First Quarter Financial Results February 5, 2015 Pursuing Growth • Building Value a global diversified industrial company Exhibit 99.1

2015 Hillenbrand Hillenbrand Participants Q1 ‘15 Earnings Presentation | 2 Joe Raver – CEO Kristina Cerniglia – CFO Thomas Kehl – President – Coperion

2015 Hillenbrand Forward-Looking Statements and Factors That May Affect Future Results: Throughout this presentation, we make a number of “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. As the words imply, these are statements about future plans, objectives, beliefs, and expectations that might or might not happen in the future, as contrasted with historical information. Forward-looking statements are based on assumptions that we believe are reasonable, but by their very nature are subject to a wide range of risks. Accordingly, in this presentation, we may say something like, “We expect that future revenue associated with the Process Equipment Group will be influenced by order backlog.” That is a forward-looking statement, as indicated by the word “expect” and by the clear meaning of the sentence. Other words that could indicate we are making forward-looking statements include: This is not an exhaustive list, but is intended to give you an idea of how we try to identify forward-looking statements. The absence of any of these words, however, does not mean that the statement is not forward-looking. Here is the key point: Forward-looking statements are not guarantees of future performance, and our actual results could differ materially from those set forth in any forward-looking statements. Any number of factors, many of which are beyond our control, could cause our performance to differ significantly from what is described in the forward-looking statements. For a discussion of factors that could cause actual results to differ from those contained in forward-looking statements, see the discussions under the heading “Risk Factors” in Item 1A of Part I our Form 10-Q for the period ended December 31, 2014, located on our website and filed with the SEC. We assume no obligation to update or revise any forward-looking statements. Disclosure regarding forward-looking statements Q1 ‘15 Earnings Presentation | 3

2015 Hillenbrand Hillenbrand’s strategy is focused on three key areas Q1 ‘15 Earnings Presentation | 4 Develop Hillenbrand into a world-class global diversified industrial company Leverage our strong financial foundation and the Hillenbrand Business System to deliver sustainable profit growth, revenue expansion, and free cash flow Reinvest this cash in new growth initiatives, both organic and inorganic, that create shareholder value

2015 Hillenbrand Q1 Highlights Q1 ‘15 Earnings Presentation | 5 Q1 2015 Consolidated Highlights – Revenue increased 4% to $401.5 million, or 8% on a constant currency basis, driven by the Process Equipment Group – Adjusted EPS* grew 44% to $0.49 per diluted share PEG Q1 2015 Highlights – Revenue increased $14 million to $256 million, +6%, or +12% on a constant currency basis, versus the prior year – Adjusted EBITDA* margin grew 390 bps compared to prior year Batesville Q1 2015 Highlights – Revenue increased 2% to $145 million driven by an increase in volume, offset by a lower average selling price – Adjusted Gross Margin* was 38.1%, down 110 bps, driven by lower average selling price *See appendix for reconciliation

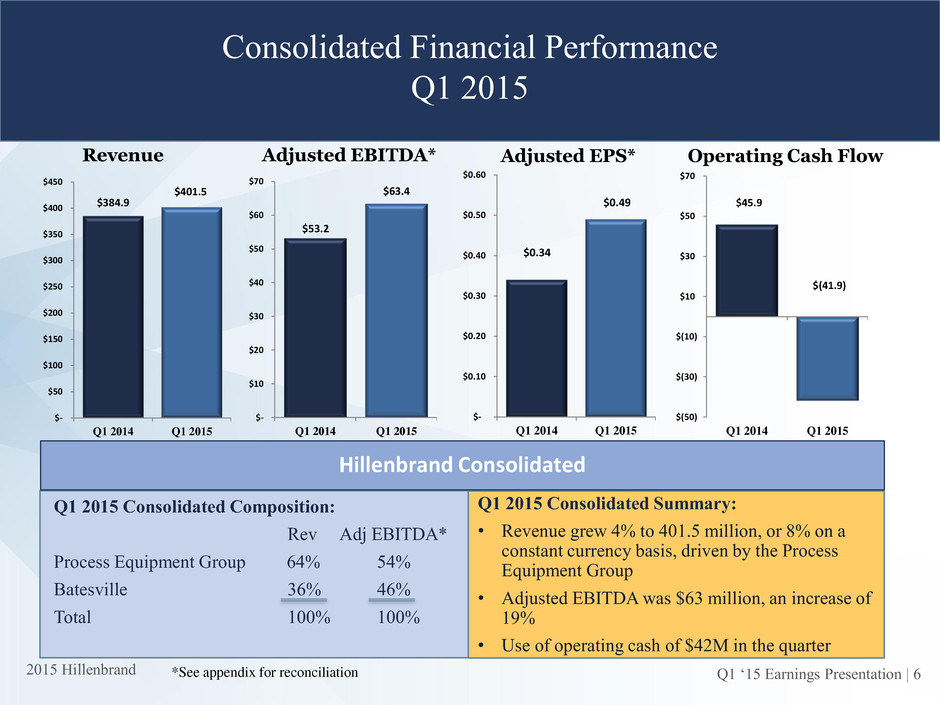

2015 Hillenbrand Consolidated Financial Performance Q1 2015 Adjusted EPS* Q1 2015 Consolidated Summary: • Revenue grew 4% to 401.5 million, or 8% on a constant currency basis, driven by the Process Equipment Group • Adjusted EBITDA was $63 million, an increase of 19% • Use of operating cash of $42M in the quarter Hillenbrand Consolidated Operating Cash Flow Q1 ‘15 Earnings Presentation | 6 Adjusted EBITDA* Revenue *See appendix for reconciliation Q1 2015 Consolidated Composition: Rev Adj EBITDA* Process Equipment Group 64% 54% Batesville 36% 46% Total 100% 100% $384.9 $401.5 $- $50 $100 $150 $200 $250 $300 $350 $400 $450 Q1 2014 Q1 2015 $53.2 $63.4 $- $10 $20 $30 $40 $50 $60 $70 Q1 2014 Q1 2015 $45.9 $(41.9) $(50) $(30) $(10) $10 $30 $50 $70 Q1 2014 Q1 2015 $0.34 $0.49 $- $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 Q1 2014 Q1 2015

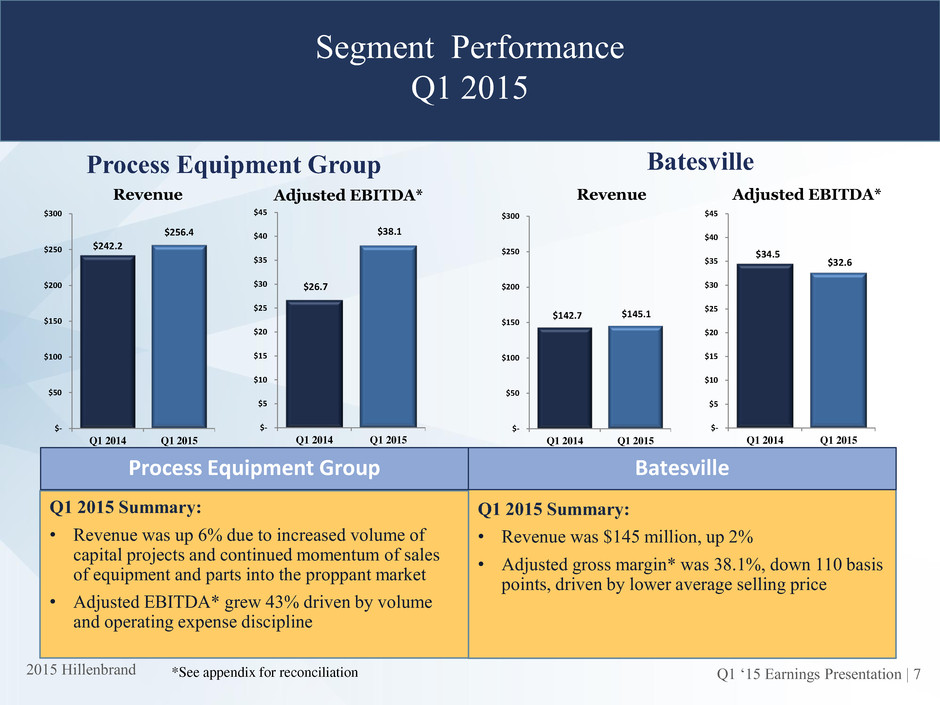

2015 Hillenbrand Q1 ‘15 Earnings Presentation | 7 Segment Performance Q1 2015 Process Equipment Group Batesville Revenue Adjusted EBITDA* Revenue Adjusted EBITDA* Q1 2015 Summary: • Revenue was $145 million, up 2% • Adjusted gross margin* was 38.1%, down 110 basis points, driven by lower average selling price Q1 2015 Summary: • Revenue was up 6% due to increased volume of capital projects and continued momentum of sales of equipment and parts into the proppant market • Adjusted EBITDA* grew 43% driven by volume and operating expense discipline Process Equipment Group Batesville *See appendix for reconciliation $242.2 $256.4 $- $50 $100 $150 $200 $250 $300 Q1 2014 Q1 2015 $26.7 $38.1 $- $5 $10 $15 $20 $25 $30 $35 $40 $45 Q1 2014 Q1 2015 $142.7 $145.1 $- $50 $100 $150 $200 $250 $300 Q1 2014 Q1 2015 $34.5 $32.6 $- $5 $10 $15 $20 $25 $30 $35 $40 $45 Q1 2014 Q1 2015

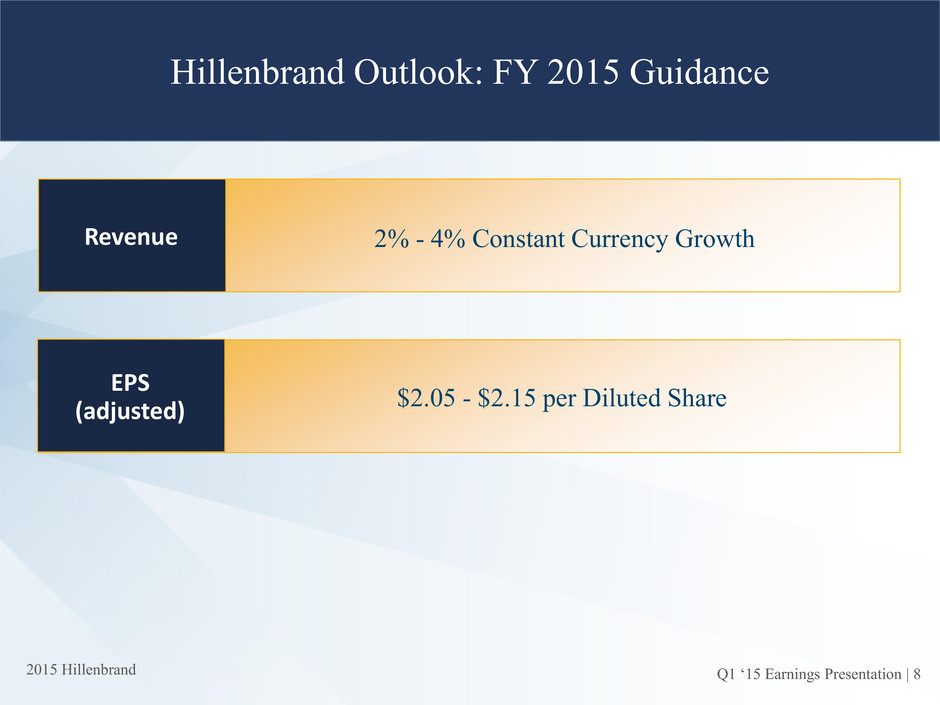

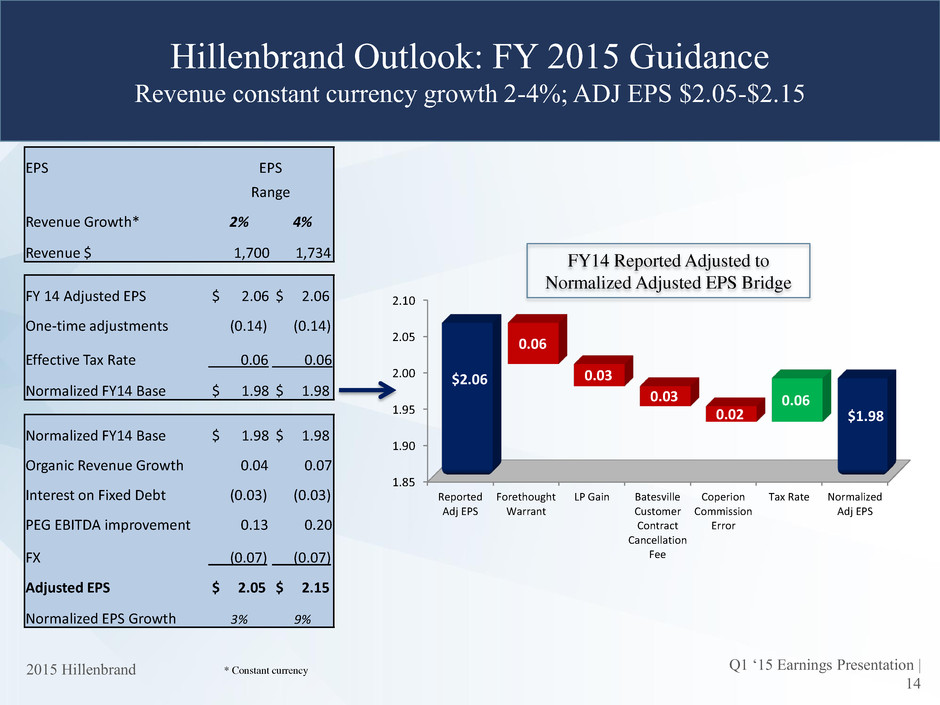

2015 Hillenbrand Hillenbrand Outlook: FY 2015 Guidance 2% - 4% Constant Currency Growth Revenue Q1 ‘15 Earnings Presentation | 8 $2.05 - $2.15 per Diluted Share EPS (adjusted)

Q&A Q1 ‘15 Earnings Presentation | 9

2015 Hillenbrand Replay Information Q1 ‘15 Earnings Presentation | 10 Dial In: (855) 859-2056 International: +1 (404) 537-3406 Conference ID: 60438544 Encore Replay Dates: 2/05/2015 - 2/19/2015 Log on to: http://ir.hillenbrandinc.com/investor-relations

2015 Hillenbrand Appendix Q1 ‘15 Earnings Presentation | 11

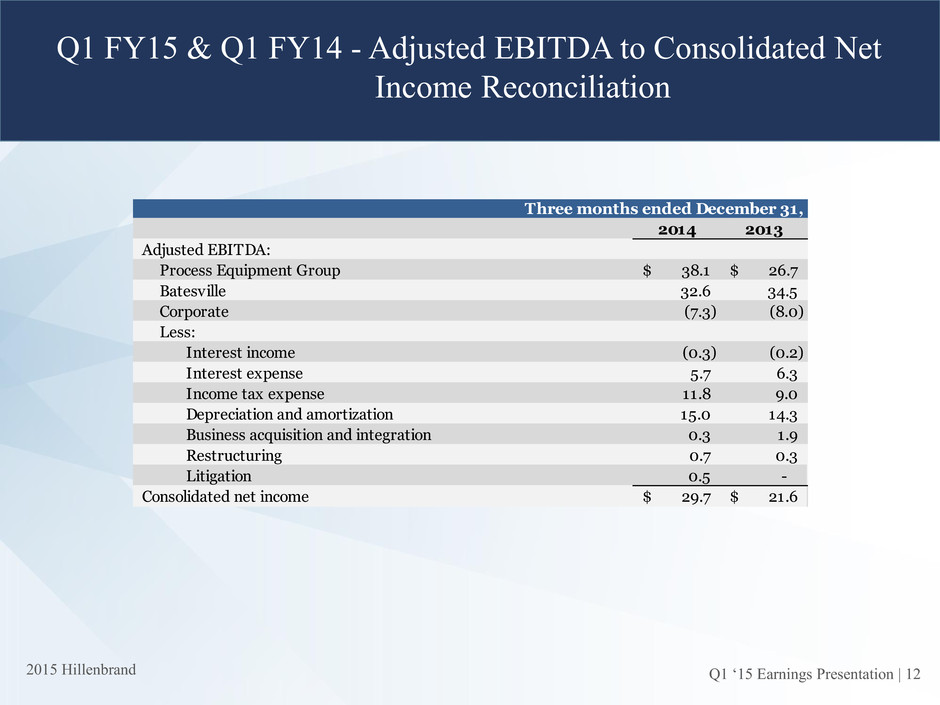

2015 Hillenbrand Q1 ‘15 Earnings Presentation | 12 Q1 FY15 & Q1 FY14 - Adjusted EBITDA to Consolidated Net Income Reconciliation 2014 2013 Adjusted EBITDA: Process Equipment Group 38.1$ 26.7$ Batesville 32.6 34.5 Corporate (7.3) (8.0) Less: Interest income (0.3) (0.2) Interest expense 5.7 6.3 Income tax expense 11.8 9.0 Depreciation and amortization 15.0 14.3 Business acquisition and integration 0.3 1.9 Restructuring 0.7 0.3 Litigation 0.5 - Consolidated net income 29.7$ 21.6$ Three months ended December 31,

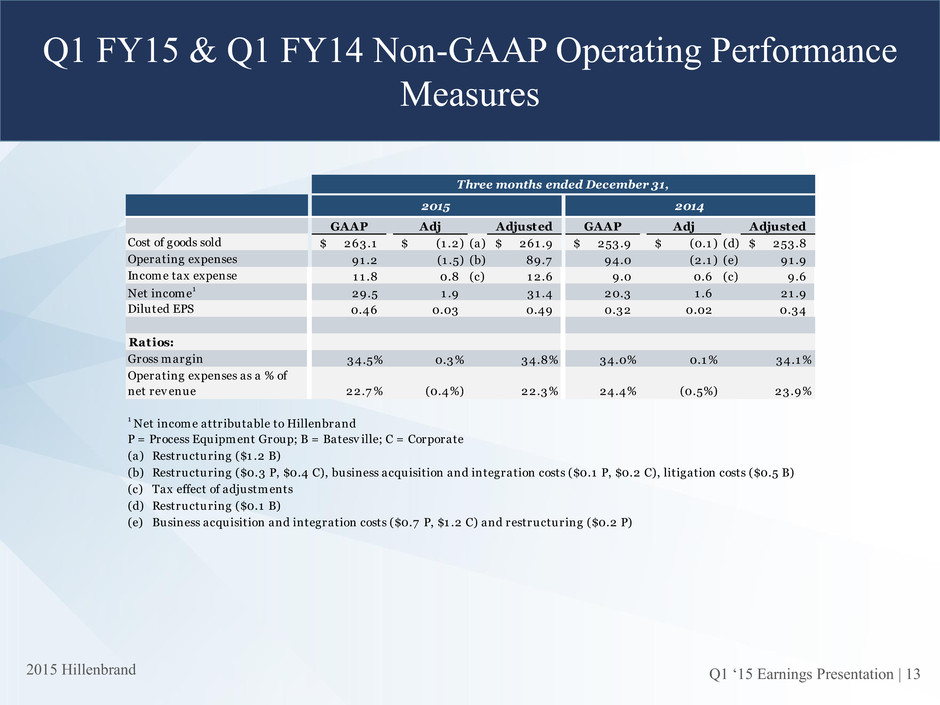

2015 Hillenbrand Q1 FY15 & Q1 FY14 Non-GAAP Operating Performance Measures Q1 ‘15 Earnings Presentation | 13 GAAP Adj Adjusted GAAP Adj Adjusted Cost of goods sold 263.1$ (1 .2)$ (a) 261 .9$ 253.9$ (0.1 )$ (d) 253.8$ Operating expenses 91 .2 (1 .5) (b) 89.7 94.0 (2.1 ) (e) 91 .9 Income tax expense 1 1 .8 0.8 (c) 1 2.6 9.0 0.6 (c) 9.6 Net income1 29.5 1 .9 31 .4 20.3 1 .6 21 .9 Diluted EPS 0.46 0.03 0.49 0.32 0.02 0.34 Ratios: Gross margin 34.5% 0.3% 34.8% 34.0% 0.1 % 34.1 % 22.7 % (0.4%) 22.3% 24.4% (0.5%) 23 .9% 1 Net income attributable to Hillenbrand P = Process Equipment Group; B = Batesv ille; C = Corporate (a) Restructuring ($1 .2 B) (b) Restructuring ($0.3 P, $0.4 C), business acquisition and integration costs ($0.1 P, $0.2 C), litigation costs ($0.5 B) (c) Tax effect of adjustments (d) Restructuring ($0.1 B) (e) Business acquisition and integration costs ($0.7 P, $1 .2 C) and restructuring ($0.2 P) Three months ended December 31, 2014 Operating expenses as a % of net rev enue 2015

2015 Hillenbrand Hillenbrand Outlook: FY 2015 Guidance Revenue constant currency growth 2-4%; ADJ EPS $2.05-$2.15 Q1 ‘15 Earnings Presentation | 14 EPS EPS Range Revenue Growth* 2% 4% Revenue $ 1,700 1,734 FY 14 Adjusted EPS $ 2.06 $ 2.06 One-time adjustments (0.14) (0.14) Effective Tax Rate 0.06 0.06 Normalized FY14 Base $ 1.98 $ 1.98 Normalized FY14 Base $ 1.98 $ 1.98 Organic Revenue Growth 0.04 0.07 Interest on Fixed Debt (0.03) (0.03) PEG EBITDA improvement 0.13 0.20 FX (0.07) (0.07) Adjusted EPS $ 2.05 $ 2.15 Normalized EPS Growth 3% 9% 1.85 1.90 1.95 2.00 2.05 2.10 Reported Adj EPS Forethought Warrant LP Gain Batesville Customer Contract Cancellation Fee Coperion Commission Error Tax Rate Normalized Adj EPS $2.06 $1.98 0.06 0.03 0.03 0.02 0.06 FY14 Reported Adjusted to Normalized Adjusted EPS Bridge * Constant currency