UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ☒ | |

| Filed by a Party other than the Registrant ☐ | |

| Check the appropriate box: | |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| Hillenbrand, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): | |||

| ☒ | No fee required. | ||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| (1) | Title of each class of securities to which transaction applies: | ||

| (2) | Aggregate number of securities to which transaction applies: | ||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| (4) | Proposed maximum aggregate value of transaction: | ||

| (5) | Total fee paid: | ||

| ☐ | Fee paid previously with preliminary materials. | ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| (1) | Amount Previously Paid: | ||

| (2) | Form, Schedule or Registration Statement No.: | ||

| (3) | Filing Party: | ||

| (4) | Date Filed: | ||

|

(1)

|

to elect four members to the Board of Directors;

|

| (2) |

to approve, by a non-binding advisory vote, the compensation paid by the Company to its Named Executive Officers (“Say on Pay Vote”);

|

| (3) |

to approve the Company’s proposed Restated and Amended Articles of Incorporation to, among other things, provide shareholders the right to unilaterally amend the Company’s Amended and Restated Code of By-laws;

|

| (4) |

to ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal year 2020; and

|

| (5) |

to transact such other business as may properly come before the meeting and any postponement or adjournment of the meeting.

|

|

By Order of the Board of Directors,

|

|

|

|

|

Nicholas R. Farrell

|

|

|

Secretary

|

|

Page

|

|

|

Proxy Statement Summary

|

1

|

|

Questions and Answers About the Annual Meeting and Voting

|

6

|

|

PROPOSAL NO. 1 – Election of Directors

|

13

|

|

The Board of Directors and Committees

|

20

|

|

Security Ownership of Directors and Management

|

32

|

|

Security Ownership of Beneficial Owners of More Than 5 Percent of the Company’s Common Stock

|

35

|

|

Executive Compensation

|

36

|

|

Part I:

|

Compensation Discussion and Analysis

|

37

|

|

|

Part II:

|

Compensation Committee Report

|

70

|

|

|

Part III:

|

Executive Compensation Tables

|

71

|

|

|

Part IV:

|

Compensation Consultant Matters

|

85

|

|

|

Part V:

|

Compensation-Related Risk Assessment

|

87

|

|

|

Part VI:

|

CEO Pay Ratio

|

88

|

|

|

Part VII:

|

Anti-Hedging and Anti-Pledging

|

89

|

|

PROPOSAL NO. 2 – Advisory Vote to Approve Compensation of Named Executive Officers

|

90

|

|

Compensation of Directors

|

91

|

|

Equity Compensation Plan Information

|

94

|

|

PROPOSAL NO. 3 – Approval of the Company’s Proposed Restated and Amended Articles of Incorporation to, Among Other Things, Provide Shareholders the Right

to Unilaterally Amend the Company’s Amended and Restated Code of By-laws

|

95

|

|

Audit Committee Report

|

97

|

|

PROPOSAL NO. 4 – Ratification of Appointment of the Independent Registered Public Accounting Firm

|

99

|

|

Other Matters

|

101

|

|

Time and Date:

|

February 13, 2020 @ 10:00 a.m. EST

|

|

Location:

|

Hillenbrand headquarters

|

|

Record Date:

|

December 16, 2019

|

|

Admission:

|

Ticket attached to the proxy card (available to beneficial owners upon request as detailed in the proxy statement)

|

|

Proposal

|

Board’s Voting

Recommendation

|

Page

References

|

|

|

No. 1

|

Election of Directors

|

FOR

|

13

|

|

No. 2

|

Advisory Vote to Approve Compensation of Named Executive Officers, or “Say on Pay”

|

FOR

|

90

|

|

No. 3

|

Approval of the Company’s Proposed Restated and Amended Articles of Incorporation to, Among Other Things, Provide Shareholders the Right to Unilaterally Amend the Company’s Amended and Restated Code of By-laws

|

FOR

|

95

|

|

No. 4

|

Ratification of Appointment of the Independent Registered Public Accounting Firm

|

FOR

|

99

|

|

Here’s What We Do . . .

|

|

|

☑

|

Pay for performance

|

|

☑

|

Benchmark Named Executive Officer target core compensation to the 50th percentile of peer group compensation

|

|

☑

|

Maintain stock ownership guidelines: for directors, five times annual cash compensation; for the CEO, five times base salary; for Senior Vice Presidents, two times base salary; for certain other senior officers designated by the CEO, one

times base salary

|

|

☑

|

Ensure that at least 75 percent of the CEO’s target core compensation is at risk

|

|

☑

|

Require an independent Chairperson of the Board and at least 80 percent of directors to be independent

|

|

☑

|

Require that directors receive at least a majority of the votes cast in an uncontested election to be elected

|

|

☑

|

Require that the Compensation Committee be composed entirely of outside, independent directors

|

|

☑

|

Engage an independent compensation consultant, hired by and reporting directly to the Compensation Committee

|

|

☑

|

Operate with multiple performance metrics that drive our incentive compensation plans, including a relative metric that measures our performance against our compensation peer group

|

|

☑

|

Maintain a clawback policy covering cash and equity incentive compensation plans that applies in the event of a restatement of our financial statements

|

|

☑

|

Impose a limit of $400,000 on total annual base compensation for non-employee directors

|

|

☑

|

Encourage Board refreshment in a variety of ways, including by requiring our directors to retire no later than the first Annual Meeting of shareholders following the date on which a director turns 73 years of age

|

|

Here’s What We Don’t Do . . .

|

|

|

☒

|

Permit re-pricing, exchanging, or cashing out of “underwater” stock options without shareholder approval

|

| ☒ |

Permit spring-loading, back-dating, or similar practices that “time” the grant of our equity awards

|

|

☒

|

Permit granting of stock options below fair market value

|

|

☒

|

Permit “recycling” (into the equity plan pool) of Company shares that are (i) used to pay an award exercise price or withholding taxes, or (ii) repurchased on the open market with the proceeds of a stock option

exercise price

|

|

☒

|

Permit transferability of stock options for consideration

|

|

☒

|

Permit single-trigger change in control agreements for executives

|

|

☒

|

Permit change in control tax gross-ups for executives

|

|

☒

|

Permit a liberal change in control definition in our equity plan

|

|

☒

|

Permit short sales or hedging of Company securities by directors, officers, or other employees

|

|

☒

|

Permit directors, officers, or other employees to hold Company securities in margin accounts or otherwise to pledge Company securities as collateral for loans

|

|

☑

|

Updated our Audit Committee Charter to further detail the Committee’s role with respect to the Company’s Compliance program and updated our Nominating/Corporate Governance Committee Charter to reference our new Board diversity policy and

that Committee’s role in reviewing our sustainability efforts

|

|

☑

|

Completed our sustainability materiality assessment and began reviewing opportunities to further our commitment to corporate social responsibility and sustainability

|

|

☑

|

Became a signatory to the United Nations Global Compact

|

|

☑

|

Approved and recommended that the shareholders likewise approve the Company’s proposed Restated and Amended Articles of Incorporation to, among other things, provide shareholders the right to unilaterally amend the Company’s Amended and

Restated Code of By-laws

|

|

☑

|

Expanded our annual shareholder engagement program to garner insights on the proposed by-law amendment right for shareholders and on sustainability topics

|

|

☑

|

Adopted our Second Amended and Restated Short-Term Incentive Compensation Plan for Key Executives, including changes to reflect recent tax law developments

|

| Q: |

What is the purpose of this proxy statement?

|

| A: |

The Board of Directors of Hillenbrand (the “Board”) is soliciting your proxy to vote at the 2020 Annual Meeting of shareholders of Hillenbrand because you were a shareholder at the close of business on December 16, 2019, the record date

for the 2020 Annual Meeting, and are entitled to vote at the Annual Meeting. The record date for the 2020 Annual Meeting was established by the Board in accordance with our Amended and Restated Code of By-laws (the “By-laws”) and Indiana

law.

|

| Q: |

What is the difference between holding shares as a “shareholder of record” and as a “beneficial owner”?

|

| A: |

If your shares are registered directly in your name with Hillenbrand’s transfer agent, Computershare Investor Services, LLC, you are the “shareholder of record” with respect to those shares, and you tell us directly how your shares are

to be voted.

|

| Q: |

What am I being asked to vote on?

|

| A: | • | Election of four directors: Daniel C. Hillenbrand, Thomas H. Johnson, Neil S. Novich, and Joe A. Raver; |

| • |

Approval, by a non-binding advisory vote, of the compensation paid to the Company’s Named Executive Officers, as disclosed pursuant to SEC compensation disclosure rules in the “Compensation Discussion and Analysis” and “Executive

Compensation Tables” sections of this proxy statement and in any related material herein (the “Say on Pay Vote”);

|

| • |

Approval of the Company’s proposed Restated and Amended Articles of Incorporation to, among other things, provide shareholders the right (the “By-law Amendment Right”) to unilaterally amend the Company’s Amended and Restated Code of

By-laws; and

|

| • |

Ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal year 2020.

|

| Q: |

What are the voting requirements to elect the directors and to approve the other proposals being voted on?

|

| A: |

The Articles of Incorporation of Hillenbrand (as amended to date, the “Articles of Incorporation”) provide that in an uncontested election, the directors are elected by a majority of the votes cast at the Annual Meeting. This means that

to be elected, the number of votes cast “for” a director nominee must exceed the number of votes “withheld” from that nominee.

|

| Q: |

How many votes do I have?

|

| A: |

You are entitled to one vote for each share of Hillenbrand common stock that you held as of the record date.

|

| Q: |

How do I vote?

|

| A: |

The different ways that you (if you are a shareholder of record) or your nominee (if you are a beneficial owner) can vote your shares depend on how you received your proxy statement this year.

|

|

|

|

Proxy card or voting instruction card. Be sure to complete, sign, and date the card and return it in the prepaid envelope.

|

|

|

|

|

|

|

|

By telephone or the Internet. The telephone and Internet voting procedures established by Hillenbrand for shareholders of record are explained in detail on your proxy card and in the Notice many

shareholders receive. These procedures are designed to authenticate your identity, to allow you to give your voting instructions, and to confirm that these instructions have been properly recorded.

|

|

|

|

|

|

|

|

In person at the Annual Meeting. You may vote in person at the Annual Meeting. You may also be represented by another person at the meeting by executing a proper proxy designating that person.

If you are not the record holder of your shares and want to attend the meeting and vote in person, you must obtain a legal proxy from your broker, bank, or nominee and present it to the inspectors of election with your ballot when you vote

at the meeting.

|

| Q: |

I share an address with another shareholder and we received only one Notice of Internet Availability of Proxy Materials or one paper copy of the proxy materials, as applicable. How may I obtain an additional

copy?

|

| A: |

The Company has adopted a procedure approved by the SEC called “householding.” Under this procedure, the Company is delivering a single copy of either the Notice of Internet Availability of Proxy Materials or a paper copy of the proxy

materials, as applicable, to multiple shareholders who share the same address, unless the Company has received contrary instructions from one or more of the shareholders. This procedure reduces the

Company’s printing costs, mailing costs, and fees. Shareholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, a

separate copy of the Notice of Internet Availability of Proxy Materials or a paper copy of the proxy materials or the annual report, as applicable, will be promptly delivered to any shareholder at a shared address to which the Company

delivered a single copy. To receive a separate copy, or a separate copy of future materials, shareholders may write or call the Company’s Investor Relations Department at One Batesville Boulevard, Batesville, Indiana 47006, telephone (812)

931‑6000 and facsimile (812) 931-5209. Shareholders who hold shares in street name may contact their broker, bank, or other nominee to request information about householding.

|

| Q: |

How will my shares be voted?

|

| A: |

For shareholders of record, all shares represented by the proxies mailed to shareholders will be voted at the Annual Meeting in accordance with instructions given by the shareholders. Where proxies are returned without instructions, the

shares will be voted: (1) FOR the election of each of the four nominees named above as directors of the Company; (2) FOR the approval, by a non-binding

advisory vote, of the compensation paid to the Named Executive Officers pursuant to the Say on Pay Vote; (3) FOR approval of the Company’s proposed Restated and Amended Articles of Incorporation to,

among other things, provide shareholders the By-law Amendment Right; (4) FOR the ratification of the appointment of Ernst & Young LLP as the independent registered public accounting firm of the

Company for fiscal year 2020; and (5) in the discretion of the proxy holders upon such other business as may properly come before the Annual Meeting. Where a proxy is not returned, the shares will not be voted unless you attend the Annual

Meeting and vote in person.

|

| Q: |

What can I do if I change my mind after I vote my shares prior to the Annual Meeting?

|

| A: |

If you are a shareholder of record, you may revoke your proxy at any time before it is voted at the Annual Meeting by:

|

| • |

sending written notice of revocation to the Secretary of Hillenbrand at One Batesville Boulevard, Batesville, Indiana 47006;

|

| • |

submitting a revised proxy by telephone, Internet, or paper ballot after the date of the revoked proxy; or

|

| • |

attending the Annual Meeting and voting in person.

|

| Q: |

Who will count the votes?

|

| A: |

Representatives of Broadridge Investor Communication Solutions, Inc. (“Broadridge”) will tabulate the votes and act as inspectors of election.

|

| Q: |

What constitutes a quorum at the Annual Meeting?

|

| A: |

As of the record date, 74,712,387 shares of Hillenbrand common stock were outstanding. A majority of the outstanding shares must be present or represented by proxy at the Annual Meeting to constitute a quorum for the purpose of

conducting business at the Annual Meeting. Your shares will be considered part of the quorum if you submit a properly executed proxy or attend the Annual Meeting.

|

| Q: |

Who can attend the Annual Meeting in person?

|

| A: |

All shareholders as of the record date may attend the Annual Meeting in person but must have an admission ticket. If you are a shareholder of record, the ticket attached to the proxy card or a copy of your Notice (whichever you receive)

will admit you and one guest. If you are a beneficial owner, you may request a ticket by writing to the Secretary of Hillenbrand at One Batesville Boulevard, Batesville, Indiana 47006, or by faxing your request to (812) 931-5185 or

emailing it to investors@hillenbrand.com. You must provide evidence of your ownership of shares with your ticket request, which you can obtain from your broker, bank, or nominee. We encourage you

or your broker to fax or email your ticket request and proof of ownership as soon as possible to avoid any mail delays.

|

| Q: |

When are shareholder proposals due for the 2021 Annual Meeting?

|

| A: |

For a shareholder proposal to be presented at the Company’s 2021 Annual Meeting of shareholders and to be considered for possible inclusion in the Company’s proxy statement and form of proxy relating to that meeting, it must be submitted

to and received by the Secretary of Hillenbrand at its principal offices at One Batesville Boulevard, Batesville, Indiana 47006, not later than September 4, 2020. Our By-laws describe certain information required to be submitted with such

a proposal.

|

| Q: |

What happens if a nominee for director is unable to serve as a director?

|

| A: |

If any of the nominees becomes unavailable for election, which we do not expect to happen, votes will be cast for such substitute nominee or nominees as may be designated by the Board, unless the Board reduces the number of directors.

|

| Q: |

Can I view the shareholder list? If so, how?

|

| A: |

A complete list of the shareholders entitled to vote at the Annual Meeting will be available to view during the Annual Meeting. The list will also be available to view at the Company’s principal offices during regular business hours

during the five business days preceding the Annual Meeting.

|

| Q: |

Who pays for the proxy solicitation related to the Annual Meeting?

|

| A: |

The Company pays for the proxy solicitation related to the Annual Meeting. In addition to sending you these materials, some of our directors and officers, as well as management and non-management employees, may contact you by

telephone, mail, email, or in person. You may also be solicited by means of press releases issued by Hillenbrand and postings on our web site, www.hillenbrand.com. None of our officers or employees will receive any additional

compensation for soliciting your proxy. We have retained Broadridge to assist us with proxy solicitation and related services for an estimated fee of $12,000, plus reasonable out of pocket expenses. Such fees will be incurred after

the mailing of the proxy materials. Broadridge will ask brokers, banks, and other custodians and nominees whether they hold shares for which other persons are beneficial owners. If so, we will supply them with additional copies of the

proxy materials for distribution to the beneficial owners. We will also reimburse banks, nominees, fiduciaries, brokers, and other custodians for their costs of sending proxy materials to the beneficial owners of Hillenbrand common

stock.

|

| Q: |

How can I obtain a copy of the Annual Report on Form 10-K?

|

| A: |

A copy of Hillenbrand’s 2019 Annual Report on Form 10-K may be obtained free of charge by writing or calling the Investor Relations Department of Hillenbrand at its principal offices at One Batesville

Boulevard, Batesville, Indiana 47006, telephone (812) 931-6000 and facsimile (812) 931-5209. The 2019 Annual Report on Form 10-K, as well as Quarterly Reports on Form 10-Q and Current Reports on Form 8‑K, are also available at

Hillenbrand’s web site, www.hillenbrand.com.

|

| Q: |

How can I obtain the Company’s corporate governance information?

|

| A: |

The documents listed below are available on the Internet at the Company’s web site, www.hillenbrand.com. You may also go directly to http://ir.hillenbrand.com/investor-relations/corporate-governance/governance-documents

for those documents. Printed copies are also available to any shareholder who requests them through our Investor Relations Department at One Batesville Boulevard, Batesville, Indiana 47006, telephone (812) 931‑6000 and facsimile (812)

931-5209. The available documents are:

|

| • |

Hillenbrand, Inc. Corporate Governance Standards

|

| • |

Hillenbrand, Inc. Committee Charters – Audit Committee, Nominating/Corporate Governance Committee, Compensation and Management Development Committee, and Mergers and Acquisitions Committee

|

| • |

Position Descriptions for Chairperson of the Board, Members of the Board, and Committee Chairpersons

|

| • |

Restated and Amended Articles of Incorporation of Hillenbrand, Inc.

|

| • |

Amended and Restated Code of By-laws of Hillenbrand, Inc.

|

| • |

Hillenbrand, Inc. Code of Ethical Business Conduct

|

| • |

Hillenbrand, Inc. Global Anti-Corruption Policy

|

| • |

Supply Chain Transparency Policy – Hillenbrand, Inc. and its subsidiaries

|

|

Class

|

Term Expires at

|

|

Class I

|

2021 Annual Meeting

|

|

Class II

|

2022 Annual Meeting

|

|

Class III

|

2020 Annual Meeting

|

|

Daniel C. Hillenbrand

|

Director since 2018

Age 53

|

|

|

Mr. Hillenbrand has served as a director of the Company since May 2018. Mr. Hillenbrand is the Founder and Managing Partner of Clear Water Capital Partners, LLC, a private venture capital firm, a position he has held since 2010. Since 2002,

he has also been the Managing Partner of Generations Company, L.P., an investment management company, as well as the Managing Partner of Legacy Company, a real estate investment company. Mr. Hillenbrand previously served as Chairman of the

Board (2004–2019) and President and Chief Executive Officer (2005–2007) of Nambé, LLC, a leading international high-end consumer products company. He has also held various leadership roles at Able Manufacturing and Assembly, LLC, a

manufacturing company with platforms in metal fabrication, fiberglass composites, and plastic thermoform manufacturing, including as Chairman of the Board (2002–present), President (2013–2014), and Chief Executive Officer (2002–2007 and

2013–2019).

Prior to that, Mr. Hillenbrand served in various roles with increasing leadership responsibility at Wealthsense, Inc., Hill-Rom Holdings, Inc. (formerly Hillenbrand Industries, Inc.), Abbott Laboratories, and Batesville Casket Company, Inc.

The Company’s Board of Directors concluded that Mr. Hillenbrand should serve as a director based on his long tenure as a managing partner of general investment firms and his deep Board and executive experience in

private manufacturing companies.

|

|||

|

Thomas H. Johnson

|

Director since 2008

Age 69

|

|

|

Mr. Johnson has served as a director of the Company since March 2008. In 1998, Mr. Johnson founded Johnson Consulting Group, a consulting firm focused on the death care industry. Prior to founding

Johnson Consulting, he founded and served as President and Chief Executive Officer of Prime Succession (a funeral home and cemetery operator) from 1992 until 1996. Before Prime Succession, he served in a variety of other capacities in the

death care profession, including as an executive of Batesville Casket Company. Mr. Johnson is a 25 percent owner, and the managing member, of Fire and Stone Group, LLC, which owns and operates a funeral home in Batesville, Indiana. Mr.

Johnson currently serves on the Advisory Board of Great Western Life Insurance. He previously served on the Board of the Funeral Service Foundation from 2004 until 2010.

The Company’s Board of Directors concluded that Mr. Johnson should serve as a director based on his long service in the death care industry and resultant expertise in funeral services, including as a public

company director and his prior service on the Board of the Funeral Service Foundation.

|

|||

|

Neil S. Novich

|

Director since 2010

Age 65

|

|

|

Mr. Novich has served as a director of the Company since February 2010. He is the former Chairman and President and Chief Executive Officer of Ryerson, Inc., a global metals distributor and fabricator. Mr. Novich joined Ryerson in 1994

as Chief Operating Officer and was named President and CEO in 1995. He served on the Board of Ryerson from 1994 until 2007, adding Chairman to his title in 1999. He remained Chairman and CEO until 2007, when the company was sold. Prior to

his time at Ryerson, Mr. Novich spent 13 years with Bain & Company, an international management consulting firm, where he spent several years as a partner. He currently serves on the Boards of Analog Devices, Inc. (a semiconductor

company), where he is a member of the Audit Committee; Beacon Roofing Supply (a distributor of residential and non-residential roofing materials), where he chairs the Compensation Committee; and W.W. Grainger, Inc. (an industrial supply

company), where he is a member of the Audit Committee and Board Affairs and Nominating Committee. Mr. Novich is also a trustee of the Field Museum of National History and life trustee of Children’s Home & Aid in Chicago and is a member

of the Dean’s Council to the Physical Sciences Division of the University of Chicago.

The Company’s Board of Directors concluded that Mr. Novich should serve as a director based on his service as President and CEO of a major public corporation and his several years of experience as a partner with

a major consulting firm, together with his extensive and continuing service on the boards of several public companies and non-profit organizations.

|

|||

|

Joe A. Raver

|

Director since 2013

Age 53

|

|

|

Mr. Raver has served as a director and as President and Chief Executive Officer of the Company since September 2013. He has served as President of the Company’s Process Equipment Group since March 2011. Mr.

Raver has been a director of Applied Industrial Technologies, Inc. (“AIT”), a leading industrial distributor serving MRO and OEM customers in virtually every industry since August 2017. Mr. Raver currently serves on the Corporate

Governance Committee and Executive Organization and Compensation Committee of AIT. He previously served as President of Batesville Casket Company from 2008 – 2011. He also previously served as Vice President and General Manager of the

respiratory care division of Hill-Rom Holdings (“Hill-Rom”), a leading global provider of medical equipment and services and the Company’s former parent, as well as Hill‑Rom’s Vice President of Strategy and Shared Services. Prior to that,

Mr. Raver spent 10 years in a variety of leadership positions at Batesville Casket Company and Hill-Rom.

The Company’s Board of Directors concluded that Mr. Raver should serve as a director because of his position as President and Chief Executive Officer of the Company and based on his years of experience as

an executive of the Company’s Process Equipment Group and Batesville Casket Company and his in-depth knowledge of the death care and process equipment industries.

|

|||

|

Gary L. Collar

|

Director since 2015

Age 63

|

|

|

Mr. Collar has served as a director of the Company since May 2015. Mr. Collar is the Senior Vice President and General Manager of the Asia Pacific and Africa (APA) region for AGCO Corporation

(“AGCO”), a world leader in the development, manufacture, and marketing of agricultural machinery and solutions. Mr. Collar is responsible for all activities and all brands within the region, which includes China, India, Asia, Africa, and

Australia - New Zealand. In addition, Mr. Collar leads the development of business, distribution structures and investments in China for AGCO. He was appointed to his current position with AGCO in January 2012. Mr. Collar previously

served as AGCO’s Senior Vice President and General Manager of Europe, Africa, Middle East, Australia, and New Zealand from 2004 to December 2011. Prior to that appointment, Mr. Collar was Vice President of Market Development, Worldwide for

the Challenger Division, after joining AGCO in 2002.

Mr. Collar currently serves on the Board of Directors of Tractors and Farm Equipment Limited, an Indian tractor manufacturer and an investment of AGCO and serves on the Global Board of Directors

of AGCO Finance, Incorporated, a joint venture between AGCO and De Lage Landen Financial Services, which provides retail and wholesale financing services to AGCO customers globally.

Mr. Collar previously held various senior management positions within several divisions at ZF Friedrichshaven A.G. between 1994 and 2002. These assignments included President and CEO of the

company’s joint venture producing steering systems for the North American automotive market, and Vice President, Business Development for the automotive group. Prior to this, he was employed by Caterpillar Incorporated.

The Company’s Board of Directors concluded that Mr. Collar should serve as a director based on his deep international experience, particularly in Asia, as an executive of several multinational companies, and

his significant experience in financial analysis and controls.

|

|||

|

Joy M. Greenway

|

Director since 2013

Age 59

|

|

|

Ms. Greenway has served as a director of the Company since February 2013. She has served as the Executive Director of Global Business Solutions of General Motors since September 2018, a position she expects to retire from in March 2020.

She was previously the Executive Director, Transformation, Global Business Services of General Motors, having served in that position since May 2017. Ms. Greenway previously served as Chief Financial Officer of the Global Purchasing and

Supply Chain of General Motors from June 2014 until May 2017. Prior to that, she served as Senior Vice President for Visteon Corporation (a Tier 1 automotive systems supplier) from 2000 until 2013. Prior to joining Visteon, Ms. Greenway was

employed as the Director, Manufacturing for United Technologies Corporation, a diversified aerospace and building company. Before United Technologies Corporation, Ms. Greenway was employed by GE Industrial Power Systems as a Materials

Manager and served in various management positions at GE Aerospace/Martin Marietta.

The Company’s Board of Directors concluded that Ms. Greenway should serve as a director based on her deep operations and global leadership experience, particularly in the manufacturing industry, and her tenure

as a senior executive of a Fortune 500 public company.

|

|||

|

F. Joseph Loughrey

|

Director since 2009

Age 70

|

|

|

Mr. Loughrey has served as a director of the Company since February 2009 and has been Chairperson of the Board since February 2013. In April 2009, he retired from Cummins Inc. (engines and related technology) after serving in a variety of

roles for 35 years, most recently as Vice Chair of the Board of Directors and as the company’s President and Chief Operating Officer. Mr. Loughrey served on the Board of Directors of Cummins from July 2005 until May 2009. Mr. Loughrey

currently serves on a number of boards, including: the Lumina Foundation for Education, where he serves as Chair of the Board; Vanguard Group (an investment management company), where he serves on the Audit Committee, the Nominating

Committee, and the Compensation Committee; Saint Anselm College; and the V Foundation for Cancer Research. He is past Chairman and a current member of the Advisory Council to the College of Arts & Letters at The University of Notre Dame,

where he also serves as Chair of the Advisory Board to the Kellogg Institute for International Studies.

The Company’s Board of Directors concluded that Mr. Loughrey should serve as a director based on his service as President and Chief Operating Officer of a major public corporation and his continuing

service on several public company and educational and nonprofit boards of directors.

|

|||

|

Edward B. Cloues, II

|

Director since 2010

Age 72

|

|

|

Mr. Cloues has served as a director of the Company since April 2010. He currently serves as Vice Chairman of the Board of Trustees of Virtua Health, Inc. (a non-profit hospital and healthcare system), where he chairs the Finance and

Investment Committee and is a member of the Executive Committee, Audit Committee, and Compensation Committee. He also serves as a director and as the non-executive Chairman of the Board of AMREP Corporation (a land development company),

where he is a member and Chairman of the Audit Committee, and a member of the Compensation and Human Resources Committee and Nominating and Corporate Governance Committee. He previously was a director (from 2001) and Chairman of the Board

(from May 2011) of Penn Virginia Corporation (an oil and gas exploration and development company) and served as the interim Chief Executive Officer (from October 2015 to September 2016), during the board-led reorganization of that company,

including a filing for bankruptcy protection under Chapter 11 of the U.S. Bankruptcy Code in May 2016 and the emergence from Chapter 11 in September 2016 pursuant to a confirmed plan of reorganization. He previously served as a director

(from January 2003) and as the non-executive Chairman of the Board (from July 2011) of PVR GP, LLC, which was the general partner of PVR Partners, L.P. (a pipeline and natural resources master limited partnership), until its sale in March

2014. He also previously served as Chairman of the Board and Chief Executive Officer of K-Tron International, Inc. (“K-Tron”) from January 1998 until the Company acquired K-Tron in April 2010. Prior to joining K-Tron, Mr. Cloues was a

senior partner of Morgan, Lewis & Bockius LLP.

The Company’s Board of Directors concluded that Mr. Cloues should serve as a director based on his past extensive legal experience as a law firm partner specializing in business law matters, particularly

in the area of mergers and acquisitions, and his experience as Chairman and CEO of K-Tron International, Inc. prior to its acquisition by the Company in 2010.

|

|||

|

Helen W. Cornell

|

Director since 2011

Age 61

|

|

|

Ms. Cornell has served as a director of the Company since August 2011. She is currently President and CEO (since December 2015) of the privately-owned Owensboro Grain Company (grain and soybean products), where she also serves as Chairman

of the Board and Chairman of the Executive Committee. She is also a director of the privately-owned Dot Family Holdings, LLC (formerly Dot Foods, Inc.) (a food distributor), where she is a member of the Compensation Committee and Chairman of

the Audit Committee. In October 2018, Ms. Cornell joined the Board of Trustees of Brescia University, where she is a member of the Finance Committee. In November 2010, Ms. Cornell retired as Executive Vice President and Chief Financial

Officer of Gardner Denver, Inc., a leading global manufacturer of compressors, blowers, pumps, loading arms, and fuel systems for various industrial, medical, environmental, transportation, and process applications. During her 22-year tenure

with Gardner Denver, Inc., Ms. Cornell served in various operating and financial roles, including Vice President and General Manager of the Fluid Transfer Division and Vice President of Strategic Planning. Until December 2016, Ms. Cornell

served on the Board of Directors of Alamo Group, Inc. (agriculture and other equipment), where she was Chairperson of the Audit Committee and a member of the Compensation Committee.

The Company’s Board of Directors concluded that Ms. Cornell should serve as a director based on her long tenure in operations and finance and her experience interfacing with investors, including as Chief

Financial Officer of a major public company and most recently as President and Chief Executive Officer of Owensboro Grain Company, and her experience as a member of the board of both a public and private company.

|

|||

|

Stuart A. Taylor, II

|

Director since 2008

Age 59

|

|

|

Mr. Taylor has served as a director of the Company since September 2008. Since 2001, Mr. Taylor has been the Chief Executive Officer of The Taylor Group LLC, a private equity firm focused on creating and acquiring businesses. He has

previously held positions as Senior Managing Director at Bear, Stearns & Co. and Managing Director of CIBC World Markets and head of its Global Automotive Group and Capital Goods Group. He also served as Managing Director of the

Automotive Industry Group at Bankers Trust following a ten-year position in corporate finance at Morgan Stanley & Co. Mr. Taylor has been a member of the Board of Directors of Ball Corporation (a diversified manufacturer) since 1999,

where he currently serves as lead independent director (since April 2019) and as Chair of the Nominating/Corporate Governance Committee. He has also been a member of the Board of Directors of Wabash National Corporation, a provider of

engineered solutions for the transportation, logistics and distribution industries, since August 2019, and serves on the Audit and Compensation Committees. Mr. Taylor was previously a member of the Board of Directors of Essendant Inc.

(formerly known as United Stationers Inc.) (a wholesale distributor of business products) from 2011 until its sale to Staples Inc. in January 2019.

The Company’s Board of Directors concluded that Mr. Taylor should serve as a director based on his experience with several leading investment firms, his ongoing experience as a member of another public

company board, and his broad merger and acquisition experience.

|

|||

|

Audit

|

Compensation and

Management

Development

|

Mergers and

Acquisitions

|

Nominating/Corporate

Governance

|

|

|

Edward B. Cloues, II

Joy M. Greenway

Daniel C. Hillenbrand

Thomas H. Johnson

Neil S. Novich ♦

♦ Committee Chairperson

|

Gary L. Collar

Helen W. Cornell ♦

F. Joseph Loughrey

Stuart A. Taylor, II

|

Edward B. Cloues, II

Helen W. Cornell

Neil S. Novich

Stuart A. Taylor, II ♦

|

Edward B. Cloues, II

Gary L. Collar

Helen W. Cornell

Joy M. Greenway

Daniel C. Hillenbrand

Thomas H. Johnson

F. Joseph Loughrey ♦

Neil S. Novich

Stuart A. Taylor, II

|

|

| • |

Have a reputation for industry, integrity, honesty, candor, fairness, and discretion;

|

| • |

Be an acknowledged expert in his or her chosen field(s) of endeavor, which area of expertise should have some relevance to the Company’s businesses or operations;

|

| • |

Be knowledgeable, or willing and able to quickly become knowledgeable, in the critical aspects of the Company’s businesses and operations;

|

| • |

Be experienced and skillful in serving as a competent overseer of, and trusted advisor to, senior management of a substantial publicly held corporation; and

|

| • |

For non-employee directors, meet the New York Stock Exchange independence standards then in effect.

|

| • |

Is or has at any time been an officer or employee of the Company or any of its subsidiaries; or

|

| • |

Has or has had at any time any direct or indirect interest in an existing or proposed transaction involving more than $120,000 in which the Company is, was, or was proposed to be a participant, or that is otherwise required to be

disclosed by us under the proxy disclosure rules.

|

|

Name

|

Shares (1)

Beneficially Owned As Of

December 16, 2019

|

Percent Of

Total Shares

Outstanding

|

||

|

F. Joseph Loughrey – Chairperson

|

79,396

|

(2) |

*

|

|

|

Edward B. Cloues, II

|

36,606

|

(3) |

*

|

|

|

Gary L. Collar

|

13,550

|

(4) |

*

|

|

|

Helen W. Cornell

|

30,928

|

(5) |

*

|

|

|

Joy M. Greenway

|

21,485

|

(6) |

*

|

|

|

Daniel C. Hillenbrand

|

873,995

|

(7) |

1.17%

|

|

|

Thomas H. Johnson

|

52,655

|

(8) |

*

|

|

|

Neil S. Novich

|

40,630

|

(9) |

*

|

|

|

Joe A. Raver

|

577,654

|

(10) |

*

|

|

|

Stuart A. Taylor, II

|

57,762

|

(11) |

*

|

|

|

Name

|

Shares (1)

Beneficially Owned As Of

December 16, 2019

|

Percent Of

Total Shares

Outstanding

|

||

|

Kristina A. Cerniglia

|

140,756

|

(12) |

*

|

|

|

Kimberly K. Ryan

|

214,388

|

(13) |

*

|

|

|

Christopher H. Trainor

|

99,985

|

(14) |

*

|

|

|

J. Michael Whitted

|

60,204

|

(15) |

*

|

|

|

All directors and executive officers of the Company as a group, consisting of 21 persons

|

2,489,812

|

(16) |

3.33%

|

|

| (1) |

The Company’s only class of equity securities outstanding is common stock without par value. Except as otherwise indicated in these footnotes, the persons named have sole voting and investment power with respect to all shares shown as

beneficially owned by them. None of the shares beneficially owned by directors or executive officers is pledged as security. Information regarding shares beneficially owned by Mr. Raver, our President and CEO, is included in the “Security

Ownership of Directors” table above.

|

| (2) |

Includes (i) 20,000 shares directly owned by Mr. Loughrey and (ii) 59,396 restricted stock units held on the books and records of the Company.

|

| (3) |

Includes 36,606 restricted stock units held on the books and records of the Company.

|

| (4) |

Includes 13,550 restricted stock units held on the books and records of the Company.

|

| (5) |

Includes 1,500 shares held by trust of which Ms. Cornell is trustee, and 29,428 restricted stock units held on the books and records of the Company.

|

| (6) |

Includes 21,485 restricted stock units held on the books and records of the Company.

|

| (7) |

Includes (i) 1,000 shares directly owned by Mr. Hillenbrand; (ii) 3,507 restricted stock units held on the books and records of the Company; and (iii) 869,488 shares indirectly beneficially owned by Mr. Hillenbrand, consisting of (a)

712,525 shares owned by Generations, LP, (b) 45,719 shares owned by Clear Water Capital Partners, LP, (c) 8,631 shares owned by John and Joan GC TR FBO (John, Rose and Olivia), with respect to which Mr. Hillenbrand is a co-trustee, (d)

5,754 shares owned by John and Joan GC TR FBO (Eleanor and Sarah), with respect to which Mr. Hillenbrand is a co-trustee, with respect to which Mr. Hillenbrand disclaims beneficial ownership, (e) 48,611 shares owned by Hillenbrand II TR FBO

(John, Rose and Olivia), with respect to which Mr. Hillenbrand is a co-trustee, (f) 28,248 shares owned by John and Joan CRT IMA, with respect to which Mr. Hillenbrand is a co-trustee, and (g) 20,000 shares owned by Anne Hillenbrand

Singleton Trust, with respect to which Mr. Hillenbrand disclaims beneficial ownership.

|

| (8) |

Includes 5,000 shares directly owned by Mr. Johnson and 47,655 restricted stock units held on the books and records of the Company.

|

| (9) |

Includes 37,515 restricted stock units held on the books and records of the Company and 3,115 shares acquired with deferred director fees and held on the books and records of the Company under the Board’s deferred compensation plan.

|

| (10) |

Includes 147,351 shares directly owned by Mr. Raver and 430,303 shares that may be purchased pursuant to stock options that are exercisable within 60 days of December 16, 2019.

|

| (11) |

Includes 46,405 restricted stock units held on the books and records of the Company and 11,357 shares acquired with deferred director fees and held on the books and records of the Company under the Board’s deferred compensation plan.

|

| (12) |

Includes 45,328 shares directly owned by Ms. Cerniglia and 95,428 shares that may be purchased pursuant to stock options that are exercisable within 60 days of December 16, 2019.

|

| (13) |

Includes 70,500 shares directly owned by Ms. Ryan and 143,888 shares that may be purchased pursuant to stock options that are exercisable within 60 days of December 16, 2019.

|

| (14) |

Includes 35,245 shares directly owned by Mr. Trainor and 64,740 shares that may be purchased pursuant to stock options that are exercisable within 60 days of December 16, 2019.

|

| (15) |

Includes 2,752 shares directly owned by Mr. Whitted and 50,072 shares that may be purchased pursuant to stock options that are exercisable within 60 days of December 16, 2019, and 7,380 restricted stock units held on the books and

records of the Company.

|

| (16) |

Includes 2,491,805 shares directly owned by the applicable director or executive officer, 832,043 shares that may be purchased pursuant to stock options that are exercisable within 60 days of December 16, 2019, 337,365 restricted stock

units held on the books and records of the Company, 86,990 shares held by trusts, 758,244 shares owned by limited partnerships, 25,754 shares with respect to which the director disclaims beneficial ownership, and 14,472 shares acquired with

deferred director fees and held on the books and records of the Company under the Board’s deferred compensation plan.

|

|

Name

|

Shares

Beneficially Owned As Of

December 16, 2019 (1)

|

Percent Of

Total Shares

Outstanding

|

||

|

BlackRock Inc.

55 East 52nd Street

New York, NY 10055

|

10,483,275

|

(2) |

14.03%

|

|

|

Vanguard Group, Inc.

P.O. Box 2600, V26

Valley Forge, PA 19482

|

6,741,155

|

(3) |

9.02%

|

|

| (1) |

On November 21, 2019, the Company closed its acquisition of Milacron Holdings Corp. (“Milacron”), which included issuance to Milacron stockholders of Company shares as a portion of the merger consideration. As of December 16, 2019, we

do not know based on publicly available information whether or to what extent the number of shares beneficially owned by the persons listed in this table may have changed as a result of the acquisition.

|

| (2) |

This information is based on a Form 13F filed by BlackRock Inc. with the Securities and Exchange Commission on November 8, 2019; reflects sole investment discretion with respect to all shares, sole voting power with respect to 10,228,410

shares, and no voting power with respect to 254,865 shares.

|

| (3) |

This information is based on a Form 13F filed by Vanguard Group, Inc. with the Securities and Exchange Commission on November 14, 2019; reflects sole investment discretion with respect to 6,631,895 shares, and shared investment

discretion with respect to 109,260 shares; reflects sole voting power with respect to 108,851 shares, shared voting power with respect to 8,027 shares, and no voting power with respect to 6,624,277 shares.

|

| • |

Our Executive Compensation Philosophy

|

| • |

Process for Determining Compensation

|

| • |

Compensation of Our Named Executive Officers for Fiscal Year 2019

|

| • |

Retirement and Savings Plans

|

| • |

Employment Agreements and Termination Benefits

|

| • |

Other Personal Benefits

|

| • |

Compensation-Related Policies

|

| • |

First, the compensation of our Named Executive Officers is set by our Compensation Committee, which is a committee of independent directors.

|

| • |

Second, a significant portion of each Named Executive Officer’s compensation is variable based on individual performance and the performance of the Company or its applicable business unit(s). This structure is designed to align

compensation with the interests of the shareholders of the Company.

|

|

The executive compensation program is designed to ensure officers and key management personnel are effectively compensated in terms of base salary, incentive compensation, and other benefits that advance the long-term interest of

Hillenbrand’s shareholders.

The compensation program is based on the following principles:

• Reinforcing the absolute requirement for ethical behavior in all practices;

• Aligning management’s interests with those of shareholders, and structuring short-term targets that lead to long-term value creation;

• Motivating management to achieve superior results by paying for sustainable performance (superior performance is rewarded with commensurate incentives, while little to no incentive

is paid for underperformance);

• Offering and maintaining competitive compensation in order to attract and retain superior talent;

• Maintaining a significant portion of at-risk compensation (with increased emphasis on at-risk compensation based on greater responsibility in the Company);

• Delineating clear accountabilities while discouraging unnecessary and excessive risk taking; and

• Providing clarity and transparency in compensation structure.

|

|

Joe A. Raver

|

President and Chief Executive Officer

|

|

Kristina A. Cerniglia

|

Senior Vice President and Chief Financial Officer

|

|

Kimberly K. Ryan

|

Senior Vice President and President of Coperion

|

|

Christopher H. Trainor

|

Senior Vice President and President of Batesville

|

|

J. Michael Whitted

|

Senior Vice President, Strategy and Corporate Development

|

|

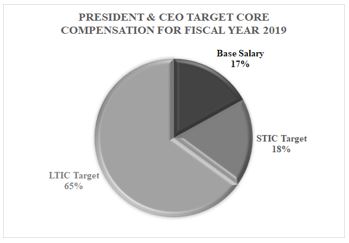

Component

|

Description And Purpose

|

|

|

Base Salary

|

Fixed compensation intended to provide a base level of income and aid in the attraction and retention of talent in a competitive market.

|

|

|

Short-Term Incentive

Compensation (“STIC”)

|

Performance-based annual cash bonus designed to motivate and reward executives based on achieving individual performance goals and the executive’s individual contributions to the Company’s performance for a given fiscal year. Also aids

in the attraction and retention of talent in a competitive market.

|

|

|

Long-Term Incentive

Compensation (“LTIC”)

|

Performance-based annual equity grant with three-year vesting period designed to reward executives for creating long-term shareholder value, as well as to motivate future contributions and decisions aimed at increasing shareholder

value. Also aids in the attraction and retention of talent in a competitive market.

|

|

|

Retirement and Other Benefits

|

Fixed component of compensation intended to protect against catastrophic expenses (healthcare, disability, and life insurance) and provide opportunity to save for retirement (pension and 401(k)).

|

|

|

Post-Termination

Compensation (Severance and

Change in Control)

|

Severance program designed to allow executives to focus on acting in the best interests of shareholders regardless of the impact on their own employment.

|

| • |

Approves the base salaries of the Named Executive Officers for the coming calendar year.

|

| • |

Approves the target STIC awards to the Named Executive Officers for the new fiscal year, determines the formulae used to calculate the awards, and establishes the performance objectives to be used in the formulae. See the discussion

below under the heading “Annual Cash Incentive Awards” in this Part I for more details regarding performance objectives and the STIC award formulae.

|

| • |

With support from the Company’s internal audit team, certifies performance and confirms the computation of the actual STIC awards to be paid to the Named Executive Officers with respect to the fiscal year ended on the preceding

September 30.

|

| • |

Approves the target LTIC awards to the Named Executive Officers for the new fiscal year and determines the formulae used to calculate the awards, including the applicable mix and underlying performance objectives. See the discussion

below under the heading “Long-Term Incentive Compensation (LTIC)” in this Part I for more details regarding performance objectives and the LTIC award formulae.

|

| • |

With support from the Company’s internal audit team, certifies performance and confirms the computation of the actual award amounts to be paid to the Named Executive Officers with respect to performance-based LTIC awards whose

three-year performance measurement period ended on the preceding September 30.

|

|

Actuant Corporation

Acuity Brands, Inc.

Barnes Group Inc.

Bruker Corporation

EnPro Industries, Inc.

Graco Inc.

Herman Miller, Inc.

HNI Corporation

IDEX Corporation

|

Itron, Inc.

John Bean Technologies Corporation

Matthews International Corporation

Rexnord Corporation

Steelcase Inc.

Tempur Sealy International Inc.

The Middleby Corporation

Waters Corporation

|

| • |

Ensure successful operating company performance – provide oversight and resources needed to generate profitable organic and acquisition growth, strong cash flows, and improved return on invested capital. This will be accomplished

through the establishment of clear goals and objectives, appropriate oversight to ensure goal achievement, a transparent resource allocation process, and a commitment to the Hillenbrand Operating Model (“HOM”).

|

| • |

Actively pursue acquisitions and integrate with success – identify prudent opportunities that meet our strategic criteria, provide attractive long-term returns for shareholders, generate profitable revenue and earnings per share

growth, and leverage our operating model. Ensure acquisition success by planning, preparing for, and executing due diligence and integration with excellence, focusing on the critical few key areas of greatest value generation.

|

| • |

Implement and expand the HOM – drive the foundation of the operating model across the enterprise, leveraging the framework to produce sustainable and predictable results. Enhance and teach the organization the fundamentals and

management practices at the core of the model. Expand the model to include additional practices and tools aimed at expanding enterprise value. Implement HOM in newly acquired companies.

|

| • |

Develop world class corporate capabilities to support the strategy and projected growth – make certain that resources, processes, procedures, technology, and controls are aligned with the Company’s transformation strategy.

|

| • |

Maintain a strong, deep, and diverse talent pool – ensure the experiences and skill sets necessary to achieve the corporate strategy are present in the organization. This will be accomplished by creating an environment so compelling

that we can attract, further develop, and retain top talent individuals.

|

| • |

For Mr. Raver – Develop and execute the Company’s strategy and business plan and achieve the Company’s financial and operational objectives; allocate capital to create shareholder value; lead the Company’s growth initiatives; oversee

the Company’s acquisition activities; oversee efforts designed to strengthen the talent pool, capabilities, and competencies of the Company; and ensure that the Company engages in appropriate, meaningful, and transparent conversations

with key stakeholders.

|

| • |

For Ms. Cerniglia – Provide financial and information technology leadership with excellence to the Company; ensure appropriate processes and procedures for the operation of the corporate financial and enterprise information systems

(EIS) functions are in place; ensure that appropriate internal controls to safeguard financial assets and proprietary information are developed and maintained; employ Lean throughout the finance and EIS functions to increase efficiency

and effectiveness; manage financial and information technology due diligence efforts and subsequent integration with respect to the Company’s acquisition activities; provide financial support where

necessary to the Company’s subsidiaries; ensure there are high performing corporate finance and EIS teams with the appropriate experiences and skill sets; and lead all aspects of the Enterprise Risk Management (ERM) process in alignment

with the strategy management process with a focus on early identification and mitigating action regarding significant risks to the business.

|

| • |

For Ms. Ryan – Develop and execute the strategic and resulting operating plan of Coperion and Rotex; grow revenue, income before taxes, and cash flow organically by penetrating growing end markets, accelerating geographic expansion,

and driving improved operational performance; use the HOM to realize the full value of the Coperion and Rotex organizations and to deliver sustainable and predictable results; and identify, execute, and integrate future strategic

acquisitions in line with the Coperion and Rotex strategies.

|

| • |

For Mr. Trainor – Develop and execute the strategic and resulting operating plan of Batesville; use the HOM to deliver sustainable and predictable results; maintain the strong cash flow generation capabilities of Batesville; ensure

the organization is sized appropriately to demand; continue to gain efficiencies and maintain margin through Lean; and provide talent to the rest of the organization.

|

| • |

For Mr. Whitted – Lead the execution of Hillenbrand’s growth strategy; oversee the work of multi-disciplinary teams involved in the Company’s acquisition and divestiture efforts, particularly as it relates to opportunity

identification and analysis, due diligence, and integration; foster global M&A relationships; and assist in the integration of strategic transactions in coordination with the CEO/CFO, the M&A Committee and OpCo leadership teams.

|

|

Name

|

Base Salary

|

|||

|

Joe A. Raver

|

$

|

844,231

|

||

|

Kristina A. Cerniglia

|

$

|

535,373

|

||

|

Kimberly K. Ryan

|

$

|

498,670

|

||

|

Christopher H. Trainor

|

$

|

447,862

|

||

|

J. Michael Whitted

|

$

|

425,000

|

||

| • |

At the beginning of each fiscal year, the Compensation Committee approves each Named Executive Officer’s target STIC award, as well as the applicable collective and individual objectives and the formulae for calculating the actual

awards, including the financial performance targets that underlie the formulae. For a Named Executive Officer who has direct responsibility to a business unit other than Hillenbrand, Inc., applicable performance targets track the

performance of the relevant business unit(s) (e.g., Ms. Ryan’s award is based on the combined performance of our Coperion and Rotex businesses10 and Mr. Trainor’s award is based on the performance of Batesville). For all other Named Executive Officers, these targets track the performance of Hillenbrand, Inc. on a consolidated basis.11

|

| • |

Following the end of the fiscal year, the Committee certifies the level of achievement of the financial performance targets applicable to each Named Executive Officer, resulting in a calculation we call the “Company Performance

Factor.” The applicable Company Performance Factor is then entered into the STIC award formula for each officer. More detail regarding achievement of performance targets is provided below under the headings “STIC Award Formula” and

“Company Performance Factor.”

|

| • |

After the applicable Company Performance Factor is entered into the formula, the Committee then applies an Individual Performance Factor, which is a multiplier based on individual performance reviews and an evaluation of the

officer’s individual performance against his or her collective and individual objectives for the prior fiscal year. For all Named Executive Officers other than the CEO, this evaluation is based upon recommendations of the CEO. For the

CEO, this evaluation is based upon the Board’s assessment. As a result, in approving the final award, the Committee exercises its authority in approving the Individual Performance Factor to increase or reduce, on an individual (i.e., not an aggregate) basis, that officer’s STIC award, if and to the extent deemed appropriate based on his or her individual achievement of established goals, which are described above under the

heading “Factors Considered in Setting Compensation.” Target performance for an Individual Performance Factor is measured as a 1.0 multiplier. It is expected that the STIC award for an officer who achieves his or her performance goals

at target level in a particular year will have an Individual Performance Factor at or near this 1.0 level, and one who shows exceptional individual performance in exceeding all of his or her performance goals for the year will have the

Individual Performance Factor increased accordingly, but not above a 1.2 multiplier. The Individual Performance Factor may also be reduced below a 1.0 multiplier for underperformance.

|

| • |

Base Salary: the amount of salary paid to the Named Executive Officer during the applicable fiscal year.

|

| • |

Individual Target Bonus Percentage: a pre-established percentage of base salary that varies among the Named Executive Officers. Mr. Raver’s Individual Target Bonus Percentage for fiscal year

2019 was 110 percent. The Individual Target Bonus Percentage for Ms. Cerniglia, Ms. Ryan, and Mr. Whitted was 75 percent. The Individual Target Bonus Percentage for Mr. Trainor was 65 percent. The Compensation Committee may adjust

those percentages from year to year if deemed appropriate based upon factors including peer group market data and internal equity.

|

| • |

Company Performance Factor: a multiplier reflecting the Company’s or, as applicable, one or more business unit(s)’ actual achievement level with respect to the pre-established financial

performance targets set by the Compensation Committee for each fiscal year. These financial performance targets are designated values of “Net Revenue,” “STIC IBT,” “Cash Conversion Cycle,” and “Order Intake,” each of which is further

described below. These performance metrics translate to operational and financial performance, efficiency, and sustainable improvement. Each of these performance metrics is adjusted to ignore the effects of the following unusual or

infrequent items (the “Adjusting Items”), which are determined in advance by the Compensation Committee during the first quarter of each fiscal year:

|

| − |

acquisitions made during the fiscal year (plan targets are adjusted accordingly);

|

| − |

divestitures made during the fiscal year (plan targets are adjusted accordingly);

|

| − |

changes in accounting pronouncements in United States GAAP, applicable international standards, or accounting methods that cause an inconsistency in computation as originally designed; and

|

| − |

the foreign exchange translation of income statements at exchange rates that differ from those assumed in the STIC Plan.

|

| o |

Net Revenue: this is a calculation of revenue, ignoring the effects of certain unusual and/or infrequent items , including the Adjusting Items.

|

| o |

STIC IBT: this is income before taxes, adjusted to eliminate the effects of the Adjusting Items and certain other unusual and/or infrequent items, including the following (which are also determined in advance by the Compensation

Committee during the first quarter of each fiscal year):

|

| − |

all professional fees, due diligence fees, expenses, and integration costs related to a specific acquisition;

|

| − |

all professional fees, due diligence fees, expenses, and integration costs related to a specific divestiture;

|

| − |

stock compensation expense;

|

| − |

extraordinary external legal costs;

|

| − |

restructuring charges and other items related to a restructuring plan approved by the Company’s CEO; and

|

| − |

realized and unrealized transaction gains and losses caused by foreign exchange, and gains and losses caused by foreign exchange translation of balance sheet accounts.

|

| o |

Cash Conversion Cycle (“CCC”): this is a calculation of the time (in days) required to generate cash flows from the production and sales process. The CCC calculation is based on a 12-month average, and is adjusted to eliminate the

effects of the Adjusting Items and certain other unusual and/or infrequent items, including the following (which are also determined in advance by the Compensation Committee during the first quarter of each fiscal year):

|

| − |

all professional fees, due diligence fees, expenses, and integration costs related to a specific acquisition;

|

| − |

all professional fees, due diligence fees, expenses, and integration costs related to a specific divestiture;

|

| − |

stock compensation expense; and

|

| − |

restructuring charges and other items related to a restructuring plan approved by the Company’s CEO.

|

| o |

Order Intake: this is a reflection of the value of firm orders received from customers (net of all cancellations), adjusted to eliminate the effects of certain unusual and/or infrequent items, including the Adjusting Items.

|

| o |

For Hillenbrand and Batesville, the achievement level with respect to target STIC IBT was weighted at 50 percent of the Company Performance Factor, the achievement level with respect to target Net Revenue12 was weighted at 25 percent, and the achievement level with respect to target Cash Conversion Cycle was weighted at 25 percent.

|

| o |

For combined Coperion and Rotex (for Ms. Ryan’s award), the achievement level with respect to target STIC IBT was weighted at 50 percent of the Company Performance Factor, the achievement level with respect to target combined Order

Intake for Coperion and Net Revenue for Rotex was weighted at 25 percent, and the achievement level with respect to target Cash Conversion Cycle was weighted at 25 percent.

|

| • |

Individual Performance Factor: a measure of the individual Named Executive Officer’s performance against his or her goals, which is based on individual performance reviews and an evaluation

of the Named Executive Officer’s individual performance against his or her collective and individual objectives for the prior year. The Compensation Committee then approves the Individual Performance Factor in the exercise of its

authority under the STIC Plan, consistent with the purposes thereof, to adjust on an individual (i.e., not an aggregate) basis, each officer’s STIC award payment amount. Lastly, the Board as a

whole must approve the Chief Executive Officer’s Individual Performance Factor and final STIC award payment amount.

|

|

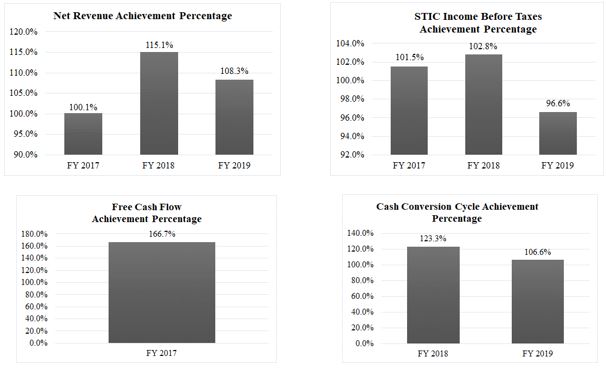

2019 Financial Criteria

(dollar amounts in millions)

|

|||||||||||||

|

Hillenbrand

|

Batesville*

|

Combined

Coperion and

Rotex**

|

|||||||||||

|

Net Revenue

Objective Amount

|

Threshold

|

$

|

1,459.7

|

$

|

440.0

|

$

|

926.9

|

||||||

|

Target

|

$

|

1,824.6

|

$

|

550.1

|

$

|

1,158.6

|

|||||||

|

Maximum

|

$

|

2,098.3

|

$

|

605.1

|

$

|

1,390.3

|

|||||||

|

Net Revenue

Achievement

Percentage

|

Actual

|

108.3

|

%

|

97.1

|

%

|

113.3

|

%

|

||||||

|

STIC IBT***

Objective Amount

|

Threshold

|

$

|

193.2

|

$

|

87.4

|

$

|

148.8

|

||||||

|

Target

|

$

|

241.5

|

$

|

109.3

|

$

|

186.0

|

|||||||

|

Maximum

|

$

|

277.7

|

$

|

120.2

|

$

|

223.2

|

|||||||

|

STIC IBT

Achievement

Percentage

|

Actual

|

96.6

|

%

|

95.1

|

%

|

98.9

|

%

|

||||||

|

Cash Conversion

Cycle Objective

Amount

|

Threshold

|

49.9 days

|

45.0 days

|

43.9 days

|

|||||||||

|

Target

|

45.4 days

|

42.9 days

|

39.9 days

|

||||||||||

|

Maximum

|

43.1 days

|

40.8 days

|

37.9 days

|

||||||||||

|

Cash Conversion

Cycle Achievement

Percentage

|

Actual

|

106.6

|

%

|

97.9

|

%

|

110.5

|

%

|

||||||

|

Company

Performance

Factor

|

Actual

|

134.7

|

%

|

86.9

|

%

|

140.2

|

%

|

||||||

| * |

Batesville targets for Net Revenue and STIC IBT reflect our expectation that burial casket volumes will continue to be negatively impacted by certain secular trends in the industry.

|

| ** |

For combined Coperion and Rotex performance, these metrics are calculated as the sum of Coperion and Rotex performance (in the case of Net Revenue, this is the sum of Coperion Order Intake and Rotex Net Revenue).

|

| *** |

STIC IBT at the Hillenbrand level reflects the impact of the full amount of corporate overhead costs for the enterprise.

|

|

Named Executive

Officer

|

Target STIC

Award13

|

Applicable

Company

Performance

Factor

|

Actual

STIC

Award

Paid14

|

|||||||||

|

Joe A. Raver

|

$

|

928,654

|

134.7

|

%

|

$

|

1,250,897

|

||||||

|

Kristina A. Cerniglia

|

$

|

401,530

|

134.7

|

%

|

$

|

567,904

|

||||||

|

Kimberly K. Ryan

|

$

|

374,002

|

140.2

|

%

|

$

|

550,569

|

||||||

|

Christopher H. Trainor

|

$

|

291,110

|

86.9

|

%

|

$

|

252,975

|

||||||

|

J. Michael Whitted

|

$

|

318,750

|

134.7

|

%

|

$

|

450,824

|

||||||

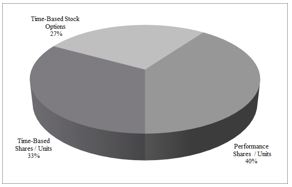

| • |

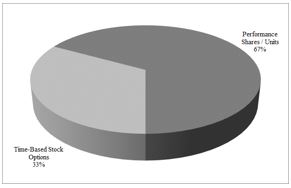

Stock Options. Incentive (tax-qualified) and non-qualified stock options may be granted to such employees and (with respect to non-qualified options) directors and for such number of shares

of our common stock as the Compensation Committee determines, subject to applicable limits as set forth in the Stock Plan. A stock option will be exercisable and vest at such times, over such term, and subject to such terms and

conditions as the Compensation Committee determines, at an exercise price which may not be less than the fair market value of our common stock on the date the option is granted. The Company has historically issued non-qualified stock

option awards with a term of ten years, which vest (and become exercisable), subject to certain terms and conditions, at the rate of 33-1/3 percent of the shares covered by the option on each of