UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

Annual Report Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

For the fiscal year ended September 30, 2009

Commission File No. 001-33794

HILLENBRAND, INC.

(Exact name of registrant as specified in its charter)

| |

|

|

Indiana

(State or other jurisdiction of

incorporation or organization)

|

|

26-1342272

(I.R.S. Employer

Identification No.) |

| |

|

|

| One Batesville Boulevard |

|

|

| Batesville, Indiana

|

|

47006 |

| (Address of principal executive offices)

|

|

(Zip Code) |

Registrant’s telephone number, including area code: (812) 934-7500

Securities registered pursuant to Section 12(b) of the Act:

| |

|

|

| Title of Each Class

|

|

Name of Each Exchange on Which Registered |

|

|

|

|

| Common Stock, without par value

|

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule

405 of the Securities Act.

Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to

Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed

by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or

for such shorter period that the registrant was required to file such reports), and (2) has been

subject to such filing requirements for the past 90 days.

Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be submitted and

posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files).

Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s

knowledge, in definitive proxy or information statements incorporated by reference in Part III of

this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated

filer, non-accelerated filer, or a smaller reporting company (as defined in Rule 12b-2 of the

Exchange Act).

| |

|

|

|

|

|

|

| Large accelerated filer þ

|

|

Accelerated filer o

|

|

Non-accelerated filer o

|

|

Smaller Reporting Company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of

the Exchange Act).

Yes o No þ

State the aggregate market value of the voting and nonvoting common equity held by non-affiliates

of the registrant.

Aggregate market value of the voting stock (which consists solely of shares of common stock)

held by non-affiliates of the registrant as of March 31, 2009, the date our common stock began

trading regularly on the New York Stock Exchange: — $989,861,589.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock,

as of the latest practicable date.

Common Stock, without par value — 61,891,536 shares outstanding as of November 17, 2009.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K

(e.g., Part I, Part II, etc.) into which the document is incorporated: Portions of our definitive

proxy statement for the 2010 Annual Meeting of Stockholders are incorporated by reference into Part

III of this report. These will be filed no later than January 15, 2010.

HILLENBRAND, INC.

Annual Report on Form 10-K

For the fiscal year ended September 30, 2009

TABLE OF CONTENTS

PART I

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

Throughout this Form 10-K, we make a number of “forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995. As the words imply, forward-looking

statements are statements about our future plans, objectives, beliefs, and expectations that might

or might not happen in the future, as contrasted with historical information. Our forward-looking

statements are based on assumptions that we believe are reasonable, but by their very nature they

are subject to a wide range of risks.

Accordingly, in this Form 10-K, we may say something like,

“We anticipate that the burial rate will be flat to slightly declining in future

years.”

That is a forward-looking statement, as indicated by the word “anticipate” and by the clear meaning

of the sentence.

Other words that could indicate we’re making forward-looking statements include the

following:

| |

|

|

|

|

|

|

|

|

|

|

intend

|

|

believe

|

|

plan

|

|

expect

|

|

may

|

|

goal |

| |

become

|

|

pursue

|

|

estimate

|

|

will

|

|

forecast

|

|

continue |

| |

targeted

|

|

encourage

|

|

promise

|

|

improve

|

|

progress

|

|

potential |

This isn’t an exhaustive list but is simply intended to give you an idea of how we try to

identify forward-looking statements. The absence of any of these words, however, does not mean

that the statement is not forward-looking.

Here’s the key point: Forward-looking statements are not guarantees of future performance,

and our actual results could differ materially from those set forth in any forward-looking

statements. Any number of factors — many of which are beyond our control — could cause our

performance to differ significantly from those described in the forward-looking statements.

For a discussion of factors that could cause actual results to differ from those contained in

forward-looking statements, see the discussions under the heading “Risk Factors” in Item 1A of

this Form 10-K. We assume no obligation to update or revise any forward looking statements.

In this section of the Form 10-K, entitled “Business,” we provide you a basic understanding of our

company, the products we manufacture and sell, how we distribute our products, with whom we

compete, and the key inputs to production (in the form of raw materials, labor, and manufacturing

locations). We also provide you background on applicable regulatory matters and certain key

patents and trademarks important to our business. Finally we provide you a brief background on our

executive officers so that you can understand their experience and qualifications.

General

Hillenbrand, Inc. (“Hillenbrand”) was formed on November 1, 2007 and became a publicly traded

company as the result of the separation of Hillenbrand Industries, Inc. (our “Former Parent” or

“Hill-Rom Holdings, Inc.” or “Hill-Rom”) into two separate publicly traded companies, Hillenbrand

and Hill-Rom, through a tax-free distribution (the “Distribution”) of Hillenbrand shares to

Hill-Rom’s shareholders. This distribution took place following the close of business on March 31,

2008. Unless the context otherwise requires, the terms “Hillenbrand,” the “Company,” “we,” “our,”

or “us” refer to Hillenbrand, Inc. and one or all of its consolidated subsidiaries.

1

Hillenbrand, Inc. is an Indiana corporation with our principal executive offices located at One

Batesville Boulevard, Batesville, Indiana 47006, and our telephone number at this address is (812)

934-7500. Our website is www.hillenbrandinc.com. We make available on this website, free of

charge, access to press releases, conference calls, and our annual, quarterly, and current reports,

and other documents filed or furnished with the Securities and Exchange Commission (“SEC”) as soon

as practicable after such reports are filed or furnished. We also make available through this

website position specifications for the Chairman, Vice Chairman, members of the Board of Directors

and the Chief Executive Officer; our Code of Ethical Business Conduct; the Corporate Governance

Standards of our Board of Directors; and the charters of each of the standing committees of the

Board of Directors. All of these documents are also available to shareholders in print upon

request.

All reports and documents filed with the SEC are also available via the SEC website, www.sec.gov,

or may be read and copied at the SEC Public Reference Room at 100 F Street, NE, Washington, DC

20549. Information on the operation of the Public Reference Room may be obtained by calling the

SEC at 1-800-SEC-0330.

Hillenbrand, Inc. is the parent holding company of its wholly-owned subsidiary, Batesville

Services, Inc. (together with its subsidiaries, “Batesville”). Through Batesville, we are the

leader in the North American death care industry where we manufacture, distribute, and sell

Batesville branded funeral service products to licensed funeral directors who operate licensed

funeral homes. Our products consist primarily of burial and cremation caskets, but also include

containers and urns, selection room display fixturing for funeral homes, and other personalization

and memorialization products and services, including the creation and hosting of websites for

funeral homes.

Products and Services

We manufacture and sell gasketed caskets made of carbon steel, stainless steel, copper, and bronze.

We also produce and market non-gasketed steel, hardwood, and veneer hardwood caskets. In addition,

we manufacture and sell cloth-covered caskets, all wood construction caskets suitable for green

burials, and a line of urns, containers, and other memorialization products used in cremations. To

assist with displaying these products, we supply selection room fixturing through our System

Solutions® by Batesville group.

Most Batesville® brand metal caskets are gasketed caskets that are electronically welded

to help resist the entrance of outside elements through the use of rubber gaskets and a locking bar

mechanism. Our premium steel caskets also employ an alloy bar to help protect the casket

cathodically from rust and corrosion. We believe that this system of cathodic protection is a

feature found only on Batesville produced caskets.

Our solid and veneer hardwood caskets are made from mahogany, cherry, walnut, maple, pine,

oak, pecan, poplar, and sycamore. Our veneer caskets are manufactured using a proprietary process

for veneering that allows for rounded corners and a furniture-grade finished appearance. We also

manufacture and provide select lines of Marsellus® premium solid wood caskets to our

funeral home customers.

Our Options® by Batesville cremation line offers a complete cremation

marketing system for funeral service professionals. In addition to a broad line of cremation

caskets, containers, and urns, the system includes training, merchandising support, and marketing

support materials. Cremation caskets and containers are manufactured primarily of hardwoods and

fiberboard. Our wide assortment of memorial urns are made from a variety of materials, including

cast bronze, cast acrylic, wood, sheet bronze, cloisonné, and marble.

We offer several other marketing and merchandising programs to funeral professionals for both

casket and cremation products. Batesville branded caskets are marketed by our direct sales force

only to licensed funeral professionals operating licensed funeral establishments (or, in the

absence of state licensing requirements, to full service funeral establishments offering both

funeral goods and funeral services in conformance with state law) throughout the United States,

Puerto Rico, Canada, Mexico, the United Kingdom, Australia, and South Africa. A significant portion

of our sales are made to large national funeral service providers under contracts. One customer,

Service Corporation International, accounted for approximately 13% of our net sales during the year

ended September 30, 2009.

2

We maintain inventory at 86 company-operated Customer Service Centers (“CSCs”) and 6 Rapid

Deployment Centers (“RDCs”) in North America. Batesville caskets are generally delivered in

specially equipped vehicles owned by us.

We primarily manufacture and distribute products in the United States. We also have 2

manufacturing facilities in Mexico and distribution facilities in Puerto Rico, Canada, Mexico, the

United Kingdom, Australia, and South Africa.

Competition

We are the recognized North American industry leader in the sale of funeral service products. We

compete on the basis of product quality, personalization, price, delivery, and customer service.

Major competitors that manufacture and/or sell funeral service products over a wide geographic area

include Aurora Casket Company and Matthews’ Casket Division, a business segment of Matthews

International Corporation.

Throughout the United States, many other enterprises manufacture, assemble, and/or distribute

funeral service products for sale, often focusing on particular regions or geographic areas.

Additionally, we are facing increasing competition from a number of non-traditional sources,

including casket manufacturers located abroad.

Regulatory Matters

We are subject to a variety of federal, state, local, and foreign laws and regulations relating to

environmental, health, and safety concerns, including the handling, storage, discharge, and

disposal of hazardous materials used in or derived from our manufacturing processes. We are

committed to operating all of our businesses in a manner that protects the environment. In the

past, we have voluntarily entered into remediation agreements with various environmental

authorities to address onsite and offsite environmental impacts. From time to time we provide for

reserves in our financial statements for environmental matters. We believe we have appropriately

satisfied the financial responsibilities for all currently known offsite issues. Based on the

nature and volume of materials involved regarding onsite impacts, we do not expect the cost to us

of the onsite remediation activities in which we are currently involved to exceed $0.5 million in

the future. Future events or changes in existing laws and regulations or their interpretation may

require us to make additional expenditures in the future. The cost or need for any such additional

expenditure is not known.

Raw Materials

We use carbon and stainless steel, copper and bronze sheets, wood, fabrics, finishing

materials, rubber gaskets, zinc, and magnesium alloy in the manufacture of our caskets. Although

most of the raw materials used in our products are generally available from several sources,

certain of these raw materials are currently procured from only a single source.

Volatility in the prices we pay for raw materials used in our products, including steel, fuel,

petroleum based products, and fuel related delivery costs, has a direct effect on our

profitability. We generally do not engage in hedging transactions with respect to these purchases,

but we do enter into fixed price supply contracts at times. We regularly take steps and actions to

lessen the impact of volatility in raw material and fuel prices, including lean business

initiatives, various sourcing actions, and rebalancing of production capacity. Most recently we

expanded our production capabilities in our Mexican manufacturing operations to include some solid

wood products, allowing us to take advantage of the overall lower cost of production, reduce

complexity at other plants, and provide increased ability to manufacture multiple models in

multiple plants, thereby reducing the risks of concentrated production. However, there can be no

assurance that we will be able to anticipate and react quickly enough to all changes in raw

material prices in the future such that future profitability will not be impacted.

Most of our sales are made pursuant to supply agreements with our customers, and historically we

have instituted annual price increases to help offset the impact of inflation and other rising

costs. While some of our agreements contain certain limitations, they generally allow us to raise

prices to offset some, but not necessarily all, raw material cost inflation.

3

Distribution

We have extensive distribution capabilities that serve our customers’ increasing delivery

expectations. Our high-velocity distribution system, consisting of 6 RDCs and 86 CSCs in North

America, serves a majority of our customers each day and is critical to the rapid delivery

requirements of funeral directors nationwide.

Patents and Trademarks

We own a number of patents on our products and manufacturing processes that are of importance, but

we do not believe any single patent or related group of patents is of material significance to our

business as a whole.

We also own a number of trademarks and service marks relating to our products and product services

which are of importance to us, but, except for the mark “Batesville®,” we do not believe

any single trademark or service mark is of material significance to our business as a whole.

Our ability to compete effectively depends, to an extent, on our ability to maintain the

proprietary nature of our intellectual property. However, we may not be sufficiently protected by

our various patents, trademarks, and service marks. Additionally, certain of our existing patents,

trademarks or service marks may be challenged, invalidated, cancelled, narrowed, or circumvented.

Beyond that, we may not receive the pending or contemplated patents, trademarks, or service marks

for which we have applied or filed.

In the past, certain of our products have been copied and sold by others. We vigorously seek to

enforce our intellectual property rights. However, we cannot ensure that the reproduction and sale

of our products by others would not materially affect the sale of our products.

Employees

As of September 30, 2009, we employed approximately 3,250 people in our operations. Approximately

1,100 of these individuals as part of our logistics and manufacturing operations in the United

States and Mexico work under collective bargaining agreements. In the United States and Mexico, the

collective bargaining agreements have expiration dates ranging from January 2010 to September 2013.

Although we have not experienced any significant work stoppages in more than 20 years as a result

of labor relations, we cannot ensure that such a stoppage will not occur in the future. An

inability to negotiate satisfactory new agreements or a labor disturbance at one of our principal

facilities could have a material adverse effect on our operations. However, we have no reason to

believe that we will have significant difficulties in negotiating new collective bargaining

agreements to replace those that will expire in the future, and we will continue to prepare

contingency plans as part of routine preparation for negotiations in order to minimize the impact

of any potential work stoppages.

Foreign Operations and Export Sales

Information about our foreign operations is set forth in tables relating to geographic information

in Note 15 to our consolidated financial statements included in Part II, Item 8 of this Form 10-K.

Our export revenues constituted less than 10 percent of consolidated revenues in fiscal 2009 and

prior years.

Our foreign operations are subject to risks inherent in doing business in foreign countries. Risks

associated with operating internationally include political, social, and economic instability,

increased operating costs, expropriation, and complex and changing government regulations, all of

which are beyond our control. Further, to the extent we receive revenue from U.S. export sales in

currencies other than U.S. dollars, the value of assets and income could be, and have in the past

been, adversely affected by fluctuations in the value of local currencies.

4

Executive Officers of the Registrant

Our Board of Directors is responsible for electing our executive officers annually and from time to

time as necessary. Executive officers serve in the ensuing year and until their respective

successors are elected and qualified. Except for Board members Gus Hillenbrand and Tom Johnson,

who are first cousins to Ray Hillenbrand, there are no other family relationships between any of

our executive officers or between any of them and any members of the Board of Directors. The

following is a list of our executive officers as of November 17, 2009.

Kenneth A. Camp, 64, was elected President and Chief Executive Officer of Hillenbrand effective

February 8, 2008. Mr. Camp was also elected as a board member on that same date. Prior to his

appointment as President and Chief Executive Officer of Hillenbrand, Mr. Camp had served as

President and Chief Executive Officer of Batesville since May 1, 2001. He was elected Senior Vice

President of our Former Parent on October 1, 2006, having been a Vice President of that company

since October 8, 2001. He was employed by our Former Parent from 1981 until the separation on March

31, 2008. Mr. Camp previously held the position of Vice President of Administration of our Former

Parent from 2000 to 2001. Prior to that assignment, he held various positions at Batesville,

including Vice President/General Manager of Operations from 1995 to 2000; Vice President, Sales and

Service; Vice President, Marketing; and Vice President, Strategic Planning.

Cynthia L. Lucchese, 48, was elected Senior Vice President and Chief Financial Officer of

Hillenbrand effective February 8, 2008. From 2005 to 2007, she served as Senior Vice President and

Chief Financial Officer for Thoratec Corporation. Prior to that, she worked 10 years for Guidant

Corporation, now a part of Boston Scientific Corporation, in a variety of senior finance roles,

including Vice President and Treasurer, Corporate Controller and Chief Accounting Officer, and Vice

President of Finance and Administration of the Guidant Sales Corporation. Ms. Lucchese was also

previously employed by Eli Lilly and Company and Ernst & Young LLP.

Joe A. Raver, 43, was elected President and Chief Operating Officer of Batesville, effective June

16, 2008, and Senior Vice President of Hillenbrand on July 15, 2008. Prior to his appointment as

an officer of Batesville and Hillenbrand, Mr. Raver served as Vice President and General Manager of

the Respiratory Care Division of Hill-Rom, a leading global provider of medical equipment and

services. He joined Hill-Rom in 2004 as Vice President of Strategy and Shared Services. Prior to

joining Hill-Rom, Mr. Raver spent 10 years in a variety of leadership positions at Batesville and

Hill-Rom, including being appointed Vice President of Strategy and Logistics at Batesville in 2002.

John R. Zerkle, 55, was elected Senior Vice President, General Counsel and Secretary of Hillenbrand

effective February 8, 2008. Most recently, Mr. Zerkle had served as Vice President and General

Counsel of Batesville since March 2004. From September 2002 to February 2004, Mr. Zerkle served as

Vice President and General Counsel of Forethought Financial Services, Inc., then a subsidiary of

Hill-Rom. He also served as Compliance Officer for Forethought Investment Management, Inc. Prior to

joining Forethought, Mr. Zerkle was in private practice for twenty years, where he focused his

practice on corporate, securities, regulatory, and banking law matters.

Paul Douglas Wilson, 57, was elected Senior Vice President, Human Resources of Hillenbrand

effective March 14, 2008. Most recently, Mr. Wilson served as Vice President, Worldwide Merger

Integration for Boston Scientific Corporation, following the close of the merger between Boston

Scientific and Guidant Corporation in 2006. Mr. Wilson joined Guidant Corporation in 2002 and

served as Vice President of Human Resources. Prior to Guidant, Mr. Wilson was President and a

Principal of Ronald Blue & Co., a privately held firm providing financial planning, investment

management, tax planning, and philanthropic counsel. Mr. Wilson began his career with Eli Lilly

and Company, where he spent 20 years in a variety of increasingly senior executive human resource

roles.

Hinesh B. Patel, 41, was elected Vice President, Strategy and Business Development of Hillenbrand

effective August 18, 2008. Prior to accepting his current position with Hillenbrand, Mr. Patel

served as Director of Strategy and Business Development for Honeywell International Inc., a

position he had held since April 2007. Prior to joining Honeywell International Inc., Mr. Patel

held other management roles in business development, strategy, and operations with Milliken &

Company, Caspian Networks Inc., Eaton Corporation, and Arthur D. Little.

5

Jan M. Santerre, 48, was elected Vice President, Lean Business of Hillenbrand effective December 1,

2008. Prior to accepting her position with Hillenbrand, Ms. Santerre served as Vice President of

Operations Hydraulics Group for Parker Hannifin Corporation, a position she had held since April

2005. From 2003 to 2005, Ms. Santerre served as Parker Hannifin’s Vice President of Lean

Enterprise and Quality, where she developed and deployed the Parker Lean System. Prior to that,

Ms. Santerre was with Delphi Automotive Systems and General Motors for 18 years with

responsibilities in engineering, quality, and manufacturing, culminating in executive operations

roles.

Theodore S. Haddad, Jr., 45, was elected Vice President, Controller and Chief Accounting Officer of

Hillenbrand on February 8, 2008. Prior to joining Hillenbrand, Mr. Haddad had served as Senior

Manager in the Audit and Business Advisory Services Group of PricewaterhouseCoopers LLP since July

2002. Prior to that, Mr. Haddad served as a Senior Manager in the audit group of Arthur Andersen

LLP, having been with that firm since July 1991. Mr. Haddad is a Certified Public Accountant and

Certified Management Accountant.

In this section of the Form 10-K, we describe the risks we believe are most important for you to

think about when you consider investing in, selling, or owning our stock. This information should

be assessed along with the other information we provide you in this Form 10-K. Like most

companies, our business involves risks. The risks described below are not the only risks we face.

Additional risks not currently known or considered immaterial by us at this time and thus not

listed below may result in adverse effects on our business.

Risks Related to Our Business

Recent global market and economic conditions, including those related to the credit markets, could

have a material adverse effect on the Company’s business, financial condition, and results of

operations.

The severity of the current economic recession caused by the recent worldwide financial and credit

market disruptions have reduced the availability of credit generally necessary to fund economic

growth and activity, and there is not yet clear evidence to suggest that efforts undertaken by the

various government entities to mitigate this recession will be successful.

A prolonged recession could adversely affect our business in several ways. A continuation or

worsening of the current credit markets and economic conditions could adversely affect our

customers’ ability to obtain sufficient credit or pay for our products within the terms of sale

and, as a result, our reserves for doubtful accounts and receivable write-offs could increase. A

prolonged recession could further intensify the competition among the manufacturers and

distributors with whom we compete for volume and market share, resulting in lower net revenues due

to steeper discounts and further product mix-down. If certain key or sole suppliers were to become

capacity constrained or insolvent as a result of the global economic conditions, it could result in

a reduction or interruption in supplies or a significant increase in the price of supplies. In

addition, the substantial losses in the equity markets as a result of the current recession can

have an adverse effect on the assets of the Company’s pension plans. A continuation of the

volatility of interest rates and negative equity returns under current market conditions could

require greater contributions to the defined benefit plans in the future.

Our business is significantly dependent on several major contracts with large national providers.

Our relationships with these customers pose several risks.

We have contracts with a number of large national funeral home customers that comprise a sizeable

portion of our overall sales volume. Our largest contract is with Service Corporation

International, which accounts for approximately 13% of our 2009 net revenues (and is our only

customer over 10% of net revenues). Any decision by our large national funeral home customers to

discontinue purchases from us could have a material adverse effect on our financial condition,

results of operations, and cash flows. Also, while our contracts with large national funeral

service providers give us important access to many of the largest purchasers of funeral service

products, they may obligate us to sell our products at contracted prices for extended periods of

time, therefore limiting our ability, in the short term, to raise prices in response to significant

increases in raw material prices or other factors.

6

Collection risk associated with our note receivable from Forethought Financial Group, Inc.

(“Forethought”) could have a material adverse impact on our earnings.

We hold a significant non-operating asset in the form of a note receivable and related interest

receivable from Forethought. This asset was transferred to us at the time of separation from

Hill-Rom. As of September 30, 2009, this note receivable has an aggregate carrying value of $142.8

million. This note receivable primarily represents seller provided financing to Forethought, the

entity that purchased Hill-Rom’s former Forethought Financial Services, Inc. subsidiary.

Forethought, through its subsidiaries, provides insurance and financial solutions for families

managing retirement and end-of-life needs.

The recent global recession and contraction in available credit has particularly impacted companies

in the financial services and insurance industries. Forethought’s ability to pay us under the

terms of the note receivable may be adversely impacted by the deterioration being experienced in

the credit markets, as it has material exposure to this market as an insurance company. Further,

its ability to access credit or raise capital may be significantly restricted by current economic

conditions, which in turn may limit its ability to execute its business plans or meet its

obligation to pay us in the future. More recently, A.M. Best has placed the financial strength

rating of Forethought’s subsidiary insurance operations “under review with negative implications.”

These actions reflect A.M. Best’s concern with the subsidiary’s decline in statutory

capitalization, net losses on a statutory and U.S. GAAP basis, its exposure related to unrealized

losses on its investment portfolio, and the significant level of intangible assets relative to its

U.S. GAAP equity. The rating has been placed under review by A.M. Best following discussions with

Forethought about significant new capital raising initiatives. These efforts are expected to

improve the capital position of the organization to support growth and offset any additional

investment losses. While A.M. Best expects tangible progress in these efforts in the near term,

the ratings of the subsidiary insurance operations will likely be negatively impacted should the

capital raising efforts be unsuccessful. A downgrade in the subsidiary’s rating could damage the

business prospects of Forethought and increase the risk of impairment to our note receivable in the

future. Conversely, a successful capital infusion would improve the financial

strength of Forethought (and immediately reduce our collection risk).

In November 2009, Forethought informed us that they successfully

raised net of proceeds approximately $101 million through the issuance of common

stock.

Should Forethought fail to perform consistently with the original expectations set forth by

Forethought or underperform to an extent that it cannot meet its financial obligations, the note

could become impaired, causing an impairment charge that could result in a material adverse impact

on our financial condition and results of operations.

Continued fluctuations in mortality rates and increased cremations may adversely affect, as they

have in recent years, the sales volume of our burial caskets.

The life expectancy of U.S. citizens has increased steadily since the 1950s and is expected to

continue to do so for the foreseeable future. As the population of the United States continues to

age, we anticipate the number of deaths in the United States will be relatively flat until the

number of deaths increase due to aging baby boomers.

Cremations as a percentage of total U.S. deaths have increased steadily since the 1960s and are

also expected to continue to increase for the foreseeable future. Therefore, the number of

U.S. cremations is gradually and steadily increasing, resulting in a contraction in the demand for

burial caskets, which was a contributing factor to lower burial casket sales volumes for us in each

of the last three fiscal years.

We expect these trends to continue into the foreseeable future, and our burial casket volumes will

likely continue to be negatively impacted by these market conditions.

Finally, the number of deaths can vary over short periods of time and among different geographical

areas, due to a variety of other factors, including the timing and severity of seasonal outbreaks

of illnesses such as pneumonia and influenza. Such variations could cause our sales of burial

caskets to fluctuate from quarter to quarter and year to year.

Our growth strategy involves the potential for future significant acquisitions, some of which may

be outside our current industry. We may not be able to achieve some or all of the benefits that we

expect to achieve from these acquisitions. If an acquisition were to perform unfavorably, it could

have an adverse impact to the

value of the Company.

7

One component of our strategy contemplates our making selected acquisitions. Our business plan

anticipates that we will make one or more acquisitions over the next few years with purchase prices

aggregating several hundred million dollars. All acquisitions involve inherent uncertainties, some

of which include, among other things, our ability to:

| |

• |

|

successfully identify targets for acquisition, |

| |

• |

|

negotiate reasonable terms for any particular deal, |

| |

• |

|

properly perform due diligence and determine all the significant risks associated with

a particular acquisition, |

| |

• |

|

properly evaluate target company management capabilities, |

| |

• |

|

successfully integrate the target and achieve the desired performance. |

We also may acquire businesses with unknown or contingent liabilities, including liabilities for

failure to comply with potential industry or environmental regulations or tax contingencies. We

have plans and procedures to conduct reviews of potential acquisition candidates for compliance

with applicable regulations and laws prior to acquisition and will also generally seek

indemnification from sellers covering these matters. Despite these efforts, we may incur material

liabilities for past activities of acquired businesses.

Volatility in our investment portfolio could negatively impact earnings. Also, if we are unable to

convert our portfolio of auction rate securities to cash at reasonable terms, our earnings could be

adversely affected.

In connection with our separation from Hill-Rom, ownership in certain investments in private

partnerships were transferred to us that had an aggregate carrying value of $14.3 million as of

September 30, 2009. Volatility in that investment portfolio negatively or positively impacts

earnings. These investments could be adversely affected by general economic conditions, changes in

interest rates, default on debt instruments, and other factors, resulting in an adverse impact on

our results from operations.

In addition, we received a portfolio of auction rate securities (consisting of highly rated tax

exempt state and municipal securities, the majority of which are collateralized by student loans

guaranteed by the U.S. government under the Federal Family Education Loan Program) that Hill-Rom

was not able to liquidate prior to the separation due to the market conditions and auction

failures. In November 2008, we received an enforceable, non-transferable right (the “Put”) from

UBS Financial Services that allows us to sell approximately $30.1 million of our existing auction

rate securities (carrying value at September 30, 2009, including the Put) at par value plus accrued

interest. We may exercise the Put at anytime during the period from June 30, 2010 through July 2,

2012. If market conditions do not improve prior to June 30, 2010, we intend to exercise our rights

under the Put. For our remaining auction rate securities (carrying value of $18.8 million at

September 30, 2009), if conditions do not improve or worsen, we may not be able to convert these

securities to cash for the foreseeable future, these assets could become impaired, and our earnings

could be adversely affected.

Our business is facing increasing competition from a number of non-traditional sources and caskets

manufactured abroad and imported into North America.

Non-traditional funeral service providers could present more of a competitive threat to us and our

sales channel than is currently anticipated. While some of these providers have competed against us

for many years, large discount retailers, casket stores, and internet casket retailers represent

more recent competitors. We recently became aware that Wal-Mart has entered our market and has

begun selling caskets online. Initially, it appears that Wal-Mart is testing this product offering

online, but not in stores. However, it is too early to estimate the impact Wal-Mart might have on

the industry. Also, there are several manufacturers located in China currently manufacturing

caskets for sale into the United States. While sales from these providers are currently a small

percentage of total casket sales in the United States, it is not possible to quantify the financial

impact that these competitors will have on our business in the future. These competitors will

continue to drive pricing and other competitive pressures in an industry that already

has approximately twice the necessary domestic production capacity. Such competitive actions could

have a negative impact on our results of operations and cash flows.

8

Increased prices for, or unavailability of, raw materials used in our products could adversely

affect profitability. In particular, our results of operations continue to be adversely affected by

volatile prices for steel, red metals (i.e. copper and bronze), and fuel.

Our profitability is affected by the prices of the raw materials used in the manufacture of our

products. These prices fluctuate based on a number of factors beyond our control, including changes

in supply and demand, general economic conditions, labor costs, fuel related delivery costs,

competition, import duties, tariffs, currency exchange rates, and in some cases, government

regulation. Significant increases in the prices of raw materials that cannot be recovered through

increases in the price of our products could adversely affect our results of operations and cash

flows.

We cannot guarantee that the prices we are paying for commodities today will continue in the future

or that the marketplace will continue to support current prices for our products or that such

prices can be adjusted to fully offset such commodity price increases in the future. Any increases

in prices resulting from a tightening supply of these or other commodities or fuel could adversely

affect our profitability. We generally do not engage in hedging transactions with respect to raw

material purchases, but we do enter into some fixed price supply contracts.

Our dependency upon regular deliveries of supplies from particular suppliers means that

interruptions or stoppages in such deliveries could adversely affect our operations until

arrangements with alternate suppliers could be made. Several of the raw materials used in the

manufacture of our products currently are procured from only a single source. If any of these

sole-source suppliers were unable to deliver these materials for an extended period of time as a

result of financial difficulties, catastrophic events affecting their facilities, or other factors,

or if we were unable to negotiate acceptable terms for the supply of materials with these

sole-source suppliers, our business could suffer. We may not be able to find acceptable

alternatives, and any such alternatives could result in increased costs. Extended unavailability of

a necessary raw material could cause us to cease manufacturing one or more products for a period of

time.

Despite our recent successes in court, the antitrust litigation in which we are a defendant has not

yet been resolved, and an adverse outcome in that matter could have a

material adverse effect on

our results of operations, financial position, and liquidity.

As discussed in Note 12 to our consolidated financial statements included in Part II, Item 8

of this Form 10-K, we are a defendant in a purported antitrust class action lawsuit. The Federal

District Court denied class certification in that matter, and the Fifth Circuit denied the

plaintiffs’ appeal petition. Further requests for reconsideration by the plaintiffs have also been

denied. Despite these favorable rulings, the FCA plaintiffs have recently indicated that they

intend to pursue their individual injunctive and damage claims. After the District Court renders a

final judgment as to the individual claims, the FCA plaintiffs may file an appeal, which could

include an appeal of the District Court’s order denying class certification. If they succeeded in

reversing the District Court order denying class certification and a class is certified in the FCA

Action filed against Hill-Rom and Batesville and if the plaintiffs prevail at a trial of the class

action, the damages awarded to the plaintiffs, which would be trebled as a matter of law, could

have a significant material adverse effect on our results of operations, financial condition and/or

liquidity. In antitrust actions the plaintiffs may elect to enforce any judgment against any or

all of our codefendants, who have no statutory contribution rights against each other.

We are involved on an ongoing basis in claims, lawsuits and governmental proceedings relating to

our operations, including environmental, antitrust, patent infringement, business practices,

commercial transactions, and other matters.

The ultimate outcome of these claims, lawsuits, and governmental proceedings cannot be predicted

with certainty but could have a material adverse effect on our financial condition, results of

operations, and cash flow. We are also involved in other possible claims, including product and

general liability, workers compensation, auto liability, and employment-related matters. While we

maintain insurance for certain of these exposures, the policies in place are high-deductible

policies resulting in our assuming exposure for a

layer of coverage with respect to such claims. For a more detailed discussion of our asserted

claims, see Note 12 to our consolidated financial statements included in Part II, Item 8 of this

Form 10-K.

9

A substantial portion of our workforce is unionized, and we could face labor disruptions that would

interfere with our operations.

Approximately 34% of our employees as part of our logistics and manufacturing operations work under

collective bargaining agreements. Although we have not experienced any significant work stoppages

in the past 20 years as a result of labor disagreements, we cannot ensure that such a stoppage will

not occur in the future. Inability to negotiate satisfactory new agreements or a labor disturbance

at one of our principal facilities could have a material adverse effect on our operations.

Risk Arising From Our Separation Transaction with Hill-Rom

The distribution of our stock to Hill-Rom’s stockholders in March 2008 could result in a

significant tax liability.

In connection with the separation in March 2008, Hill-Rom received a private letter ruling from the

Internal Revenue Service (“IRS”) that the distribution qualified for tax-free treatment under Code

Sections 355 and 368(a)(1)(D). The IRS ruling relies on certain representations, assumptions, and

undertakings, including those relating to the past and future conduct of our business. Although

Hill-Rom believes that all of these representations, assumptions, and undertakings were correct,

the IRS ruling would not be valid if they were incorrect. Moreover, the IRS private letter ruling

does not address all the issues that are relevant to determining whether the distribution qualified

for tax-free treatment, although Hill-Rom received an opinion of counsel with respect to the legal

and tax issues not addressed in the private letter ruling. Notwithstanding the IRS private letter

ruling, the IRS could determine that the distribution should have been treated as a taxable

transaction if it determines that any of the representations, assumptions, or undertakings that

were included in the request for the private letter ruling was false or had been violated.

If the distribution were to fail to qualify for tax-free treatment, Hill-Rom would be subject to

tax as if it had sold the common stock of our company in a taxable sale for its fair market value,

and our initial public shareholders would be subject to tax as if they had received a taxable

distribution equal to the fair market value of our common stock that was distributed to them. Under

the tax sharing agreement between Hill-Rom and us, we would generally be required to indemnify

Hill-Rom against any tax resulting from the distribution to the extent that such tax resulted from

(1) an issuance of our equity securities, a redemption of our equity securities or our involvement

in other acquisitions of our equity securities, (2) other actions or failures to act by us or

(3) any of our representations or undertakings being incorrect or violated. For a more detailed

discussion, see the section entitled “Tax Sharing Agreement” within Note 6 to our consolidated

financial statements included in Part II, Item 8 of this Form 10-K. Our indemnification obligations

to Hill-Rom and its subsidiaries, officers and directors are not limited by any maximum amount. If

we are required to indemnify Hill-Rom or such other persons under the circumstances set forth in

the tax sharing agreement, we may be subject to substantial liabilities.

Our ability to engage in desirable strategic transactions and equity issuances is limited by the

Tax Sharing Agreement we entered into with Hill-Rom.

To preserve the tax-free treatment to Hill-Rom and its shareholders of the distribution, under a

tax sharing agreement that we entered into with Hill-Rom, for the two year period following the

distribution, we are prohibited, except in specified circumstances, from:

| |

• |

|

issuing equity securities; |

| |

• |

|

engaging in certain business combination or asset sale

transactions; or |

| |

• |

|

engaging in other actions or transactions that could jeopardize

the tax-free status of the distribution. |

These restrictions limit our ability to pursue strategic transactions or engage in new business or

other transactions that may maximize the value of our business. For more information, see the

section entitled

“Tax Sharing Agreement” within Note 6 to our consolidated financial statements included in Part II,

Item 8 of this Form 10-K.

10

Risks Relating to Our Common Stock

Provisions in our Articles of Incorporation and By-laws and of Indiana law may prevent or delay an

acquisition of our company, which could decrease the trading price of our common stock.

Our Articles of Incorporation, By-laws and Indiana law contain provisions that could have the

effect of delaying or preventing changes in control if our Board of Directors determines that such

changes in control are not in the best interests of our shareholders. While these provisions have

the effect of encouraging persons seeking to acquire control of our company to negotiate with our

Board of Directors, they could enable our Board of Directors to hinder or frustrate a transaction

that some, or a majority, of our shareholders might believe to be in their best interests. These

provisions include, among others:

| |

• |

|

the division of our Board of Directors into three classes with staggered terms; |

| |

• |

|

the inability of our shareholders to act by less than unanimous written consent; |

| |

• |

|

rules regarding how shareholders may present proposals or nominate directors for

election at shareholder meetings; |

| |

• |

|

the right of our Board of Directors to issue preferred stock without shareholder

approval; and |

| |

• |

|

limitations on the right of shareholders to remove directors. |

Indiana law also imposes some restrictions on mergers and other business combinations between us

and any holder of 10% or more of our outstanding common stock, as well as on certain “control

share” acquisitions.

We believe these provisions are important for a public company and protect our shareholders from

coercive or otherwise potentially unfair takeover tactics by requiring potential acquirers to

negotiate with our Board of Directors and by providing our Board of Directors with more time to

assess any acquisition proposal. These provisions are not intended to make our company immune from

takeovers. However, these provisions apply even if the offer may be considered beneficial by some

shareholders and could delay or prevent an acquisition that our Board of Directors determines is

not in the best interests of our shareholders.

|

|

|

| Item 1B. |

|

UNRESOLVED STAFF COMMENTS |

We have not received any comments from the staff of the SEC regarding our periodic or current

reports that remain unresolved.

11

The principal properties used in our operations are listed below and, except for our leased

facility in Chihuahua, Mexico, are owned by us and not subject to material encumbrances. All

facilities are suitable for their intended purpose, are being efficiently utilized, and are

believed to provide adequate capacity to meet demand for the next several years.

| |

|

|

|

|

| Location |

|

Description |

|

Primary Use |

Batesville, Indiana

|

|

Manufacturing plants

Office Facilities

|

|

Manufacturing of metal caskets

Administration |

|

|

|

|

|

Manchester, Tennessee

|

|

Manufacturing plant

|

|

Manufacturing of metal caskets |

|

|

|

|

|

Vicksburg, Mississippi

|

|

Kiln drying and

lumber cutting

plant

|

|

Drying and dimensioning of lumber |

|

|

|

|

|

Batesville, Mississippi

|

|

Manufacturing plant

|

|

Manufacturing of hardwood caskets |

|

|

|

|

|

Chihuahua, Mexico

|

|

Manufacturing plant

|

|

Manufacturing of veneer hardwood

and hardwood caskets |

|

|

|

|

|

Mexico City, Mexico

|

|

Manufacturing plant

|

|

Manufacturing of metal caskets,

primarily for sale outside the

United States |

In addition to the foregoing, we lease or own a number of warehouse distribution centers, service

centers, and sales offices throughout North America, the United Kingdom, Mexico, Australia, and

South Africa.

12

|

|

|

| Item 3. |

|

LEGAL PROCEEDINGS |

Antitrust Litigation

In 2005 the Funeral Consumers Alliance, Inc. (“FCA”) and a number of individual consumer casket

purchasers filed a purported class action antitrust lawsuit on behalf of certain consumer

purchasers of Batesville® caskets against the Company and its former parent company, Hillenbrand

Industries, Inc., now Hill-Rom Holdings, Inc. (“Hill-Rom”), and three national funeral home

businesses (the “FCA Action”). A similar purported antitrust class action lawsuit was later filed

by Pioneer Valley Casket Co. and several so-called “independent casket distributors” on behalf of

casket sellers who were unaffiliated with any licensed funeral home (the “Pioneer Valley Action”).

Class certification hearings in the FCA Action and the Pioneer Valley Action were held before a

Magistrate Judge in early December 2006. On November 24, 2008, the Magistrate Judge recommended

that the plaintiffs’ motions for class certification in both cases be denied. On March 26, 2009,

the District Judge adopted the memoranda and recommendations of the Magistrate Judge and denied

class certification in both cases. On April 9, 2009, the plaintiffs in the FCA case filed a

petition with the United States Court of Appeals for the Fifth Circuit for leave to file an appeal

of the Court’s order denying class certification. On June 19, a three-judge panel of the Fifth

Circuit denied the FCA plaintiffs’ petition. On July 9, 2009, the FCA plaintiffs filed a request

for reconsideration of the denial of their petition. On July 29, 2009, a three-judge panel of the

Fifth Circuit denied the FCA plaintiffs’ motion for reconsideration and their alternative motion

for leave to file a petition for rehearing en banc (by all of the judges sitting on the Fifth

Circuit Court of Appeals.)

The Pioneer Valley plaintiffs did not appeal the District Court’s order denying class

certification, and on April 29, 2009, pursuant to a stipulation among the parties, the District

Court dismissed the Pioneer Valley Action with prejudice (i.e., Pioneer Valley cannot appeal or

otherwise reinstitute the case). Neither the Company nor Hill-Rom provided any payment or

consideration for the plaintiffs to dismiss this case, other than agreeing to bear their own

costs, rather than pursuing plaintiffs for costs.

Plaintiffs in the FCA Action generally seek monetary damages, trebling of any such damages that

may be awarded, recovery of attorneys’ fees and costs, and injunctive relief. The plaintiffs in

the FCA Action filed a report indicating that they are seeking damages ranging from approximately

$947.0 million to approximately $1.46 billion before trebling on behalf of the purported class of

consumers they seek to represent, based on approximately one million casket purchases by the

purported class members.

Because Batesville continues to adhere to its long-standing policy of selling Batesville

caskets only to licensed funeral homes, a policy that it continues to believe is appropriate and

lawful, if the case goes to trial the plaintiffs are likely to claim additional alleged damages

for periods between their reports and the time of trial. At this point, it is not possible to

estimate the amount of any additional alleged damage claims that they may make. The defendants are

vigorously contesting both liability and the plaintiffs’ damages theories.

Despite the July 29, 2009 ruling, the FCA plaintiffs have recently indicated that they intend to

pursue their individual injunctive and damages claims. Their individual damages claims would be

limited to the alleged overcharges on the plaintiffs’ individual casket purchases (the complaint

currently alleges a total of ten casket purchases by the individual plaintiffs), which would be

trebled, plus reasonable attorneys fees and costs. Should the plaintiffs proceed, we anticipate

that we will move for summary judgment at the appropriate time.

After the district court renders a final judgment as to the individual claims, the FCA plaintiffs

may file an appeal, which could include an appeal of the District Court’s order denying class

certification. If they succeeded in reversing the district court order denying class certification

and a class is certified in the FCA Action filed against Hill-Rom and Batesville and if the

plaintiffs prevail at a trial of the class action, the damages awarded to the plaintiffs, which

would be trebled as a matter of law, could have a significant material adverse effect on our

results of operations, financial condition and/or liquidity. In antitrust actions such as the FCA

Action the plaintiffs may elect to enforce any judgment against any or all of the codefendants, who

have no statutory contribution rights against each other. We and Hill-Rom have entered into a

judgment sharing agreement that apportions the costs and any potential liabilities associated with

this litigation between us and Hill-Rom. See Note 6 to our consolidated financial statements included

in Part II, Item 8 of this Form 10-K.

13

As of September 30, 2009, we have incurred approximately $22.4 million in legal and related costs

associated with the FCA matter.

General

We are involved on an ongoing basis in claims and lawsuits relating to our operations, including

environmental, antitrust, patent infringement, business practices, commercial transactions, and

other matters. The ultimate outcome of these lawsuits cannot be predicted with certainty. An

estimated loss from these contingencies is recognized when we believe it is probable that a loss

has been incurred and the amount of the loss can be reasonably estimated. However, it is difficult

to measure the actual loss that might be incurred related to litigation. The ultimate outcome of

these lawsuits could have a material adverse effect on our financial condition, results of

operations, and cash flow.

Legal fees associated with claims and lawsuits are generally expensed as incurred. Upon recognition

of an estimated loss resulting from a settlement, an estimate of legal fees to complete the

settlement is also included in the amount of the loss recognized.

We are also involved in other possible claims, including product and general liability, workers

compensation, auto liability, and employment related matters. Claims other than employment and

related matters have deductibles and self-insured retentions ranging from $0.5 million to $1.0

million per occurrence or per claim, depending upon the type of coverage and policy period. Outside

insurance companies and third-party claims administrators establish individual claim reserves, and

an independent outside actuary provides estimates of ultimate projected losses, including incurred

but not reported claims, which are used to establish reserves for losses. Claim reserves for

employment related matters are established based upon advice from internal and external counsel and

historical settlement information for claims and related fees, when such amounts are considered

probable of payment.

The recorded amounts represent our best estimate of the costs we will incur in relation to such

exposures, but it is virtually certain that actual costs will differ from those estimates.

|

|

|

| Item 4. |

|

SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

There were no matters submitted to a vote of security holders during the quarter ended September

30, 2009.

14

PART II

|

|

|

| Item 5. |

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

Hillenbrand, Inc.’s common stock is traded on the New York Stock Exchange under the ticker symbol

“HI.” The closing price of our common stock on the New York Stock Exchange on November 17, 2009,

was $20.41. The following table reflects the range of high and low selling prices of our common

stock by quarterly period since our common stock began trading on the New York Stock Exchange on

March 20, 2008.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Hillenbrand, Inc. |

|

| |

|

2009 |

|

|

2008 |

|

| |

|

Hi |

|

|

Low |

|

|

Hi |

|

|

Low |

|

First quarter |

|

$ |

20.88 |

|

|

$ |

13.96 |

|

|

|

N/A |

|

|

|

N/A |

|

Second quarter * |

|

$ |

19.39 |

|

|

$ |

14.68 |

|

|

$ |

23.33 |

|

|

$ |

18.00 |

|

Third quarter |

|

$ |

18.18 |

|

|

$ |

15.24 |

|

|

$ |

24.29 |

|

|

$ |

18.01 |

|

Fourth quarter |

|

$ |

20.97 |

|

|

$ |

16.70 |

|

|

$ |

24.19 |

|

|

$ |

19.78 |

|

| |

|

|

| * |

|

For fiscal 2008, the price represents “when issued” trading on the New York Stock Exchange for

the period from March 20, 2008 through March 31, 2008, when our separation from Hill-Rom was

completed. |

Holders

On November 17, 2009, we had approximately 3,000 shareholders of record.

Dividends

The following table reflects historical dividend information for the periods presented.

| |

|

|

|

|

|

|

|

|

| |

|

Hillenbrand, Inc. |

|

| |

|

2009 |

|

|

2008 |

|

First quarter |

|

$ |

0.1850 |

|

|

|

N/A |

|

Second quarter |

|

$ |

0.1850 |

|

|

|

N/A |

|

Third quarter * |

|

$ |

0.1850 |

|

|

$ |

0.1825 |

|

Fourth quarter |

|

$ |

0.1850 |

|

|

$ |

0.1825 |

|

| |

|

|

| * |

|

On April 30, 2008, our Board of Directors declared our first dividend payment of $0.1825 per

share, which was paid on June 30, 2008. |

In accordance with the covenants contained in our Distribution Agreement with Hill-Rom, as amended,

we are restricted from paying regular quarterly dividends in excess of $0.185 or from incurring

indebtedness to pay an extraordinary cash dividend without prior written approval of Hill-Rom until

the occurrence of an Agreed Termination Event (as defined in the Distribution Agreement) with

Hill-Rom has occurred. For a more detailed discussion, see the section entitled “Distribution

Agreement” within Note 6 to our consolidated financial statements included in Part II, Item 8 of

this Form 10-K. We currently expect that comparable quarterly cash dividends will continue to be

paid in the future.

15

Issuer Purchases of Equity Securities

On July 24, 2008, our Board of Directors approved the repurchase of up to $100 million of common

stock. The program has no expiration date, but may be terminated by the Board of Directors at

anytime. As of September 30, 2009, we had repurchased approximately 1.0 million shares for $18.7

million, which are being held as treasury stock until reissued. Of the 1.0 million shares

repurchased, 0.7 million were repurchased during fiscal 2009 for $12.5 million. During fiscal

2009, 0.1 million shares were issued from treasury stock under our various stock compensation

programs. Additional information related to our equity compensation programs is included in Note

11 to our consolidated financial statements included in Part II, Item 8 of this Form 10-K.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Total Dollar |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Amount of |

|

|

Maximum Dollar |

|

| |

|

|

|

|

|

Average |

|

|

Shares |

|

|

Amount of Shares |

|

| |

|

Total |

|

|

Price |

|

|

Purchased as |

|

|

That May Yet Be |

|

| |

|

Number |

|

|

Paid |

|

|

Part of Publicly |

|

|

Purchased Under |

|

| |

|

of Shares |

|

|

per |

|

|

Announced Plan |

|

|

the Plans or |

|

| Period |

|

Purchased |

|

|

Share |

|

|

or Program * |

|

|

Programs |

|

| |

July 1, 2009 – July 31, 2009 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

$ |

81,250,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

August 1, 2009 – August 31, 2009 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

$ |

81,250,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 1, 2009 – September

30, 2009 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

$ |

81,250,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| * |

|

Includes commissions paid. |

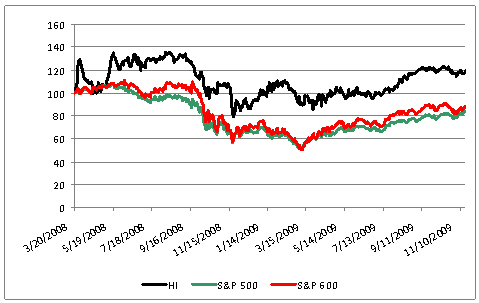

Stock Performance Graph

The following graph compares the return on Hillenbrand common stock with that of Standard & Poor’s

500 Stock Index (“S&P 500 Index”), and the Standard & Poor’s 600 Small Cap Stock Index (“S&P 600

Index”) for the period from March 20, 2008, the date our common stock began trading on the New York

Stock Exchange, to November 17, 2009. The graph assumes that the value of the investment in our

common stock, the S&P 500 Index, and S&P 600 Index was $100 on March 20, 2008 and that all

dividends were reinvested.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Base Period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Company |

|

March 20, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name/Index |

|

2008 |

|

|

Q3-2008 |

|

|

Q4-2008 |

|

|

Q1-2009 |

|

|

Q2-2009 |

|

|

Q3-2009 |

|

|

Q4-2009 |

|

| |

Hillenbrand, Inc. |

|

$ |

100 |

|

|

$ |

120 |

|

|

$ |

114 |

|

|

$ |

96 |

|

|

$ |

93 |

|

|

$ |

98 |

|

|

$ |

119 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S&P 500 Index |

|

$ |

100 |

|

|

$ |

96 |

|

|

$ |

88 |

|

|

$ |

68 |

|

|

$ |

60 |

|

|

$ |

69 |

|

|

$ |

80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S&P 600 Small Cap

Index * |

|

$ |

100 |

|

|

$ |

101 |

|

|

$ |

100 |

|

|

$ |

74 |

|

|

$ |

61 |

|

|

$ |

74 |

|

|

$ |

88 |

|

| |

|

|

| * |

|

The S&P 600 Small Cap Index consists of companies with market capitalizations between $200

million and $1 billion. We are included within this index. |

16

|

|

|

| Item 6. |

|

SELECTED FINANCIAL DATA |

Selected historical financial data as of and for the fiscal year ended September 30, 2005 to 2009

is derived from our audited consolidated financial statements for Hillenbrand, Inc. and its

subsidiaries and is not necessarily indicative of results to be expected in the future. The

historical financial information related to the periods prior to the separation on March 31, 2008,

included herein, does not necessarily reflect the financial condition, results of operations, or

cash flows that we would have achieved as a separate, publicly traded company during the periods

presented or those that we will achieve in the future.

The selected financial data should be read together with Part II, Item 7, Management’s Discussion

and Analysis of Financial Condition and Results of Operations and Part II, Item 8, Financial

Statements and Supplemental Data included in this Form 10-K.

The following table presents comparative consolidated financial data of Hillenbrand, Inc. for each

of the last five years ended September 30 (amounts in millions, except per share data):

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2009 |

|

|

2008 |

|

|

2007 |

|

|

2006 |

|

|

2005 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net revenues |

|

$ |

649.1 |

|

|

$ |

678.1 |

|

|

$ |

667.2 |

|

|

$ |

674.6 |

|

|

$ |

659.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating profit |

|

$ |

155.0 |

|

|

$ |

149.6 |

|

|

$ |

155.6 |

|

|

$ |

177.4 |

|

|

$ |

161.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

102.3 |

|

|

$ |

93.2 |

|

|

$ |

99.5 |

|

|

$ |

113.2 |

|

|

$ |

102.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share |

|

$ |

1.66 |

|

|

$ |

1.49 |

|

|

$ |

1.59 |

|

|

$ |

1.81 |

|

|

$ |

1.64 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends declared per share* |

|

$ |

0.74 |

|

|

$ |

.365 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

561.1 |

|

|

$ |

545.3 |

|

|

$ |

316.6 |

|

|

$ |

329.4 |

|

|

$ |

337.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term obligations |

|

$ |

122.2 |

|

|

$ |

70.9 |

|

|

$ |