

Banker’s Trust, a privately-owned financial institution. | |

| 1993 to 1996 | Managing Director of Automotive Industry Group | |

| HILLENBRAND BOARD SERVICE | |

| Since 2012 | Member and Chairperson of the M&A Committee | |

| 2009 to 2018 | Audit Committee Member | |

| 2008 to 2009; Since 2019 | Compensation Committee Member | |

| Since 2008 | Director, NCG Committee Member | |

| OTHER BOARD SERVICE | EDUCATION | |

Ball Corporation, a diversified manufacturer. | MBA (Finance), Harvard

BA (History), Yale | |

| Since 1999 | Director, current Lead Independent Director and Chair of NCG Committee, Human Resources Committee Member | |

Wabash National Corporation, a provider of engineered solutions for transportation, logistics and distribution industries. | |

| Since 2019 | Director, Member, Audit and Compensation Committees | |

Solenis, LLC, a global producer of specialty chemicals for water-intensive industries. | |

| Since 2020 | Director and Compensation Committee Member | |

Essendant, Inc., (f/k/a United Stationers, Inc.), a wholesale distributor of business products. | |

2011 to 2019 | Director | |

| | | | | | | | | | | | |

| Class II Directors with Terms Expiring in 2025

| |

Gary L. Collar Independent | Age 67 Chairperson of the Compensation Committee | |

| CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

AGCO Corporation, a world leader in the development, manufacture, and marketing of agricultural machinery and solutions. | International Business/Global Markets. International business leader at Fortune 500 company with proven expertise within the manufacturing industry and extensive experience leading, managing, and overseeing global operations.

Human Resources. Considerable experience managing and overseeing labor and human relations risks globally, as well as service as Chairperson of the Company’s Compensation and Management Development Committee.

Strategic Thinking. Experience providing strategic direction while overseeing global development and manufacturing at AGCO.

Operations (Manufacturing, Service). Decades of senior executive experience in the industrial sector at global public companies.

Industrial Experience. Career devoted to serving as a senior executive to global public and private manufacturing companies, as well as board service at Tractor and Farm Equipment Limited.

| |

| 2012 to 2021 | Senior Vice President and General Manager of the Asia Pacific and Africa (APA) Region | |

| 2004 to 2011 | Senior Vice President and General Manager of Europe, Africa, Middle East, Australia, and New Zealand | |

| 2002 to 2003 | Vice President of Worldwide Market Development, Challenger Division

| |

ZF Friedrichshaven A.G., a leader in development and manufacture of advanced technology automotive chassis and power train systems. | |

| 2001 to 2002 | Vice President of Business Development, ZF Group NAO | |

| 1995 to 2001 | President and CEO, Zua Autoparts Joint Venture | |

| HILLENBRAND BOARD SERVICE | |

| Since 2022 | Chairperson of the Compensation Committee | |

| Since 2015 | Compensation Committee Member

| |

| Since 2015 | Director and NCG Committee Member

| |

| OTHER BOARD SERVICE | EDUCATION | |

Tractors and Farm Equipment Limited, a tractor manufacturer and an investment of AGCO, based in India. | BS (Business Administration and Marketing Management), California State University – East Bay | |

2012 to 2021 | Director | |

AGCO Finance, Inc., a joint venture between AGCO and De Lage Landen Financial Services, which provides retail and wholesale financing services to AGCO customers globally. | |

| 2016 to 2021 | Global Director | |

| | | | | | | | | | | | |

| | |

Joy M. Greenway Independent | Age 63

| |

| CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

General Motors, a global motor vehicle manufacturer headquartered in the USA. | Operations (Manufacturing, Service). Extensive profit and loss leadership experience in businesses requiring long-term financial planning, successfully impacting top- and bottom-line results.

Continuous Improvement (Lean, Six Sigma). Experience operating above industry market growth rates reinforcing existing strategic customer business, capitalizing on global footprint, investing in technology, and creating synergistic corporate infrastructures.

International Business/Global Markets. Global operational and multicultural experience, building relationships throughout Asia, Eastern and Western Europe, and the Americas, with expertise in Asia and growth markets.

Industrial Experience. Decades of leadership experience in global industrial manufacturing, including senior executive roles at Fortune 500 companies.

Innovation/Technology. Deep technological and innovation background and experience, particularly as an executive of a Fortune 500 public industrial company.

| |

| 2018 to 2020 | Executive Director Global Business Solutions | |

| 2017 to 2018 | Executive Director Transformation, Global Business Services | |

| 2014 to 2017 | CFO, Global Purchasing and Supply Chain

| |

Visteon Corporation, a tier one automotive supplier. | |

| 2005 to 2013 | Vice President and President of Climate | |

| 2000 to 2005 | Director, Strategic Business Unit, Customer Business Unit, Powertrain

| |

United Technologies Corporation, a diversified aerospace and building company. | |

| 1995 to 2000 | Director, Operations

| |

GE Industrial Power Systems, a world energy leader providing technology, solutions, and services across the entire energy value chain from the point of generation to consumption. | |

| 1994 to 1995 | Director, Materials | |

| HILLENBRAND BOARD SERVICE | EDUCATION | |

Since 2013

|

Director, Audit Committee Member, and NCG Committee Member | MBA, Massachusetts Institute of Technology MS (Mechanical Engineering), Syracuse University BS (Industrial Education Engineering), University of Illinois Urbana-Champaign

| |

| OTHER BOARD SERVICE | |

Electricfil Corporation, a company headquartered in France specializing in the private design and manufacture of sensors and actuators for powertrain and transmissions. | |

| 2020 to 2021 | Director and Senior Advisor to Chairman and President | |

| | | | | | | | | | | | |

| | |

Dennis W. Pullin Independent | Age 64

| |

| CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

Virtua Health, a not-for-profit academic health system in New Jersey. | Sustainability/ESG. Insight and commitment to sustainability and to diversity, equity, and inclusion efforts demonstrated by leadership at Virtua Health, emphasizing core values, equity, and inclusion, and supporting sustainability initiatives; and promoting gender equality among Virtua Health’s leadership.

Strategic Thinking. Deep leadership and strategic experience, including customer service focus and digital transformation, and Virtua Health's “Hospital at Home” program, transforming the patient experience.

Cyber / Information Security. Years of information security oversight and knowledge gained as a hospital system senior executive responsible for protecting patients’ health information while complying with applicable privacy laws and policies.

Risk Management and Oversight. Extensive background in senior management as an executive at large, diverse organizations with elevated risk profiles.

Mergers and Acquisitions. Extensive leadership experience in mergers and acquisitions demonstrated at a variety of dynamic organizations.

| |

| Since 2017 | President and CEO

| |

MedStar Harbor, a not-for-profit, community-based health care organization comprising ten major hospitals and twenty-five integrated businesses in U. S. Mid-Atlantic region. | |

| 2009 to 2017 | President of MedStar Harbor Hospital

| |

MedStar Washington Hospital Center, largest private teaching and researching hospital based in Washington, D.C. | |

| 2006 to 2009 | COO and Senior Vice President

| |

CHI St. Luke’s Health, a tertiary community teaching hospital in the Texas Medical Center. | |

| 2002 to 2006 | Vice President of Operations and Business Development | |

| HILLENBRAND BOARD SERVICE | |

| Since 2021 |

Director, Compensation Committee Member, and NCG Committee Member

| |

| OTHER BOARD SERVICE | |

New Jersey Hospital Association, an organization serving healthcare groups to identify savings opportunities, reduce costs, and provide affordable and flexible education programs. | |

| Since 2019 | Director | EDUCATION | |

Chamber of Commerce Southern New Jersey, a member-driven organization that advocates for economic prosperity. | Certificate for Post-Graduate Studies in Cardiac Rehabilitation, Baylor College of Medicine MS (Physiology), Texas A&M University BA (Biology), Texas Lutheran University

| |

| Since 2018 | Director | |

Healthcare for the Homeless, a non-profit advocating for affordable housing and providing health care services to the homeless. | |

| 2013 to 2017 | Director | |

| | | | | | | | | | | | |

| Class III Directors with Terms Expiring in 2026 | |

Daniel C. Hillenbrand Independent | Age 57 | |

| CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

Clear Water Capital Partners, LLC, a private diversified venture capital firm. | Strategic Thinking. Decades of operational and investment experience with responsibility for evaluating and pursuing attractive strategic opportunities.

Operations (Manufacturing, Service). Long tenure and deep board and executive experience in private manufacturing companies.

Risk Management and Oversight. Managing partner of various investment firms, including founder of diversified investment firm leveraging expertise in crisis management, strategy, and business development in the context of risk mitigation.

Mergers and Acquisitions. Extensive experience, including at Clear Water Capital Partners, overseeing and assessing the performance of companies with respect to mergers and acquisitions.

Continuous Improvement (Lean, Six Sigma). Accomplished leader in Lean manufacturing principles, as well as business and brand development; experience creating and driving rapid value appreciation in sourcing, distribution, logistics, and e-commerce.

| |

| Since 2010 | Founder and Managing Partner

| |

Generations, L.P., an investment management company. | |

| Since 2002 | Managing Partner

| |

Legacy Company, a real estate investment company. | |

| Since 2022 | Managing Partner

| |

Able Manufacturing and Assembly, LLC, a manufacturing company with platforms in metal fabrication, fiberglass composites, and plastic thermoform manufacturing. | |

2013 to 2019, | CEO | |

| 2002 to 2007 | |

2013 to 2014 | President | |

Nambé, LLC, a leading international high-end consumer products company. | |

| 2005 to 2007 | President and CEO

| |

| HILLENBRAND BOARD SERVICE | |

Since 2018

| Director, Audit Committee Member, and NCG Committee Member | |

| OTHER BOARD SERVICE | EDUCATION | |

Spring Grove Cemeteries, National Historic Landmark and cemetery serving the residents of Cincinnati and surrounding communities. | MBA, Northwestern University BA (Political Science), Boston College

| |

| Since 2023 | Director

| |

| Nambé, LLC | |

| 2004 to 2019 | Chair of the Board

| |

Pri Pak, Inc., a provider of name brand and private label contract beverage manufacturing services. | |

| 2009 to 2017 | Vice Chair of the Board

| |

| Able Manufacturing and Assembly, LLC | |

2002 to 2021 | Chair of the Board | |

| | | | | | | | | |

| | |

Neil S. Novich Independent | Age 69 Chairperson of the Audit Committee | |

| CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

Ryerson, Inc., a global metals distributor and fabricator. | Risk Management and Oversight. Former Chair/CEO and board member of Fortune 500 public companies with an understanding of critical success factors for mitigation and executive management of risk.

Operations (Manufacturing Experience). Deep engagement, as President and CEO, in Ryerson’s distribution and fabrication operations, both domestic and international, striving for continuous operations improvement, while providing overall leadership, following more than a decade with a major management consulting firm focused on optimizing strategy development and execution for clients, including marketing, operations, sales, and technology.

Strategic Thinking. Orientation for high engagement in the board room; recognized for providing innovative strategic insights that support enhanced growth and well-functioning strategic systems.

Cyber/Information Security; Information Technology. Significant experience providing oversight to these functions as Chair of Audit Committee at Hillenbrand, with background knowledge derived from continuing education and certificates in highly analytical subjects.

Human Resources. Leadership experience at Bain and Ryerson with responsibility for large teams; significant boardroom experience in executive compensation and other human resources topics. | |

1999 to 2007 | Chairperson, President and CEO | |

1994 to 1999 | President and CEO | |

| 1994 to 1996 | Chief Operating Officer

| |

Bain and Company, an international management consulting firm. | |

| 1981 to 1994 | Partner | |

| HILLENBRAND BOARD SERVICE | |

| Since 2019 | Chairperson of the Audit Committee | |

| Since 2018 | Audit Committee Member | |

| Since 2013 | M&A Committee Member | |

| 2013 to 2018 | Chairperson of the Compensation Committee | |

| 2010 to 2018 | Compensation Committee Member | |

| Since 2010 | Director and NCG Committee Member | |

| OTHER BOARD SERVICE | |

Beacon Roofing Supply, a distributor of residential and non-residential roofing materials. | |

| Since 2012 | Director; Chair, Compensation Committee (since 2018); past Chair, Audit Committee | |

Analog Devices, Inc., a global semiconductor leader. | |

| 2008 to 2020 | Director; Member, Audit Committee; past Chair, Compensation Committee

| |

American Securities, a private equity fund. | EDUCATION | |

| Since 2004 | Member, Executive Council

| MS (Management), Massachusetts Institute of Technology MS (Nuclear Engineering), Massachusetts Institute of Technology BS (Physics), Harvard University | |

WW. Grainger, Inc., an industrial supply company. | |

| Since 1999 | Director; Member, Audit and Nominating and Governance Committees; past Chair and Member, Compensation Committee | |

Field Museum of Natural History, a Chicago museum. | |

| Since 1999 | Trustee, Former Chair of Research and Technology Committees | |

Ryerson, Inc. | |

1994 to 2007 | Director; Chairperson of the Board (since 1999)

| |

| | | | | | | | | | | | |

| | |

Kimberly K. Ryan Not Independent | Age 57 President and CEO | |

| CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

Hillenbrand, Inc. | Risk Management and Oversight. Decades of senior management experience addressing risks as an executive, as well as oversight of overall company risk management as Chairperson of the Board of Directors of Kimball International, Inc. Corporate Finance. A leader in finance, with extensive experience beginning early career at Hill-Rom, as well as CEO and Board Chair at Kimball, and continuing through tenure as President of Coperion, Hillenbrand's largest business. Industrial Experience. Deep knowledge of process solutions industries as well as broad-based business, international manufacturing, operations, and procurement experience, including in business-to-business product sales and services for a variety of global industries; service since 1989 in positions of increasing responsibility in finance, strategy, operations, logistics, and information technology at the Company and Hill-Rom (the Company’s former parent company). Information Technology. Experience leading information technology teams from early career to present, including leadership of enterprise resource planning system project at Hill-Rom and board and executive roles overseeing IT. Cyber/Information Security. Cyber and information security fluency from decades of exposure to this topic, including as Senior Vice President of Information Technology and Office of Program Leadership at Hill-Rom. | |

| Since 2021 | President and CEO | |

| 2021 | Executive Vice President | |

| 2015 to 2021 | President of Coperion and Senior Vice President of Hillenbrand | |

| 2011 to 2015 | President of Batesville and Senior Vice President of Hillenbrand

| |

Hill-Rom, Inc., a leading global provider of medical equipment and services. | |

| 2006 to 2011 | Senior Vice President, Post Acute Care Division | |

| 2005 to 2006 | Senior Vice President, Information Technology and Office of Program Leadership | |

2003 to 2005 | Vice President, Shared Services | |

| HILLENBRAND BOARD SERVICE | |

Since 2021 | Director | |

| OTHER BOARD SERVICE | |

Kimball International, Inc., a public manufacturing company in the furniture industry. | |

| 2014 to 2023 | Director and Member of Audit Committee | |

| 2018 to 2021 | Chairperson of the Board, Member of Compensation and Governance Committees

| |

National Association of Manufacturers, a manufacturing industrial trade association. | |

| Since 2022 | Director

| |

Iowa State University, College of Business, a public land-grant institution. | |

| Since 2022 | Deans Advisory Board Council | EDUCATION | |

Conexus Indiana, an Indiana non-profit organization advancing manufacturing and logistics for business and educators. | BA (Accounting), Iowa State University | |

| 2018 to 2021 | Director

| |

| | | | | | | | | | | | |

| | |

Inderpreet Sawhney Independent | Age 59 | |

| CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

Infosys Ltd., a global leader in next-generation digital services. | Cyber/Information Security; Information Technology. Experienced general counsel and senior executive at large information technology firms with in-depth knowledge of and exposure to technology, legal, compliance, and cyber matters.

Risk Management and Oversight. Extensive experience overseeing risk associated with the development and growth of digital services including cyber security, technology, and compliance risks from a legal standpoint.

Strategic Thinking. Experience navigating organizations through various high-profile strategic issues, such as employee and customer safety, business continuity, and diversity and inclusion initiatives.

Sustainability/ESG. Track record of executing sustainability initiatives in the context of compliance, equity, and inclusion, in particular as Chief Compliance Officer of Infosys Ltd.

Mergers and Acquisitions. Wide experience in mergers, acquisitions, and strategic transactions as general counsel at large, diverse organizations.

International Business/Global Markets. Extensive international experience with a focus on India, including World Economic Forum, Co-Chair of Global Future Council on Good Governance. | |

| Since 2017 | General Counsel and Chief Compliance Officer

| |

Wipro Limited, a leading technology services and consulting company with capabilities in consulting, design, engineering, and operations. | |

| 2011 to 2017 | Senior Vice President and General Counsel

| |

The Chugh Firm, a private law firm. | |

| 1997 to 2011 | Managing Partner of the Silicon Valley Office | |

| HILLENBRAND BOARD SERVICE | |

Since 2023 |

M&A Committee Member

| |

| Since 2021 |

Director, Audit Committee Member, and NCG Committee Member

| |

| OTHER BOARD SERVICE | |

SABANA (South Asian Bar Association of North America), organization encouraging professional growth and advocating for equal rights and access to justice for South Asian community. | |

| Since 2019 | Advisory Council Member

| |

Infosys Foundation USA, a nonprofit organization that aims to expand computer science education and training, particularly in underrepresented communities. | |

| Since 2022 | Chair | EDUCATION | |

| Since 2021 | Trustee | LLM, Queens University LLB, Delhi University BS (Economics), Delhi University, Lady Shriram College | |

| |

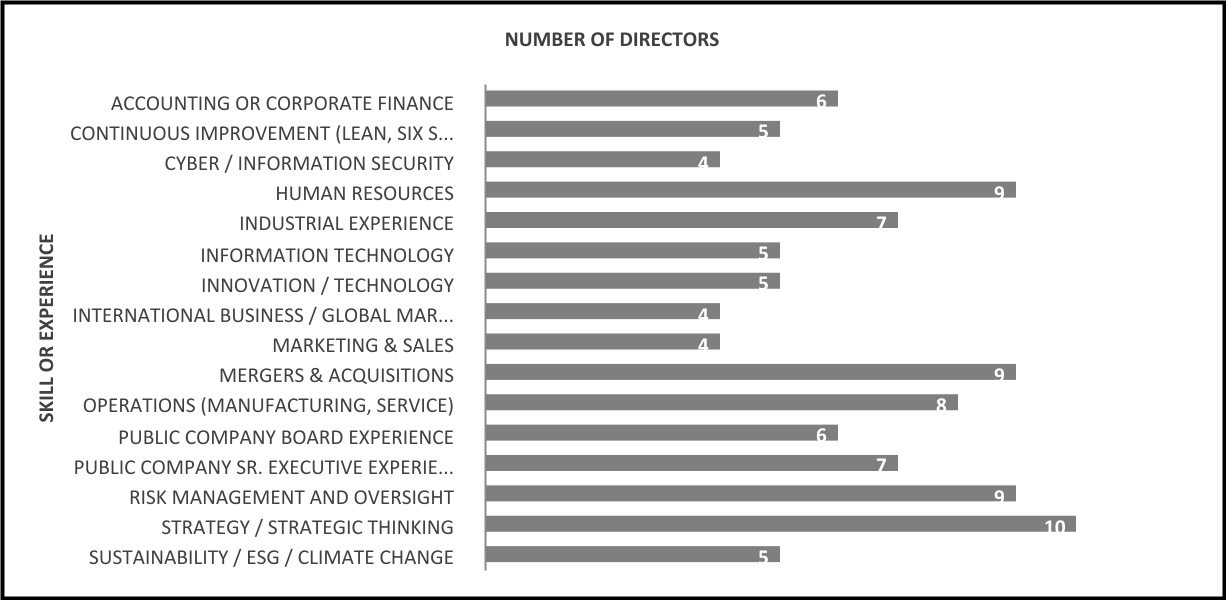

Skills and Experience Matrix. The graph below summarizes the Skills and Experience Matrix that our Board uses to align its composition with the Company’s strategic priorities and to identify key skills and experiences most relevant to decisions about Board composition. The graph presents the areas for which the Board relies on individual directors, given their relatively deep background in the area, and the number of directors with such background in each area. This presentation does not mean that some directors lack certain skills or experiences, but rather that other directors have relatively deeper expertise. The director and director nominee biographies above further showcase the diversity of our Board and each person’s qualifications and relevant experience in more detail.

THE BOARD OF DIRECTORS AND COMMITTEES

The Company’s business is managed under the direction of its Board of Directors. In this section of the proxy statement, we describe the general and certain specific responsibilities of the Board of Directors and its committees, our governance practices, and how you can communicate with the Board or with individual directors.

Board’s Responsibilities

The Board of Directors is the ultimate decision-making body of the Company, except with respect to those matters reserved to the shareholders. The Board acts as an advisor and counselor to senior management and oversees and monitors management’s performance. The Board also oversees the Company’s management of risk involved or potentially involved in the Company’s business.

Board Leadership Structure and Role in Risk Oversight

The Corporate Governance Standards for our Board of Directors provide that the Company’s Chief Executive Officer (“CEO”) cannot also serve as the Chairperson of the Board. At all times since the Company’s formation, the positions of CEO and Chairperson of the Board have been held by separate individuals. Our Board believes that the separation of these two positions is the most appropriate leadership structure for the Company at this time because it enables us to benefit from the expertise, experience, and strengths of both of the individuals holding those key leadership positions in the Company.