Transaction

Overview

January

11,2010

2

Mark

Lanning

Vice President of Investor

Relations & Treasurer

Vice President of Investor

Relations & Treasurer

Hillenbrand,

Inc

Hillenbrand

Speaker

Certain

statements in this presentation contain forward-looking statements, within the

meaning of the Private Securities Litigation Reform Act of 1995, regarding

the

company’s future plans, objectives, beliefs, expectations, representations and projections. The company has tried, wherever possible, to identify these forward-looking

statements using words such as “intend,” “anticipate,” “believe,” “plan,” “encourage,” “expect,” “may,” “goal,” “become,” “pursue,” “estimate,” “strategy,” “will,”

“projection,” “forecast,” “continue,” “accelerate,” “promise,” “increase,” “higher,” “lower,” “reduce,” “improve,” “expand,” “progress,” “potential” or the negative of

those terms or other variations of them or by comparable terminology. The absence of such terms, however, does not mean that the statement is not forward-looking. It is

important to note that forward-looking statements are not guarantees of future performance, and the company's actual results could differ materially from those set forth in

any forward-looking statements. Factors that could cause actual results to differ from forward-looking statements include but are not limited to: the company’s ongoing

antitrust litigation; the company’s dependence on its relationships with several large national providers; continued fluctuations in mortality rates and increased cremations;

ongoing involvement in claims, lawsuits and governmental proceedings related to operations; failure of the company’s announced strategic initiatives to achieve expected

growth, efficiencies or cost reductions; disruptions in the company’s business or other adverse consequences resulting from the separation of Hillenbrand Industries into

two operating companies; failure of the company to execute its acquisition and business alliance strategy through the consummation and successful integration of

acquisitions (such as the acquisition of K-Tron International, Inc.) or entry into joint ventures or other business alliances; competition from nontraditional sources in the

funeral services business; volatility of the company’s investment portfolio; increased costs or unavailability of raw materials; labor disruptions; the ability to retain

executive officers and other key personnel; and certain tax-related matters. For a more in-depth discussion of these and other factors that could cause actual results to

differ from those contained in forward-looking statements, see the discussions under the heading “Risk Factors” in Item 1 of the company’s Annual Report on Form 10-K

for the year ended September 30, 2009, filed November 24, 2009. The company assumes no obligation to update or revise any forward-looking information.

company’s future plans, objectives, beliefs, expectations, representations and projections. The company has tried, wherever possible, to identify these forward-looking

statements using words such as “intend,” “anticipate,” “believe,” “plan,” “encourage,” “expect,” “may,” “goal,” “become,” “pursue,” “estimate,” “strategy,” “will,”

“projection,” “forecast,” “continue,” “accelerate,” “promise,” “increase,” “higher,” “lower,” “reduce,” “improve,” “expand,” “progress,” “potential” or the negative of

those terms or other variations of them or by comparable terminology. The absence of such terms, however, does not mean that the statement is not forward-looking. It is

important to note that forward-looking statements are not guarantees of future performance, and the company's actual results could differ materially from those set forth in

any forward-looking statements. Factors that could cause actual results to differ from forward-looking statements include but are not limited to: the company’s ongoing

antitrust litigation; the company’s dependence on its relationships with several large national providers; continued fluctuations in mortality rates and increased cremations;

ongoing involvement in claims, lawsuits and governmental proceedings related to operations; failure of the company’s announced strategic initiatives to achieve expected

growth, efficiencies or cost reductions; disruptions in the company’s business or other adverse consequences resulting from the separation of Hillenbrand Industries into

two operating companies; failure of the company to execute its acquisition and business alliance strategy through the consummation and successful integration of

acquisitions (such as the acquisition of K-Tron International, Inc.) or entry into joint ventures or other business alliances; competition from nontraditional sources in the

funeral services business; volatility of the company’s investment portfolio; increased costs or unavailability of raw materials; labor disruptions; the ability to retain

executive officers and other key personnel; and certain tax-related matters. For a more in-depth discussion of these and other factors that could cause actual results to

differ from those contained in forward-looking statements, see the discussions under the heading “Risk Factors” in Item 1 of the company’s Annual Report on Form 10-K

for the year ended September 30, 2009, filed November 24, 2009. The company assumes no obligation to update or revise any forward-looking information.

Additional

Information and Where to Find It

This

investor presentation may be deemed to be solicitation material in respect of

the proposed acquisition of K-Tron International, Inc. (“K-Tron”) by

Hillenbrand, Inc.

(“Hillenbrand”). In connection with the proposed acquisition, K-Tron plans to file a proxy statement with the SEC. INVESTORS AND SECURITY HOLDERS OF K-

TRON ARE ADVISED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY

BECOME AVAILABLE BECAUSE THOSE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED ACQUISITION.

The final proxy statement will be mailed to shareholders of K-Tron. Investors and security holders may obtain a free copy of the proxy statement when it

becomes available, and other documents filed by K-Tron with the SEC, at the SEC’s web site at http://www.sec.gov. Free copies of the proxy statement, when it

becomes available, and K-Tron’s other filings with the SEC may also be obtained from K-Tron by directing a request to K-Tron International, Inc., Attention:

Investor Relations, Route 55 and 553, P.O. Box 888, Pitman, N.J. 08071, or by calling 856-589-0500.

(“Hillenbrand”). In connection with the proposed acquisition, K-Tron plans to file a proxy statement with the SEC. INVESTORS AND SECURITY HOLDERS OF K-

TRON ARE ADVISED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY

BECOME AVAILABLE BECAUSE THOSE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED ACQUISITION.

The final proxy statement will be mailed to shareholders of K-Tron. Investors and security holders may obtain a free copy of the proxy statement when it

becomes available, and other documents filed by K-Tron with the SEC, at the SEC’s web site at http://www.sec.gov. Free copies of the proxy statement, when it

becomes available, and K-Tron’s other filings with the SEC may also be obtained from K-Tron by directing a request to K-Tron International, Inc., Attention:

Investor Relations, Route 55 and 553, P.O. Box 888, Pitman, N.J. 08071, or by calling 856-589-0500.

Hillenbrand,

K-Tron and their respective directors, executive officers and other members of

their management and employees may be deemed to be soliciting proxies

from K-Tron shareholders in favor of the proposed acquisition. Information regarding Hillenbrand’s directors and executive officers is available in its 2009 Annual

Report on Form 10-K filed with the SEC on November 24, 2009, and definitive proxy statement relating to its 2010 Annual Meeting of Shareholders filed with the SEC

on January 5, 2010. Information regarding K-Tron’s directors and executive officers is available in its 2008 Annual Report on Form 10-K filed with the SEC on March

13, 2009, and definitive proxy statement relating to its 2009 Annual Meeting of Shareholders filed with the SEC on April 6, 2009. Additional information regarding the

interests of such potential participants will be included in the proxy statement and the other relevant documents filed with the SEC when they become available.

from K-Tron shareholders in favor of the proposed acquisition. Information regarding Hillenbrand’s directors and executive officers is available in its 2009 Annual

Report on Form 10-K filed with the SEC on November 24, 2009, and definitive proxy statement relating to its 2010 Annual Meeting of Shareholders filed with the SEC

on January 5, 2010. Information regarding K-Tron’s directors and executive officers is available in its 2008 Annual Report on Form 10-K filed with the SEC on March

13, 2009, and definitive proxy statement relating to its 2009 Annual Meeting of Shareholders filed with the SEC on April 6, 2009. Additional information regarding the

interests of such potential participants will be included in the proxy statement and the other relevant documents filed with the SEC when they become available.

Forward-looking

Statements

3

4

Ken

Camp

President &

President &

Chief

Executive Officer

Hillenbrand,

Inc

Hillenbrand

Speaker

It’s

the Right Acquisition

• $435MM cash

purchase ($390MM net purchase price) provides approximately $200MM

of revenue

of revenue

• Preserves

Hillenbrand’s high quality of earnings and cash flows while improving

growth

potential

potential

• EBITDA

multiple of 10.3x EBITDA is in line with recent market comparables

• We expect

the transaction to be immediately accretive to EPS and cash flow,

excluding

acquisition costs, transition costs, and non-recurring purchase accounting adjustments

acquisition costs, transition costs, and non-recurring purchase accounting adjustments

• Attractive

product, industry and customer diversification

• Creates

sizable new global platforms in two attractive sectors

• Ideal fit

with Hillenbrand’s stringent acquisition criteria

• K-Tron

International has limited lean experience. Meaningful improvement opportunities

exist

through the application of lean business practices

through the application of lean business practices

• Strong

cultural fit with proven management

• Adds

leading brands and market positions with two new platforms

• A proven

high margin, high growth business

Operational

and

Cultural

Financial

Strategic

5

6

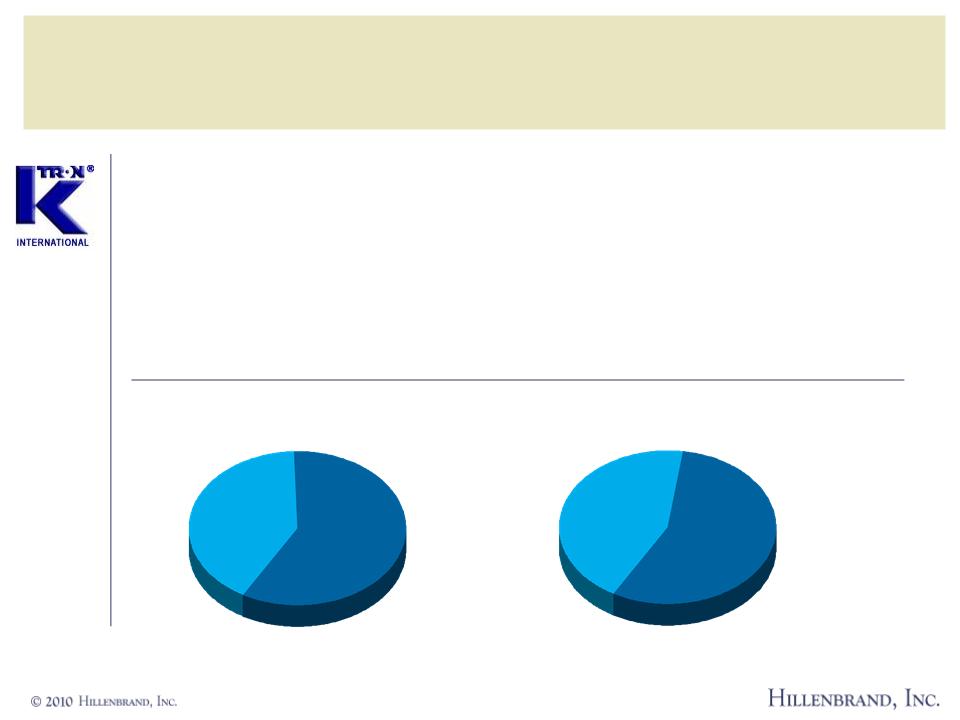

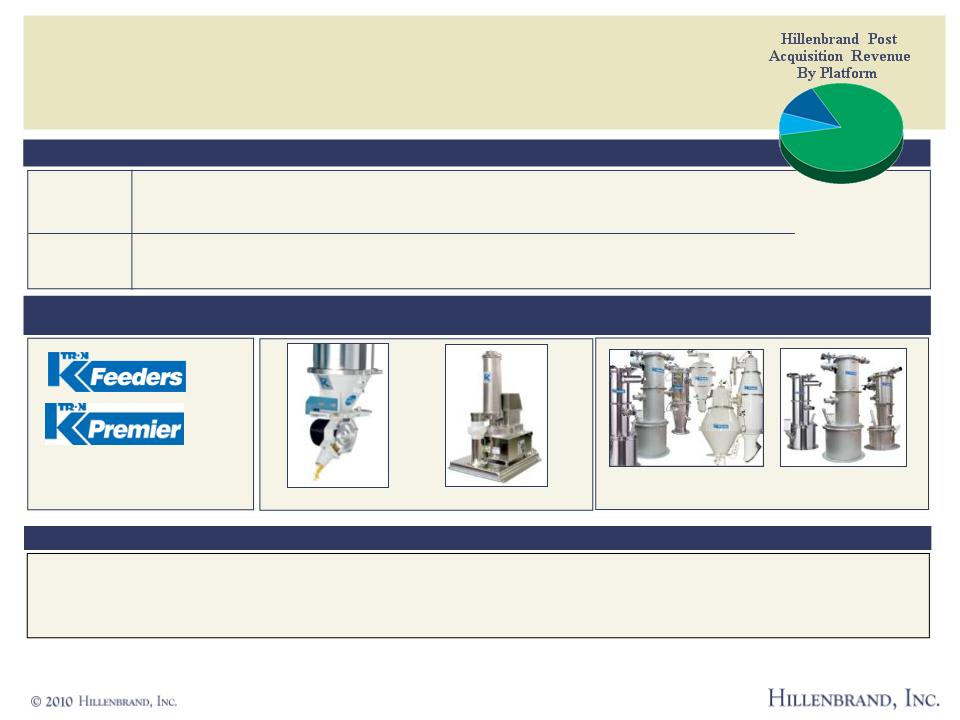

K-Tron

International’s

Corporate Profile Is Very Attractive

to Hillenbrand

to Hillenbrand

• 2008

Revenues and EBITDA of $243 MM and $44.6 MM

• 21% Total

revenue CAGR over last 5 years;

• 10%

Organic revenue CAGR over last 5 years

• Two

attractive segments within bulk solids material handling equipment

sector

• Leading,

respected brands

• Serves

diverse base of global customers through wholly-owned subsidiaries and

independent representatives

• Highly

productive operation with more than 650 employees

• Operates 7

manufacturing facilities: 5 in the U.S. and 1 each in Switzerland and

China

• Numerous

meaningful opportunities have been identified to grow as economy

recovers

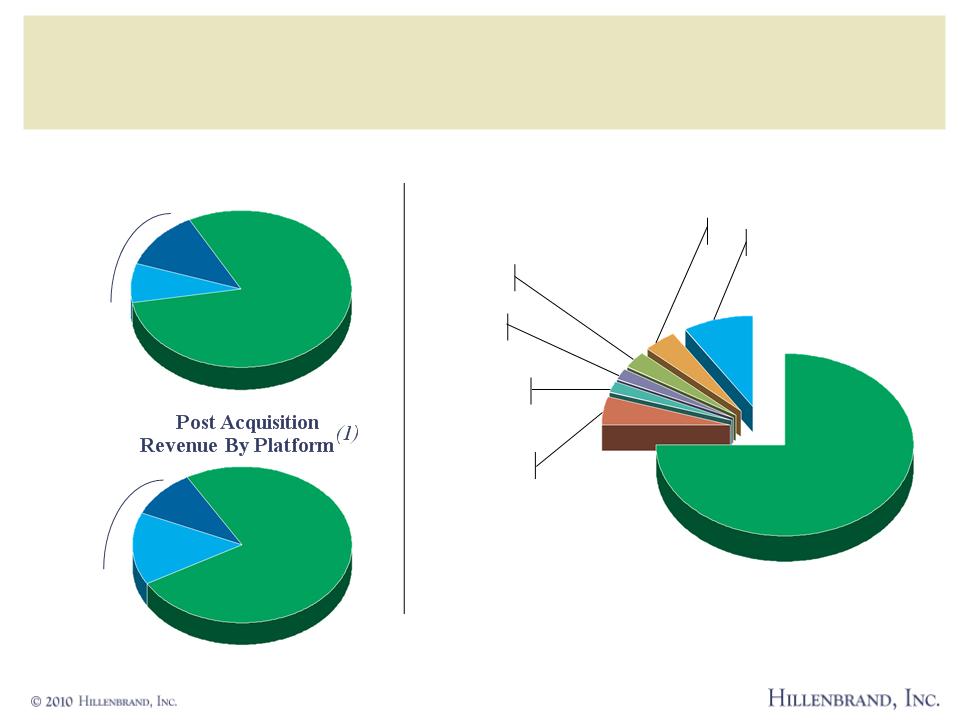

Estimated

Revenue by Business Line (1)

Estimated

EBITDA by Business Line (1)

(1) For FY

2008

Size

Reduction

Group

Reduction

Group

Process

Group

Group

Size

Reduction

Group

Reduction

Group

Process

Group

Group

7

New

Platform: K-Tron Process Group Is a Leader

in Feeding and Conveying With a Clear Growth

Path

in Feeding and Conveying With a Clear Growth

Path

Feeders

Provide

accurate feeding of “hard-to-handle” materials in a wide variety of

manufacturing

processes, enabling customers in key end markets to produce high quality products and

optimize raw material usage

processes, enabling customers in key end markets to produce high quality products and

optimize raw material usage

Conveyers

Product Summary

Brand Names

(1) Higher

sensitivity to economic cycles.

Convey

bulk solids with positive or negative pressure through mass-customized

pneumatic

conveying equipment and systems

conveying equipment and systems

Growth Strategy

• Differentiated

by material flow expertise (multiple types)

• Leading

brand position in each category

• Expanding

back into value chain: same sales, engineering & service channels, and same

customers

Feeders

Conveyers

Gravimetric

Feeders

Twin Screw

Micro-Ingredient Feeder

Pneumatic

Conveying Components

Sanitary

Pneumatic Conveying Systems

for Food

and Pharmaceutical

8

New

Platform: K-Tron Size Reduction Group Is a

Brand Leader Supported by its High Margin,

Recurring Consumable Parts Business

Brand Leader Supported by its High Margin,

Recurring Consumable Parts Business

Size

Reduction

Coal

Processing:

Hammermills, sizers, roll crushers

Wood/pulp

Processing/Biomass: Wood/bark

hogs, chip screens

Mining: Potash

and mineral mining crushers

Significant

recurring parts revenue

Product Summary

Brand Names

Growth Strategy

Leverage

installed base and brand equity (#1 or #2 brand presence)

Penn Crusher

& Reversible Hammermill

Jeffrey EZ

Access Word/Bark Hog

Gundlach Cage

Packer

Grundlach

Two-stage Four-roll Breaker

Duratip® Wood Hog

Jammers

Big Buster™

Hammer

Stant-Flow®

Grates

Buster®

Bar

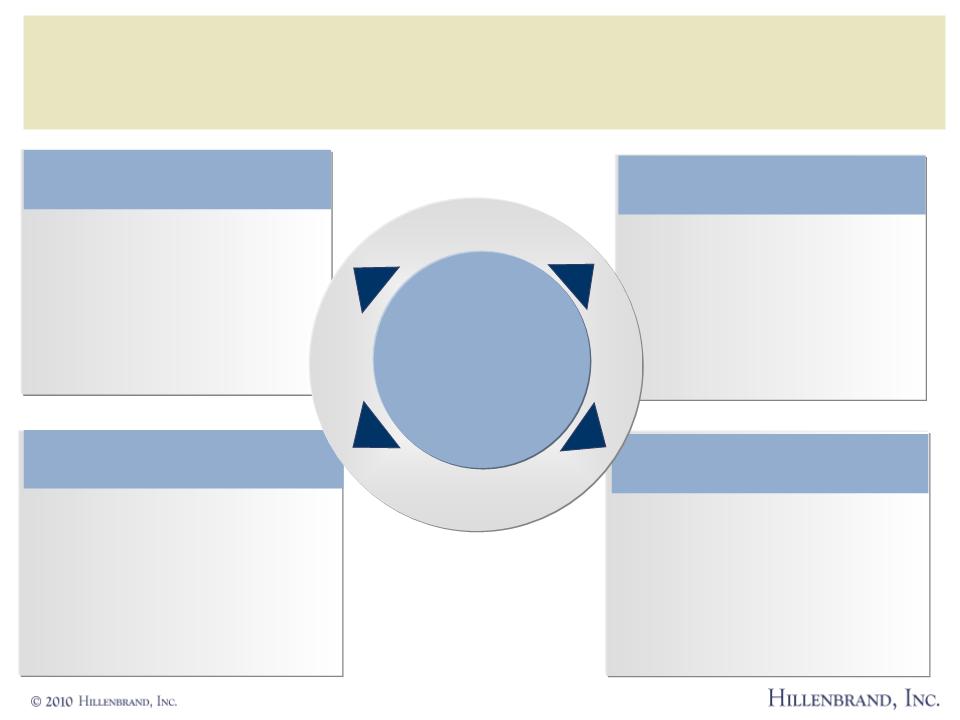

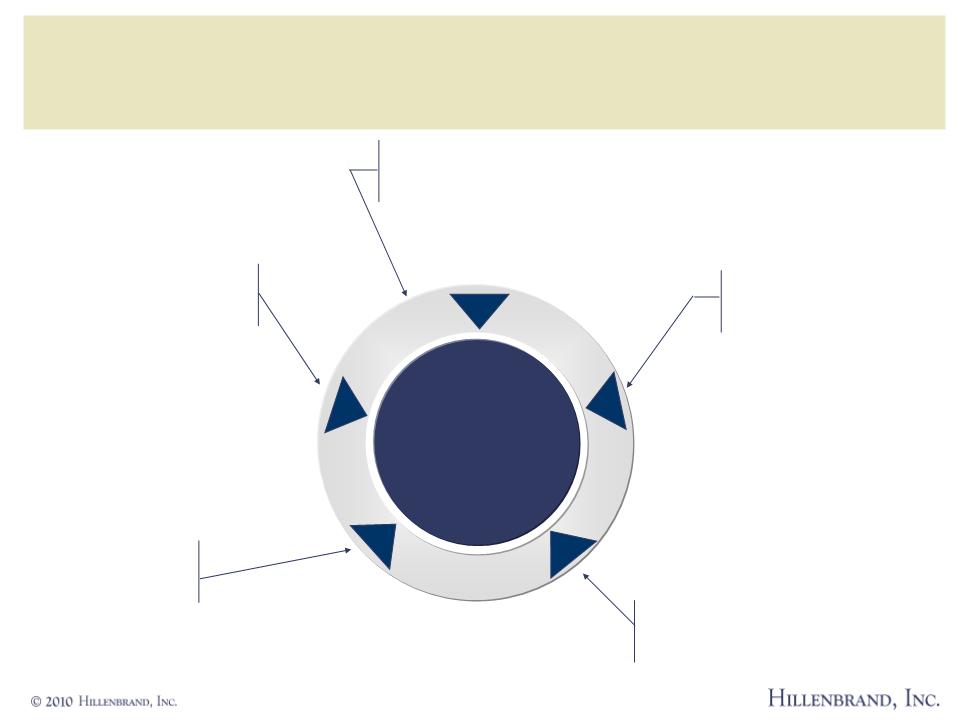

To

Maximize Value Creation, We Will Leverage Hillenbrand’s Core

Competencies Across New Platforms

Competencies Across New Platforms

9

Lean Business

(Capabilities nationally

recognized

beyond the death care industry)

beyond the death care industry)

Culture

of

Execution

Execution

Management Team

§ High

quality

§ Low-cost

§ Flexible

§ Safety-conscious

§ Innovative

§ Profitability

improvement

§ Highly

effective merchandising

§ History

of successful acquisition

integration

integration

§ Manage

for strong cash flow

Supply Chain

Optimization

(Favorably benchmarked against FedEx

& UPS)

§ Efficient

§ Dependable

§ Fast

§ Optimizes

finished goods inventory

§ Deep

acquisition &

integration skills

integration skills

§ Robust

business development

& lean skills

& lean skills

New Platforms

Processes

&

People

People

§ Strategic

planning

§ People

development

§ Policy

deployment

10

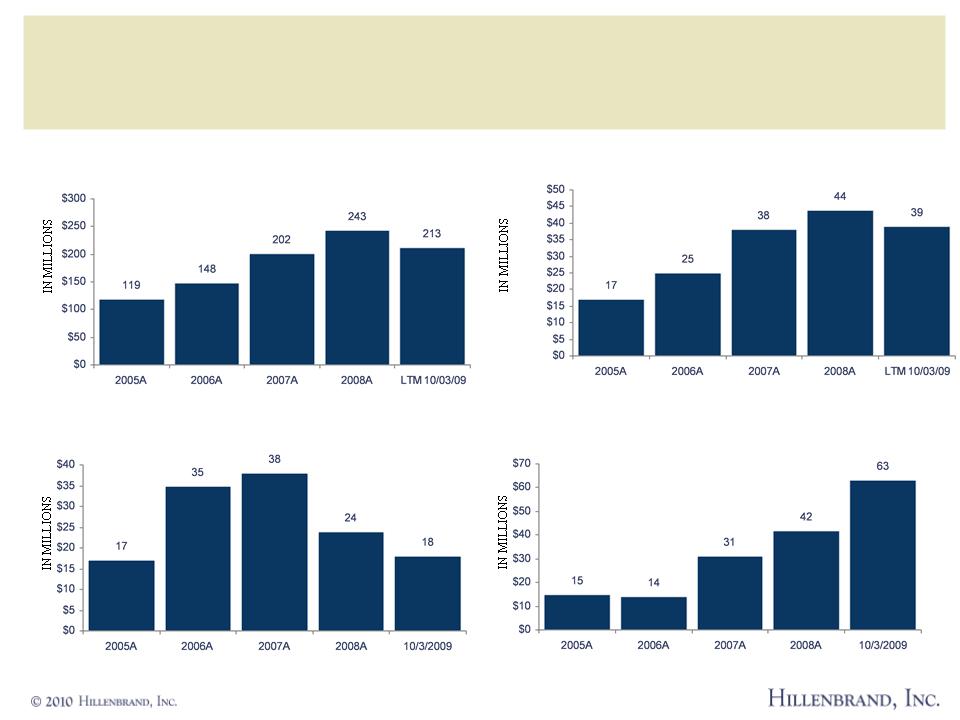

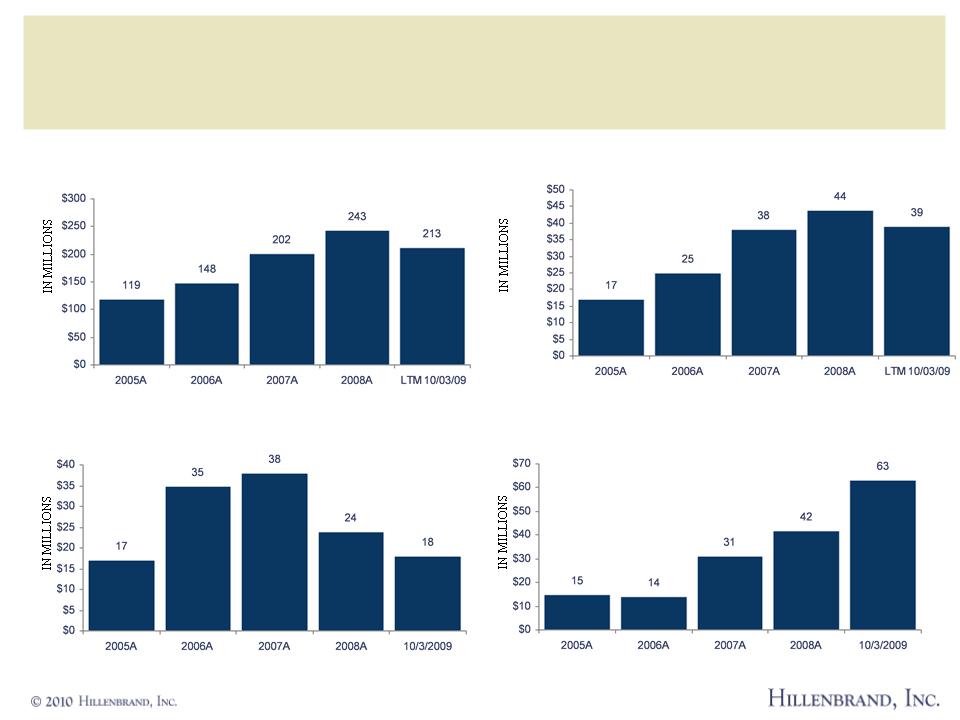

K-Tron

International Historical Results Show Strong Growth

and Cash Generation Capabilities

and Cash Generation Capabilities

Revenue

EBITDA

Total

Debt

Cash

11

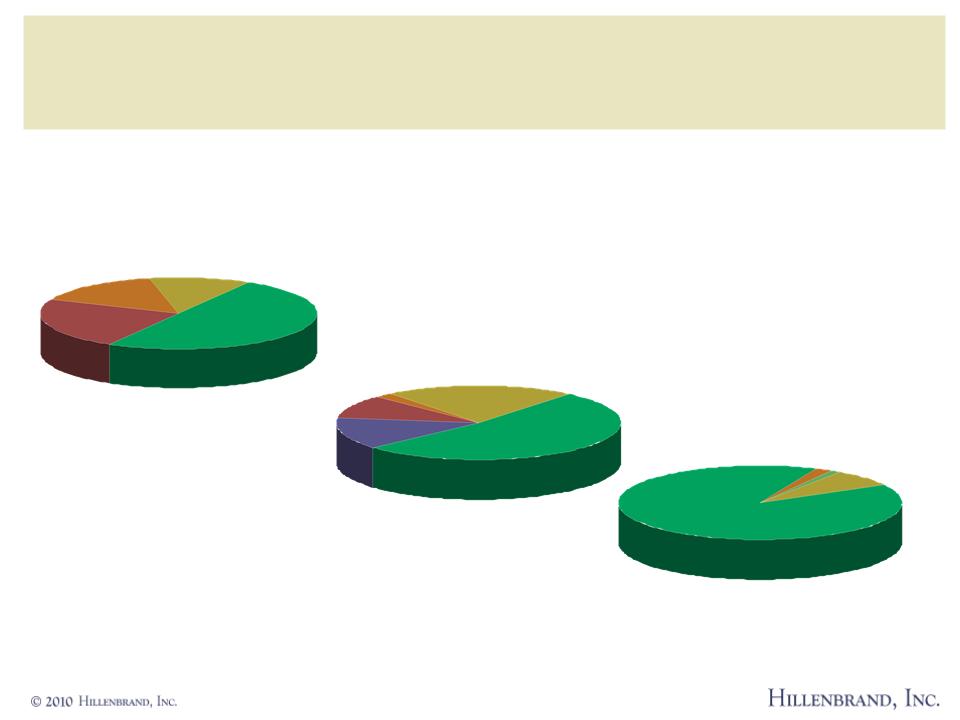

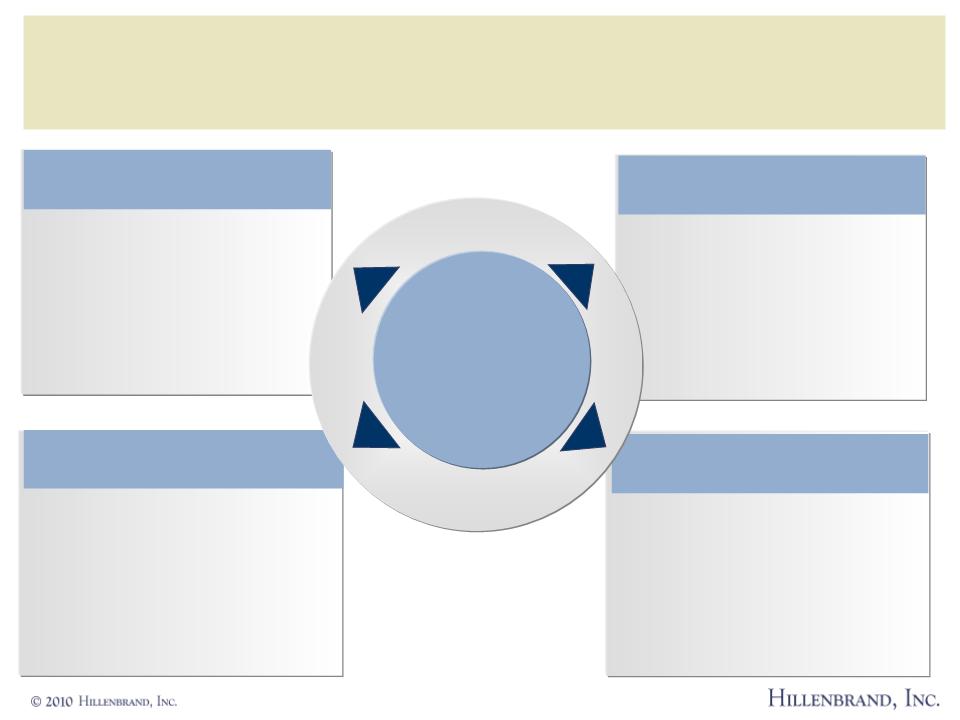

Creates

Multiple Pathways to Strong Revenue Growth

Through New Platforms

Through New Platforms

• Proven history of modest

acquisitions

($10-$30MM)

• Opportunities for bolt-on

acquisitions in both

platforms

platforms

• Size Reduction Group well

positioned to

capture Biomass Energy growth

capture Biomass Energy growth

• Pharmaceutical Industry

trending from

batch

to continuous process

• Expand Pneumatics into

Europe, Asia and the

Middle East

Middle East

• Swiss facility offers

competitive advantage to

serve high growth Eastern Europe markets

serve high growth Eastern Europe markets

• China & India for coal

mining

• Aggressively grow Wuxi

K-Tron Colormax

division in China

division in China

• Enhance Sales &

Marketing efforts for Penn

Crusher in China

Crusher in China

• Strong growth in demand

from mineral mining

sector

sector

Complementary Acquisitions

Attractive New End Markets

New Platform

Key

Growth Drivers

New Geographics

Growth Within Existing Regions

12

K-Tron

International Has a Proven Senior Management Team

30+ Year Industry

Veteran

Ground-up Knowledge of Coal

Industry

Long-standing Industry

Executive

Donald W.

Melchiorre

SVP Size Reduction

Group

30+ Yrs with the

Company

Well Regarded Sales & Marketing

Expertise

Extensive Knowledge of each K-Tron

Divisions

Kevin C. Bowen

SVP Process

Group

Point Person on Each Acquisition

Since 2003

Extensive Global

Experience

Regarded as a Strategy

Enabler

Lukas Guenthardt

SVP Corporate

Development

Corporate Finance and Private Equity

Background

Former Siemens Executive and 11

years at Ernst & Young

Newest Management Team Member

(2008)

Robert E.

Wisniewski

SVP & CFO

Turnaround and Acquisition

Expertise

Diverse Industry

Knowledge

Strong Legal / M&A

Background

Edward B.

Cloues,II

Chairman &

CEO

13

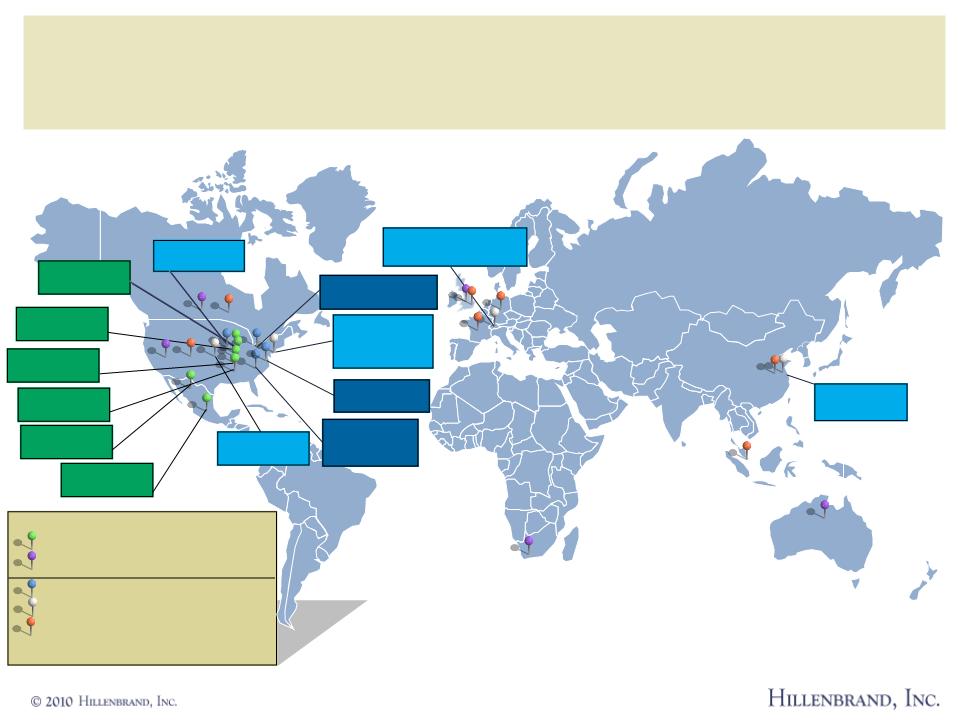

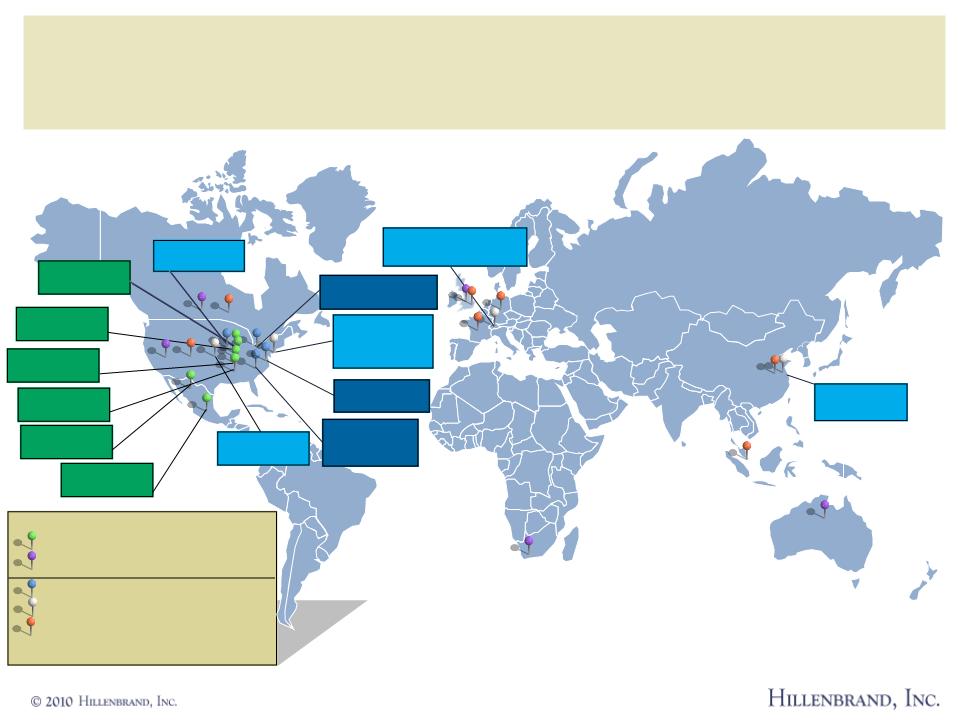

Provides

Hillenbrand With a Global Business Platform

Belleville, IL

54,000 sq. ft.

Wuxi, China

30,000 sq. ft.

K-Tron HQ

Pitman, NJ

92,000 sq. ft.

Cuyahoga Falls,

OH

70,000 sq. ft.

Woodruff, SC

149,000 sq. ft.

Niederlenz,

Switzerland

Switzerland

65,000 sq. ft.

Batesville, IN

494,000 sq. ft.

Salina, KS

134,000 sq. ft.

Manchester, TN

375,000 sq. ft.

Mexico City,

Mexico

58.700 sq. ft.

Chihauhau,

Mexico

125,000 sq. ft.

Batesville, MS

180,000 sq. ft.

Vicksburg, MS

142,000 sq. ft.

Process

Group and Size Reduction Group have

~175 sales reps. (mostly independent) in U.S.,

Canada, France, Germany, the United Kingdom,

Singapore and China.

~175 sales reps. (mostly independent) in U.S.,

Canada, France, Germany, the United Kingdom,

Singapore and China.

Size Reduction

Manufacturing

Process Group

Manufacturing

Batesville

Manufacturing

Post Acquisition

Locations

Batesville Warehouse Distribution,

Service or Sales

(165 sales reps in the U.S. and

Canada.)

Penn Crusher

HQ

14

Cindy

Lucchese

Senior Vice President &

Senior Vice President &

Chief

Financial Officer

Hillenbrand, Inc

Hillenbrand, Inc

Hillenbrand

Speaker

(1)

Excludes a $3.0 MM gain in 2009 on sale of 19.9% investment in Hasler

International. Including the gain, K-Tron’s LTM EPS would have been $7.81 and

the EBITDA would have been $42MM.

15

Contributes

to Hillenbrand’s

Ability to Deliver Predictable

Performance

Performance

• Strong

and consistent EBITDA margins during current severe economic

downturn

|

K-Tron

International Financial Highlights

|

|||||||

|

$ IN

MILLIONS, EXCEPT PER SHARE DATA

|

2004

|

2005

|

2006

|

2007

|

2008

|

LTM

10/03/09(1)

|

2004

- 2008

|

|

Total

Revenue

|

$113

|

$119

|

$148

|

$202

|

$243

|

$213

|

|

|

Gross

Profit

|

$46

|

$50

|

$62

|

$86

|

$101

|

$88

|

|

|

EBITDA

|

$14

|

$17

|

$25

|

$38

|

$44

|

$39

|

|

|

Diluted

EPS

|

$2.65

|

$2.85

|

$4.95

|

$7.93

|

$9.37

|

$6.79

|

|

|

Growth

(yr/yr)

|

|

|

|

|

|

|

CAGR

|

|

Revenue

|

18.8%

|

5.7%

|

24.6%

|

36.2%

|

20.5%

|

(9.9%)

|

21.2%

|

|

EBITDA

|

43.3%

|

23.0%

|

46.8%

|

49.4%

|

17.1%

|

(11.0%)

|

33.3%

|

|

As

a % of Revenue

|

|

|

|

|

|

|

Average

|

|

Gross

Profit

|

41.2%

|

42.1%

|

42.1%

|

42.7%

|

41.7%

|

41.3%

|

42.0%

|

|

EBITDA

|

12.4%

|

14.4%

|

16.9%

|

18.6%

|

18.1%

|

18.2%

|

16.1%

|

16

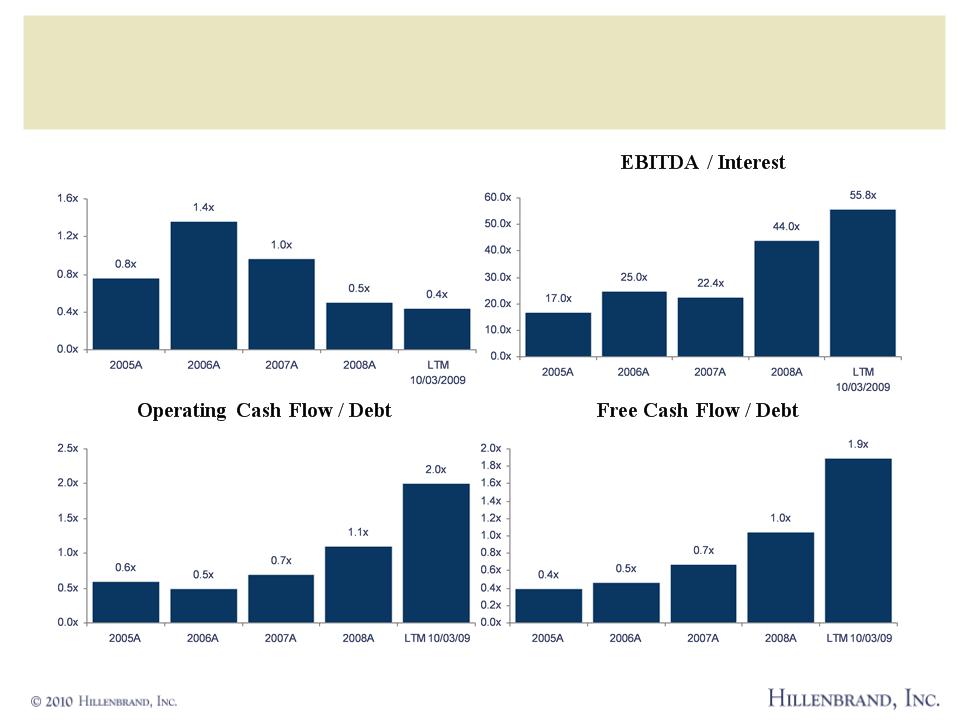

K-Tron

International - Cash Flow Summary

*Free cash

flow is defined as operating cash flow less capital expenditures

|

FISCAL

YEAR ENDING

|

|||||

|

|

|

|

|

|

LTM

10/03/09

ACTUAL

|

|

$ IN

MILLIONS

|

2005

ACTUAL

|

2006

ACTUAL |

2007

ACTUAL |

2008

ACTUAL |

|

|

Operating

Activities

|

|

|

|

|

|

|

Net

Income

|

$7

|

$13

|

$21

|

$26

|

$23

|

|

Depreciation

& Amortization

|

4

|

5

|

6

|

6

|

6

|

|

Change

in Working Capital

|

(1)

|

0

|

(1)

|

(7)

|

9

|

|

Other,

Net

|

1

|

1

|

1

|

2

|

(1)

|

|

Cash

Flow from Operating Activities

|

11

|

19

|

27

|

27

|

37

|

|

|

|

|

|

|

|

|

Capex

& Purchase of Intangibles

|

(2)

|

(3)

|

(2)

|

(4)

|

(3)

|

|

Other

Investing Activities

|

0

|

(33)

|

(17)

|

0

|

0

|

|

Debt

Transactions

|

(6)

|

16

|

3

|

(14)

|

(8)

|

|

Capital

Stock Increase

|

1

|

0

|

3

|

2

|

0

|

|

Other

|

(1)

|

0

|

3

|

0

|

3

|

|

Net

Change in Cash

|

$3

|

$(1)

|

$17

|

$11

|

$29

|

|

Free

Cash Flow*

|

$9

|

$16

|

$25

|

$23

|

$34

|

17

Transaction

Summary

Overview

Purchase

Price

Ownership

Closing

Conditions

Timing

Hillenbrand,

Inc. to acquire K-Tron International, Inc. (Nasdaq: KTII) for 100%

cash consideration

cash consideration

The net

purchase price associated with this transaction is approximately $390

million based on equity purchase price of $435 million and a net cash balance at

10/03/09 of approximately $45 million. This net purchase price implies a

multiple of 10.3x EBITDA

million based on equity purchase price of $435 million and a net cash balance at

10/03/09 of approximately $45 million. This net purchase price implies a

multiple of 10.3x EBITDA

Upon

completion of the transaction, Hillenbrand stockholders would own 100%

of the combined company

of the combined company

The

transaction is subject to approval by K-Tron International shareholders,

as

well as the satisfaction of customary closing conditions and regulatory approvals

well as the satisfaction of customary closing conditions and regulatory approvals

The

transaction is expected to close near the end of March

18

K-Tron

International Represents a Very Attractive Strategic

Opportunity

Opportunity

• Matches

Hillenbrand’s growth strategy

• Market

leader with preeminent brands

• Strong

platforms in growing industries/markets

• Proven

growth potential (organic and acquisition)

• Attractive

markets - large, diversified, fragmented, growing and global

• Reduces

risk and dependence on death care

• Proven

management team eager to continue

• Risks

are manageable

• Solid

financials

• Predictable,

strong cash flows and margins

• Strong

balance sheet with little debt

• Growing

revenues with stable gross profit margins

• Proven

high margin, high growth business

• We

believe this acquisition will provide a platform for creating

significant

shareholder value over the next several years

shareholder value over the next several years

Transaction

Overview

January

11,2010